热点栏目

客户端

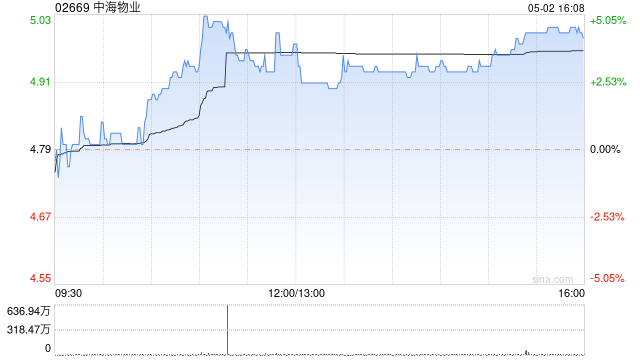

开源证券发布研报称,首次覆盖中海物业(02669),给予“买入”评级,预计公司2025-2027年归母净利润为16.1、17.6、19.6亿元,对应EPS为0.49、0.54、0.60元,当前股价对应PE为9.5、8.7、7.8倍。中海物业隶属于中建集团旗下中国海外集团,关联方拿地稳健销售市占率明显提升,交付资源充足且项目能级不断提升。公司在管项目规模持续提升,伴随亏损项目退出、高端住宅陆续交付等项目结构调整,盈利能力有望持续改善。

报告中称,公司上市以来收入利润均保持增长,2019-2024年收入和利润复合增长率分别为23.1%和25.7%,基础物管收入占比超70%,仍为公司主要收入来源。公司2024年利润增速高于收入增速,销售毛利率和净利率分别提升0.7pct、0.5pct至16.6%、10.8%,主要系基础物管毛利率提升。公司2019-2023年分红比例保持在30%左右,2024年提升至35.8%,但相较主流物企派息率相对较低。

责任编辑:史丽君

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.