GE Aerospace (NYSE:GE) will release earnings results for the third quarter, before the opening bell on Tuesday, Oct. 21.

Analysts expect the Evendale, Ohio-based company to report quarterly earnings at $1.47 per share, up from $1.15 per share in the year-ago period. The consensus estimate for GE Aerospace's quarterly revenue is $10.41 billion, compared to $8.94 billion a year earlier, according to data from Benzinga Pro.

On Sept. 23, Kratos Defense & Security Solutions Inc. (NASDAQ:KTOS) and GE Aerospace announced that they have begun altitude testing of the GEK800 engine, designed for unmanned aerial systems and collaborative combat aircraft.

GE Aerospace shares rose 0.1% to close at $300.14 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

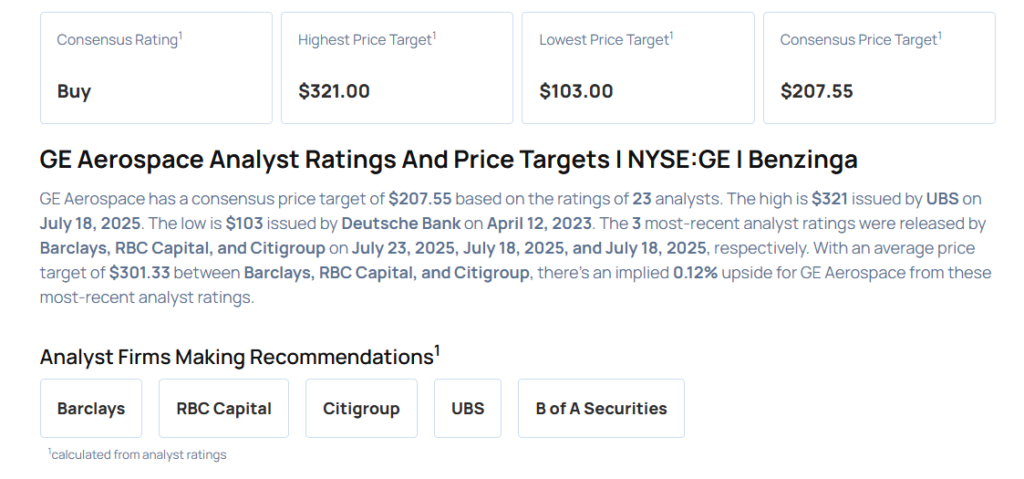

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Barclays analyst Julian Mitchell maintained an Overweight rating and raised the price target from $230 to $295 on July 23, 2025. This analyst has an accuracy rate of 73%.

- RBC Capital analyst Ken Herbert maintained an Outperform rating and boosted the price target from $275 to $300 on July 18, 2025. This analyst has an accuracy rate of 79%.

- Citigroup analyst Andrew Kaplowitz maintained a Buy rating and raised the price target from $296 to $309 on July 18, 2025. This analyst has an accuracy rate of 84%.

- UBS analyst Gavin Parsons maintained a Buy rating and increased the price target from $300 to $321 on July 18, 2025. This analyst has an accuracy rate of 66%.

- B of A Securities analyst Ronald Epstein maintained a Buy rating and raised the price target from $225 to $230 on April 25, 2025. This analyst has an accuracy rate of 70%.

Considering buying GE stock? Here’s what analysts think:

Read This Next:

- Top 2 Industrials Stocks That May Collapse This Quarter

Photo via Shutterstock