Shoulder Innovations Inc. (NYSE:SI) shares climbed 21.04% in after-hours trading Tuesday, closing at $13.75, after the medical technology company reported third-quarter earnings that beat expectations and raised its full-year revenue outlook.

Check out the current price of SI stock here.

According to Benzinga Pro data, SI closed regular trading at $11.36, up $0.35, or 3.18%, on Tuesday.

Q3 Revenue Growth Accelerates

The Michigan-based company reported third-quarter revenue of $11.8 million, up 58% from $7.5 million a year earlier.

Shoulder Innovations sold 1,584 implant systems during the quarter, a 53% increase year over year, while maintaining a gross margin of 76.2%.

Market watchers took note of the results.

$SI Q3 2025 earnings: Strong Top-Line Acceleration and Raised Guidance Overshadow Widening Operational LossesShoulder Innovations reported a very strong quarter, marked by a significant acceleration in revenue growth and an increase in its full-year guidance. This performance…

— Finsee (@Finsee_main) November 11, 2025

Upgraded Full-Year Guidance

Shoulder Innovations raised its 2025 revenue forecast to $45 million to $46 million, projecting roughly 42% to 45% growth compared with 2024.

CEO Rob Ball stated the company is “very excited about our accelerating momentum through 2025, with first-half year-over-year revenue growth of 37% expanding to 58% in the third quarter.”

See Also: Why Did Salarius (SLRX) Shares Soar Over 23% After-Hours?

Losses Widen Despite Revenue Growth

In comparison to the previous year, operating loss grew from $3.9 million to $7.6 million, and net loss expanded from $4.1 million to $8.7 million.

Selling, general, and administrative expenses rose 78% to $15.1 million, primarily due to increased commercial headcount, higher legal costs related to litigation, higher variable selling expenses, and increased public company costs.

Financial Position Strengthened

As of Sept. 30, Shoulder Innovations had $137 million in cash, cash equivalents and marketable securities.

This total includes about $115 million in gross proceeds from convertible notes issued in July and from its initial public offering completed on Aug. 1.

Stock Performance

The stock has slipped 6.58% over the past month and is down 0.18% in the last five days.

Shares of the commercial-stage company have a 52-week range of $10.92 to $17.94 and a market capitalization of $231.29 million.

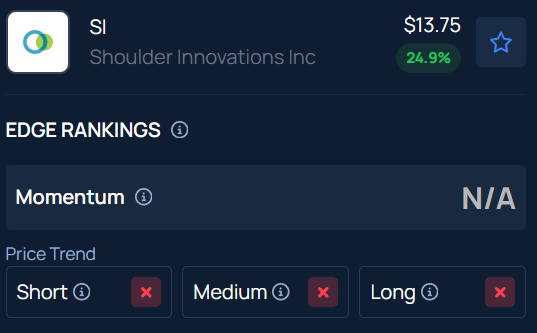

Benzinga's Edge Stock Rankings indicates SI has a negative price trend across all time frames. Here is how the stock fares on other parameters.

Read Next:

- Leifras (LFS) Stock Trending Overnight After 576% Massive Rally On Tuesday

Photo Courtesy: vectorfusionart on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.