Fifth Third Bancorp (NASDAQ:FITB) will release earnings results for the third quarter, before the opening bell on Friday, Oct. 17.

Analysts expect the Cincinnati, Ohio-based company to report quarterly earnings at 86 cents per share, up from 78 cents per share in the year-ago period. The consensus estimate for Fifth Third Bancorp’s quarterly revenue is $2.29 billion, compared to $2.14 billion a year earlier, according to data from Benzinga Pro.

On Oct. 6, Fifth Third Bancorp agreed to merge with Comerica Incorporated (NYSE:CMA) in an all-stock deal valued at $10.9 billion.

Fifth Third Bancorp shares fell 6% to close at $40.36 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

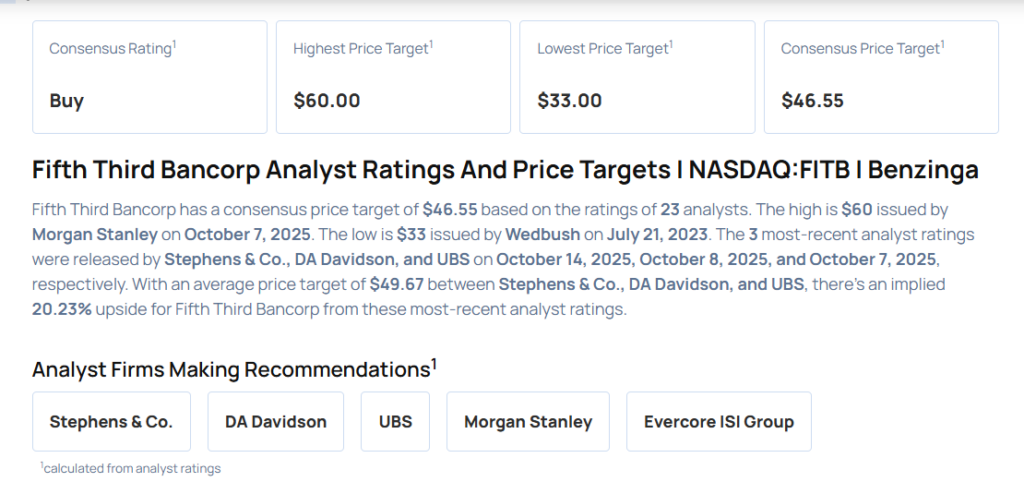

- Stephens & Co. analyst Terry McEvoy upgraded the stock from Equal-Weight to Overweight rating and raised the price target from $49 to $52 on Oct. 14, 2025. This analyst has an accuracy rate of 67%.

- DA Davidson analyst Peter Winter maintained a Buy rating and increased the price target from $49 to $52 on Oct. 8, 2025. This analyst has an accuracy rate of 70%.

- UBS analyst Erika Najarian maintained a Neutral rating and raised the price target from $43 to $45 on Oct. 7, 2025. This analyst has an accuracy rate of 62%.

- Morgan Stanley analyst Manan Gosalia upgraded the stock from Equal-Weight to Overweight and increased the price target from $56 to $60 on Oct. 7, 2025. This analyst has an accuracy rate of 73%.

- Evercore ISI Group analyst John Pancari maintained an In-Line rating and raised the price target from $45 to $49 on Sept. 30, 2025. This analyst has an accuracy rate of 62%.

Considering buying FITB stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says This Basic Materials Stock Is ‘Hot As A Pistol’

Photo via Shutterstock