HP Inc. (NYSE:HPQ) posted better-than-expected third-quarter sales results after Wednesday’s closing bell.

HP reported quarterly earnings of 75 cents per share, which met the consensus estimate. Quarterly revenue clocked in at $13.93 billion, which beat the analyst consensus estimate of $13.69 billion.

"In Q3 we delivered a fifth consecutive quarter of revenue growth, driven by strength in Personal Systems and strong momentum in our key growth areas," said Enrique Lores, CEO of HP. "These results demonstrate our agility and focused execution in the quarter, reinforce the strength of our strategy, and our commitment to be a leader in the future of work," Lores added.

HP estimates fourth-quarter non-GAAP diluted net EPS to be in the range of 87 cents to 97 cents, versus the 92 cent estimate.

HP shares gained 4.6% to $28.36 on Thursday.

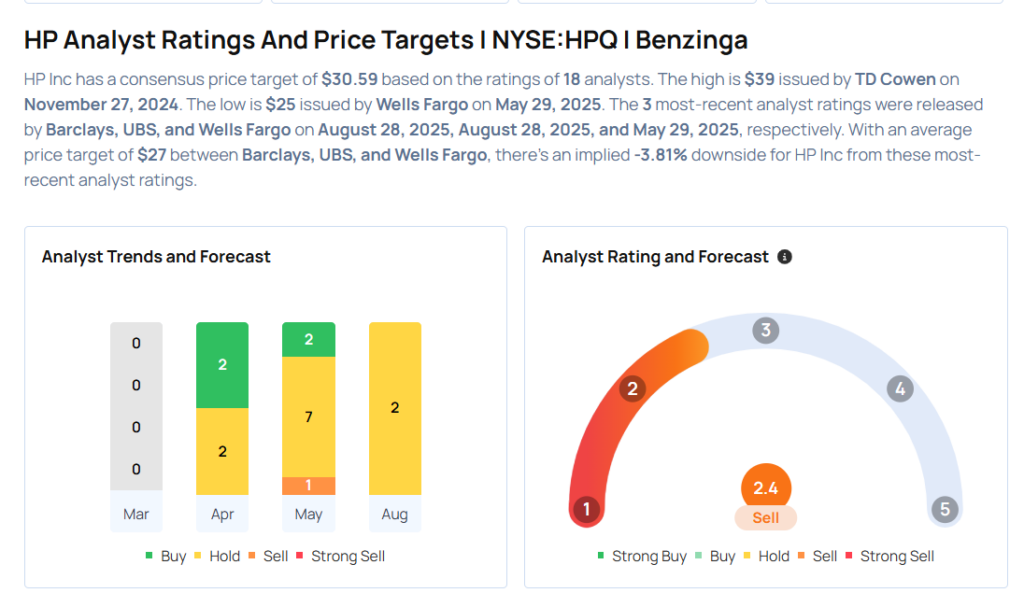

These analysts made changes to their price targets on HP following earnings announcement.

- UBS analyst David Vogt maintained HP with a Neutral and raised the price target from $26 to $29.

- Barclays analyst Tim Long maintained the stock with an Equal-Weight rating and lowered the price target from $28 to $27.

Considering buying HPQ stock? Here’s what analysts think:

Read This Next:

- Top 3 Tech Stocks That Could Lead To Your Biggest Gains This Quarter

Photo via Shutterstock