Jabil Inc. (NYSE:JBL) reported better-than-expected third-quarter results on Tuesday.

The company reported quarterly adjusted earnings per share of $2.55, beating the analyst consensus estimate of $2.31. Quarterly sales of $7.83 billion outpaced the analyst consensus estimate of $7.06 billion.

For the fourth quarter, the company projects net revenues of $7.10 billion to $7.80 billion versus a consensus of $7.19 billion. The company anticipates an adjusted EPS of $2.64-$3.04 versus a consensus of $2.74. In the fourth quarter, the company anticipates segment revenues of: $2.9 billion for Regulated Industries, $3.3 billion for Intelligent Infrastructure, and $1.3 billion for Connected Living & Digital Commerce.

For fiscal 2025, Jabil expects revenues to be $29.0 billion versus a consensus of $28.0 billion, up from the prior view of $27.9 billion. The company anticipates an adjusted EPS $9.33 versus a consensus of $8.97, up from the previous view of $8.95.

Jabil shares rose 4.1% to trade at $204.98 on Wednesday.

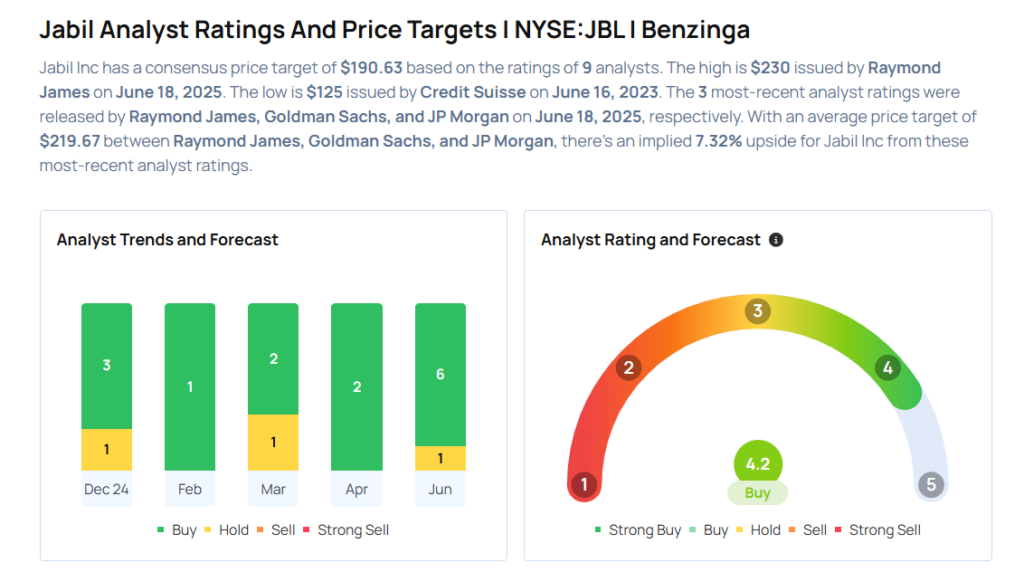

These analysts made changes to their price targets on Jabil following earnings announcement.

- UBS analyst David Vogt maintained Jabil with a Neutral and raised the price target from $157 to $208.

- JP Morgan analyst Samik Chatterjee maintained the stock with an Overweight rating and raised the price target from $180 to $214.

- Goldman Sachs analyst Mark Delaney maintained Jabil with a Buy and raised the price target from $188 to $215.

- Raymond James analyst Melissa Fairbanks reiterated the stock with a Strong Buy and raised the price target from $170 to $230.

Considering buying JBL stock? Here’s what analysts think:

Read This Next:

- Uber, Southern Company And More On CNBC’s ‘Final Trades’

Photo via Shutterstock