Crypto SWOT: BNY Mellon and Goldman Sachs are using blockchain to track money market fund ownership

Kitco

28 Jul

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Conflux, rising 68.87%.

- PNC Financial Services Group has partnered with crypto exchange Coinbase Global to provide its banking customers with access to digital currency services. The collaboration will likely start by enabling wealth and asset management clients to trade cryptocurrency through their PNC accounts, according to Emma Loftus, head of treasury management at PNC, as reported by Bloomberg.

- Strategy’s upsized $2.5 billion offering to buy more Bitcoin highlights growing institutional confidence in digital currency as a strategic treasury asset. With favorable accounting changes and rising adoption among public companies, this move represents a major opportunity for firms to diversify balance sheets and capitalize on Bitcoin’s long-term upside.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Pump.fun, down 41.20%.

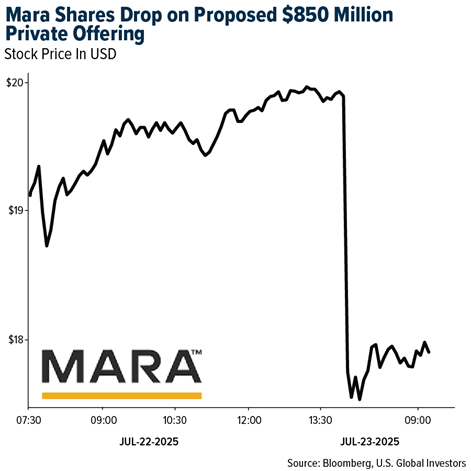

- MARA Holdings shares slid as much as 6.2% in premarket trading Wednesday after the Bitcoin miner announced it intends to offer $850 million of zero-coupon convertible senior notes due in 2032 through a private offering, according to Bloomberg.

- The SEC’s Division of Trading and Markets initially approved the conversion of the Bitwise 10 Crypto Index Fund into an ETF but later issued an indefinite stay suspending the launch. A Bloomberg analyst suggests the SEC may want to finalize a regulatory framework for crypto asset ETPs before allowing such products to convert to ETFs, according to Bloomberg.

Opportunities

- Bank of New York Mellon and Goldman Sachs are collaborating to use blockchain technology to maintain ownership records of money market funds. The firms will use GS DAP, a blockchain platform developed by Goldman, to allow institutional investors to record tokenized versions of select BNY funds, writes Bloomberg.

- The partnership between Goldman Sachs and BNY Mellon to tokenize money market fund shares marks a key step in traditional finance embracing blockchain. With JPMorgan noting the potential to rival stablecoins and use these funds as margin collateral, this move signals a structural shift in how cash moves through markets. Major banks are no longer on the sidelines—they're leading the next wave of crypto integration.

- Tether Holdings SA is planning to resume business in the U.S. following the passage of landmark U.S. crypto legislation, with a focus on institutional markets. The firm’s CEO says Tether’s U.S. domestic strategy will provide an efficient stablecoin for payments, interbank settlements, and trading, according to Bloomberg.

Threats

- JPMorgan Chase considers the $2 trillion projection for the stablecoin market’s potential growth somewhat optimistic. JPMorgan strategists say the market’s infrastructure and ecosystem are still far from fully developed and will take time to build, making substantial growth over the next few years unlikely, writes Bloomberg.

- ConsenSys plans to lay off 7% of its workforce as part of a broader effort to improve profitability. The company recently acquired a startup with about 30 employees who will remain with ConsenSys, and it intends to continue hiring additional workers, writes Bloomberg.

- Crypto stocks slumped alongside Bitcoin as stronger-than-expected U.S. jobs data dampened hopes for imminent Fed rate cuts, pressuring risk appetite. Rising interest rates pose a clear threat to more speculative assets, tightening liquidity and drawing capital away from high-volatility sectors like digital assets and crypto-linked equities.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10