Domino's Pizza, Inc. (NASDAQ:DPZ) will release earnings results for the second quarter before the opening bell on Monday, July 21.

Analysts expect the pizza company to report quarterly earnings at $3.96 per share, down from $4.03 per share in the year-ago period. Domino's Pizza is projected to report quarterly revenue of $1.14 billion, compared to $1.1 billion a year earlier, according to data from Benzinga Pro.

On June 30, Domino’s Pizza® named Stephen Kramer to Board of Directors.

Domino's shares fell 0.6% to close at $465.95 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

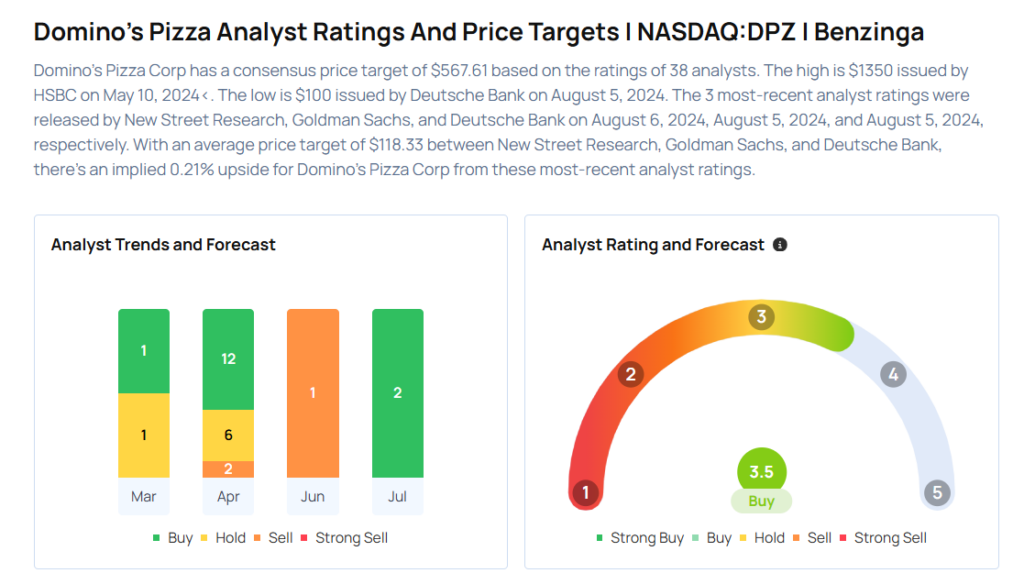

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Barclays analyst Jeffrey Bernstein maintained an Underweight rating and cut the price target from $425 to $420 on April 30, 2025. This analyst has an accuracy rate of 64%.

- Citigroup analyst Jon Tower maintained a Neutral rating and raised the price target from $480 to $500 on April 29, 2025. This analyst has an accuracy rate of 70%.

- Argus Research analyst John Staszak reiterated a Hold rating with a price target of $490 on April 29, 2025. This analyst has an accuracy rate of 68%.

- BMO Capital analyst Andrew Strelzik maintained an Outperform rating and increased the price target from $515 to $540 on April 29, 2025. This analyst has an accuracy rate of 65%.

- Wells Fargo analyst Zachary Fadem maintained an Equal-Weight rating and raised the price target from $445 to $465 on April 29, 2025. This analyst has an accuracy rate of 83%

Considering buying DPZ stock? Here’s what analysts think:

Read This Next:

- Top 2 Energy Stocks That May Fall Off A Cliff This Quarter

Photo via Shutterstock