DuPont de Nemours Inc. (NYSE:DD) posted better-than-expected first-quarter 2025 results on Friday.

The company reported sales growth of 5% year-over-year to $3.07 billion, beating the consensus of $3.04 billion. Organic sales increased by +6% YoY, with an 8% volume boost offset by 2% lower prices. Electronics, healthcare and water drove volume gains. Adjusted EPS for the quarter was $1.03 (+30% YoY), beating the consensus of $0.79.

"We continue to benefit from ongoing strength in electronics markets as well as strong demand in healthcare and water end-markets. Through April, we continued to see strong order patterns consistent with our expectations," said Lori Koch, DuPont's CEO.

For the second quarter, DuPont expects net sales of ~$3.20 billion versus the consensus of $3.25 billion and Adjusted EPS of ~$1.05 versus the consensus of $1.08.

DuPont said it sees 2025 adjusted EPS of $4.30–$4.40 versus the $4.34 consensus and expects revenue of $12.8 billion-$12.9 billion versus the $12.92 billion consensus.

DuPont shares fell 0.8% to trade at $66.72 on Monday.

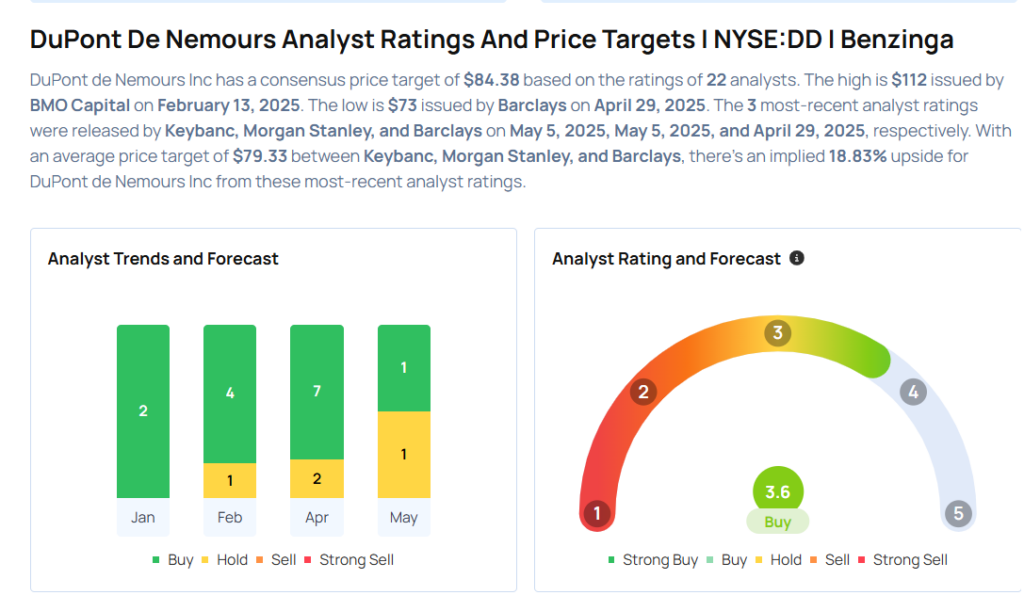

These analysts made changes to their price targets on DuPont following earnings announcement.

- Morgan Stanley analyst Vincent Andrews maintained DuPont de Nemours with an Equal-Weight rating and lowered the price target from $94 to $80.

- Keybanc analyst Aleksey Yefremov maintained DuPont with an Overweight rating and raised the price target from $81 to $85.

Considering buying DD stock? Here’s what analysts think:

Read This Next:

- Top 3 Tech And Telecom Stocks That May Jump This Quarter

Photo via Shutterstock