monday.com Ltd. (NASDAQ:MNDY) will release earnings results for the third quarter before the opening bell on Monday, Nov. 10.

Analysts expect the Tel Aviv, Israel-based company to report quarterly earnings at 88 cents per share. That's up from 85 cents per share in the year-ago period. The consensus estimate for monday.com's quarterly revenue is $312.26 million, compared to $251 million a year earlier, according to data from Benzinga Pro.

On Aug. 11, the company reported a second-quarter revenue growth of 27% year-on-year (Y/Y) to $299.01 million, beating the analyst consensus estimate of $293.54 million.

Shares of monday.com rose 4.7% to close at $189.59 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

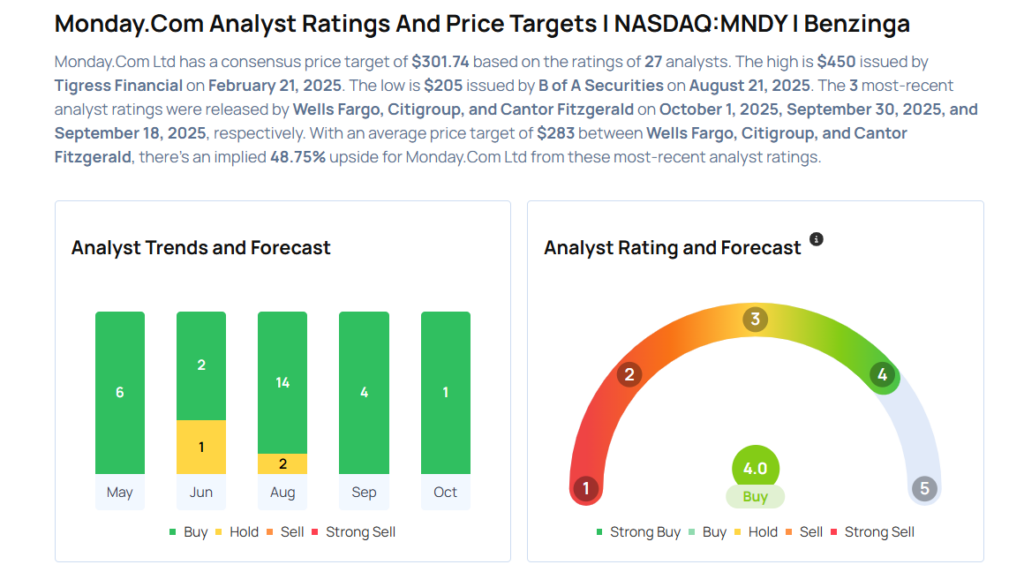

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wells Fargo analyst Ryan Macwilliams initiated coverage on the stock with an Overweight rating and a price target of $260 on Oct. 1, 2025. This analyst has an accuracy rate of 60%.

- Citigroup analyst Steven Enders maintained a Buy rating and increased the price target from $326 to $332 on Sept. 30, 2025. This analyst has an accuracy rate of 68%.

- Cantor Fitzgerald analyst Thomas Blakey maintained an Overweight rating and cut the price target from $286 to $257 on Sept. 18, 2025. This analyst has an accuracy rate of 69%.

- Piper Sandler analyst Brent Bracelin maintained an Overweight rating and slashed the price target from $300 to $275 on Sept. 18, 2025. This analyst has an accuracy rate of 73%.

- Goldman Sachs analyst Kash Rangan maintained a Buy rating and cut the price target from $350 to $270 on Aug. 13, 2025. This analyst has an accuracy rate of 67%

Considering buying MNDY stock? Here’s what analysts think:

Read This Next:

- Top 2 Real Estate Stocks That May Fall Off A Cliff This Month

Photo via Shutterstock