智通财经APP获悉,尽管法国政局动荡引发市场担忧,但货币期权数据显示投资者对欧元仍保持强劲需求,表明这一共同货币再次成功规避了政治风波的冲击。

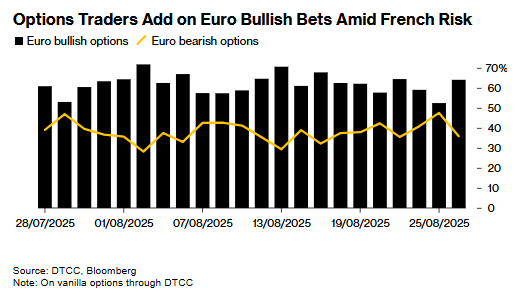

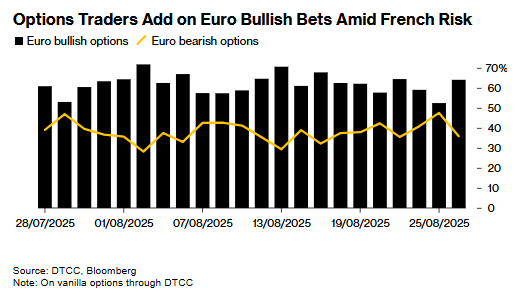

根据美国存管信托和结算公司数据,周二欧元看涨期权合约迎来本月最强劲的交易时段之一。与此同时,由于市场担忧法国政府可能因信任投票垮台,该国资产持续承压。

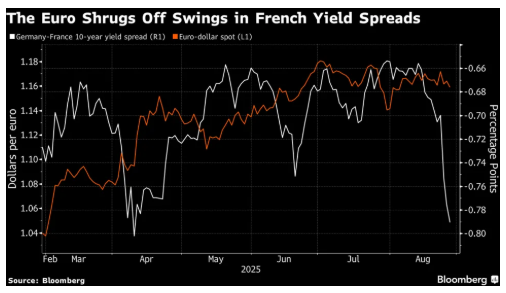

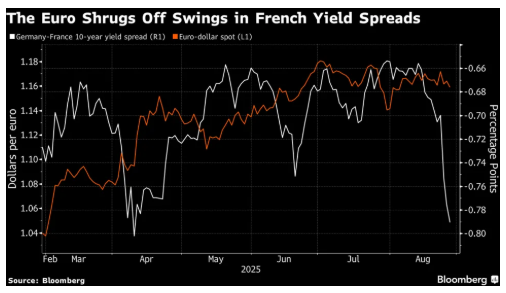

欧元展现出的韧性表明,交易员将当前动荡视为法国国内事务,而非可能蔓延至整个欧元区的系统性风险。类似情景去年已然上演——当时法国股市大幅下跌,且其与德国的收益率利差不断扩大,但汇市对此的反应却十分平淡。

仓位布局与市场情绪指标也指向相同趋势。一个月期与一周期风险逆转期权的价差持续处于正值区间,这凸显出尽管市场对短期走势持谨慎态度,但对年底前的欧元走势仍持看涨预期,两种情绪相互抵消。从所谓的 “波动率偏斜” 指标中可以看出,长期限期权的押注也进一步印证了这一趋势。

在现货外汇市场,欧元走势主要受美元波动主导,而非法国政治及财政预算问题影响。周二欧元兑美元上涨0.2%,因市场对美联储独立性受威胁的担忧拖累美元走软。但据欧洲交易员透露,随着月末资金流动推动美元回升,周三欧元汇率跌至三周低点。

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.