Highlighting Burke & Herbert Financial Services Among 3 Notable Dividend Stocks

As the S&P 500 and Nasdaq Composite reach new highs, buoyed by strong corporate earnings and easing trade concerns, investors are keenly observing market dynamics amid anticipated tech earnings and Federal Reserve decisions. In this context of economic optimism, dividend stocks present a compelling option for those seeking income stability; Burke & Herbert Financial Services is among three notable choices that exemplify the potential benefits of such investments in today's market landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.67% | ★★★★★☆ |

| Universal (UVV) | 5.98% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.68% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.32% | ★★★★★★ |

| Ennis (EBF) | 5.57% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 4.03% | ★★★★★☆ |

| Dillard's (DDS) | 5.21% | ★★★★★★ |

| Credicorp (BAP) | 4.66% | ★★★★★☆ |

| CompX International (CIX) | 4.87% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.80% | ★★★★★★ |

Click here to see the full list of 138 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Burke & Herbert Financial Services (BHRB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Burke & Herbert Financial Services Corp. is the bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland, with a market cap of $943.23 million.

Operations: Burke & Herbert Financial Services Corp. generates revenue primarily through its community banking segment, which accounts for $329.61 million.

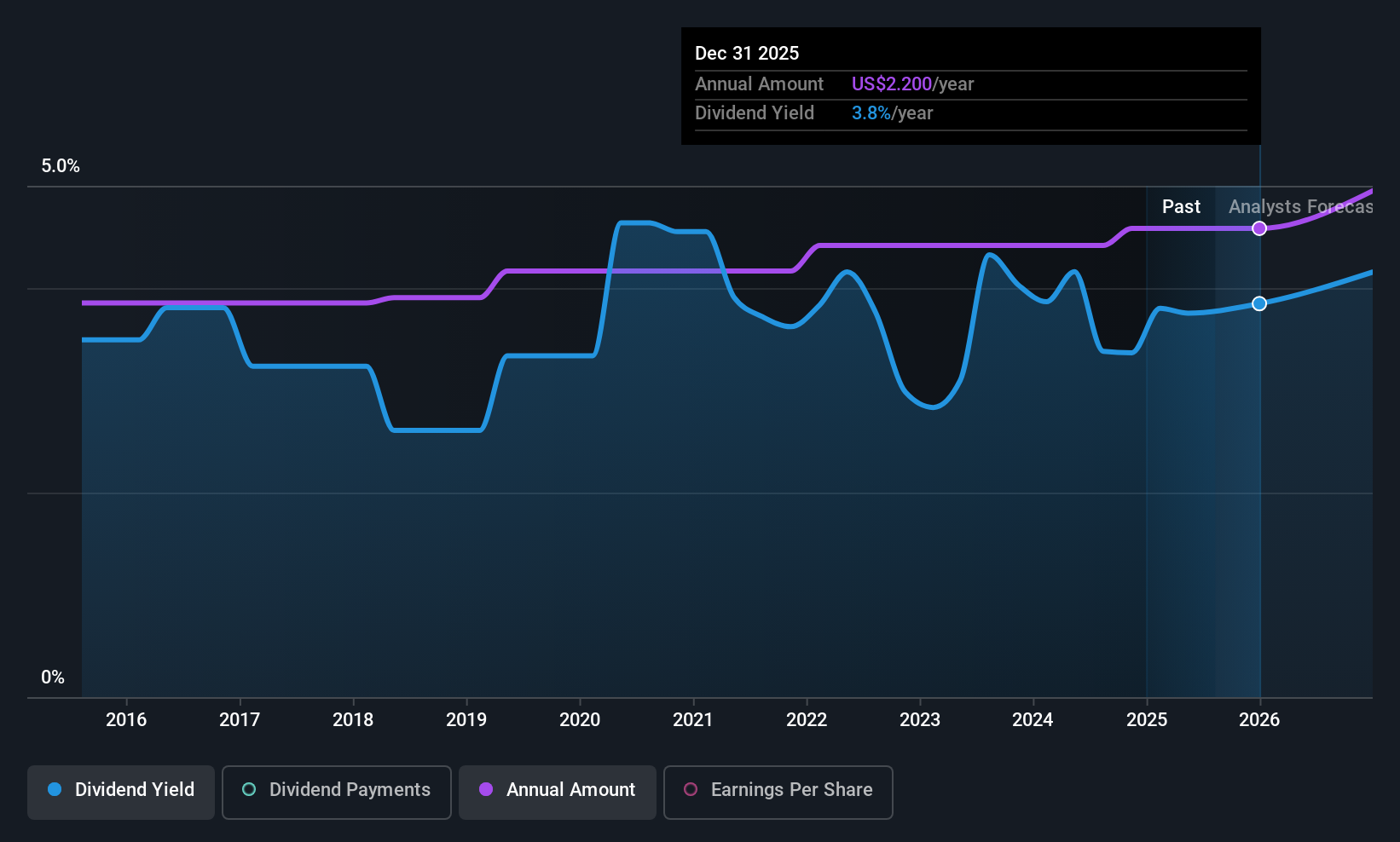

Dividend Yield: 3.5%

Burke & Herbert Financial Services recently declared a $0.55 per share dividend, maintaining its stable and reliable dividend history over the past decade. The company's net income turnaround to $29.9 million in Q2 2025 from a prior loss highlights improved profitability, supporting its 3.5% yield with a low payout ratio of 29.4%. Although trading at good value relative to peers, its yield is below the top tier in the US market.

- Navigate through the intricacies of Burke & Herbert Financial Services with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Burke & Herbert Financial Services' share price might be too pessimistic.

CompX International (CIX)

Simply Wall St Dividend Rating: ★★★★★★

Overview: CompX International Inc. manufactures and sells security products and recreational marine components primarily in North America, with a market cap of $303.41 million.

Operations: CompX International Inc. generates revenue from two main segments: $115.59 million from Security Products and $32.66 million from Marine Components.

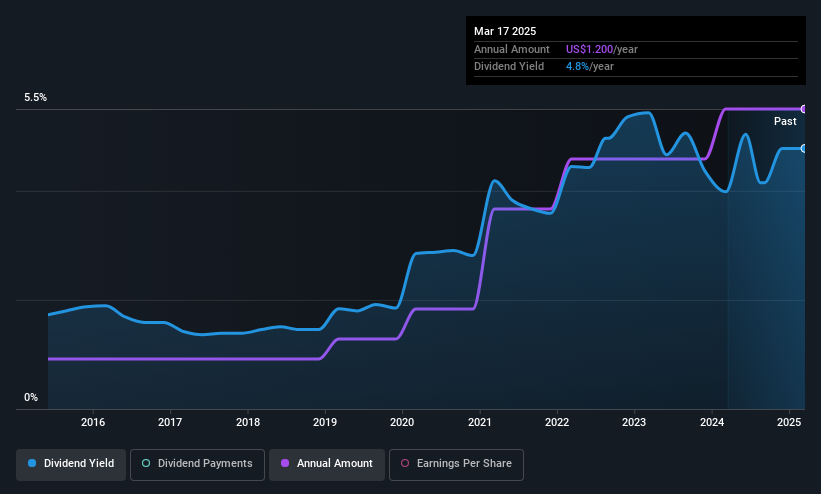

Dividend Yield: 4.9%

CompX International offers a compelling dividend profile with a stable and reliable history over the past decade. Recently added to the Russell 2000 Dynamic Index, it declared a quarterly dividend of $0.30 per share. The payout is well-covered by earnings (82.3%) and cash flows (77.1%), ensuring sustainability. With its 4.87% yield ranking in the top 25% of US dividend payers, CompX trades at a significant discount to its estimated fair value, enhancing its investment appeal for income-focused investors.

- Click here to discover the nuances of CompX International with our detailed analytical dividend report.

- Our expertly prepared valuation report CompX International implies its share price may be lower than expected.

National Bank Holdings (NBHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: National Bank Holdings Corporation is a bank holding company for NBH Bank, offering a range of banking products and financial services to commercial, business, and consumer clients in the United States, with a market cap of approximately $1.49 billion.

Operations: National Bank Holdings Corporation generates its revenue primarily from its banking segment, which accounted for $399.53 million.

Dividend Yield: 3.1%

National Bank Holdings offers a stable dividend history with a recent increase to $0.30 per share, reflecting its commitment to shareholders. The payout is well-covered by earnings, supported by strong financial performance, including Q2 net income of US$34.02 million. However, its 3.06% yield lags behind top-tier US dividend payers. Strategic initiatives like the partnership with Nav aim to bolster growth and enhance long-term value for investors while maintaining a focus on small business support.

- Click to explore a detailed breakdown of our findings in National Bank Holdings' dividend report.

- In light of our recent valuation report, it seems possible that National Bank Holdings is trading beyond its estimated value.

Turning Ideas Into Actions

- Explore the 138 names from our Top US Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10