Investing in US stocks used to feel like a hurdle, especially when a share of a big company in the S&P 500 was considered too expensive to purchase. But now, many well-known companies have moved towards stock splits and fractional shares that let investors buy just a part of a stock. This makes it much easier for more people to start investing and slowly build their positions without having to provide a lot of money upfront.

With both options available on Tiger Trade, beginner investors might be considering whether it's better to buy a fractional share or a whole share. In this article, we'll break down the differences in liquidity, costs and more to assist in making a decision between investing in a fractional share or a whole share.

Consider the trading rules

The trading rules are different for fractional shares and whole shares. These rules affect how you trade and what rights you get as an investor.

Trading unit

Whole shares: You have to buy at least 1 full share. You can only buy whole units, like 1, 2, or 10 shares. There is no fraction allowed.

Fractional shares: You can buy less than one full share. At Tiger Brokers Australia, you can invest in as little as 0.00001 quantity of a certain stock. And, you should start to invest in big-name stocks from USD 1!

Trading time

Whole shares: You can trade during regular US stock market hours (11:30 p.m. to 6:00 a.m. AEST ), as well as during pre-market and after-market sessions.

Fractional shares: Usually, fractional shares can only be traded during regular market hours. Pre-market and after-market trading are often not supported.

Shareholder rights

Whole shares: When you own a whole share, you get full shareholder rights. This includes voting on company decisions and receiving dividends.

Fractional shares: Fractional share owners usually do not get voting rights. However, you can still receive cash dividends based on the part of the share you own.

Consider market liquidity

When investing in US stocks, it's important to know how quickly and easily you can buy or sell your shares. This is called liquidity.

Whole shares: Easy to trade, fully transparent

Whole shares are part of the main stock market. When you place an order to buy or sell a full share, it goes directly to the exchange order book, where it's matched with other investors in real time. This means:

Trades usually happen fast

Prices are transparent and fair

You can choose between market or limit orders

Fractional shares: Limited liquidity, behind-the-scenes matching

Fractional shares work differently. They are usually handled behind the scenes by your brokerage, not directly on the stock exchange. This means:

Your trade is matched inside the system, not with the open market

You usually can't place limit orders—only market orders

There might be delays in trade execution

Prices may be slightly less favourable due to small spreads (price gaps)

Consider investment thresholds

Investors generally aim to maximise profitable market returns while keeping costs low. When considering investments, it's important to think about your investment thresholds, including what type of investment suits you and what you can afford.

Whole shares

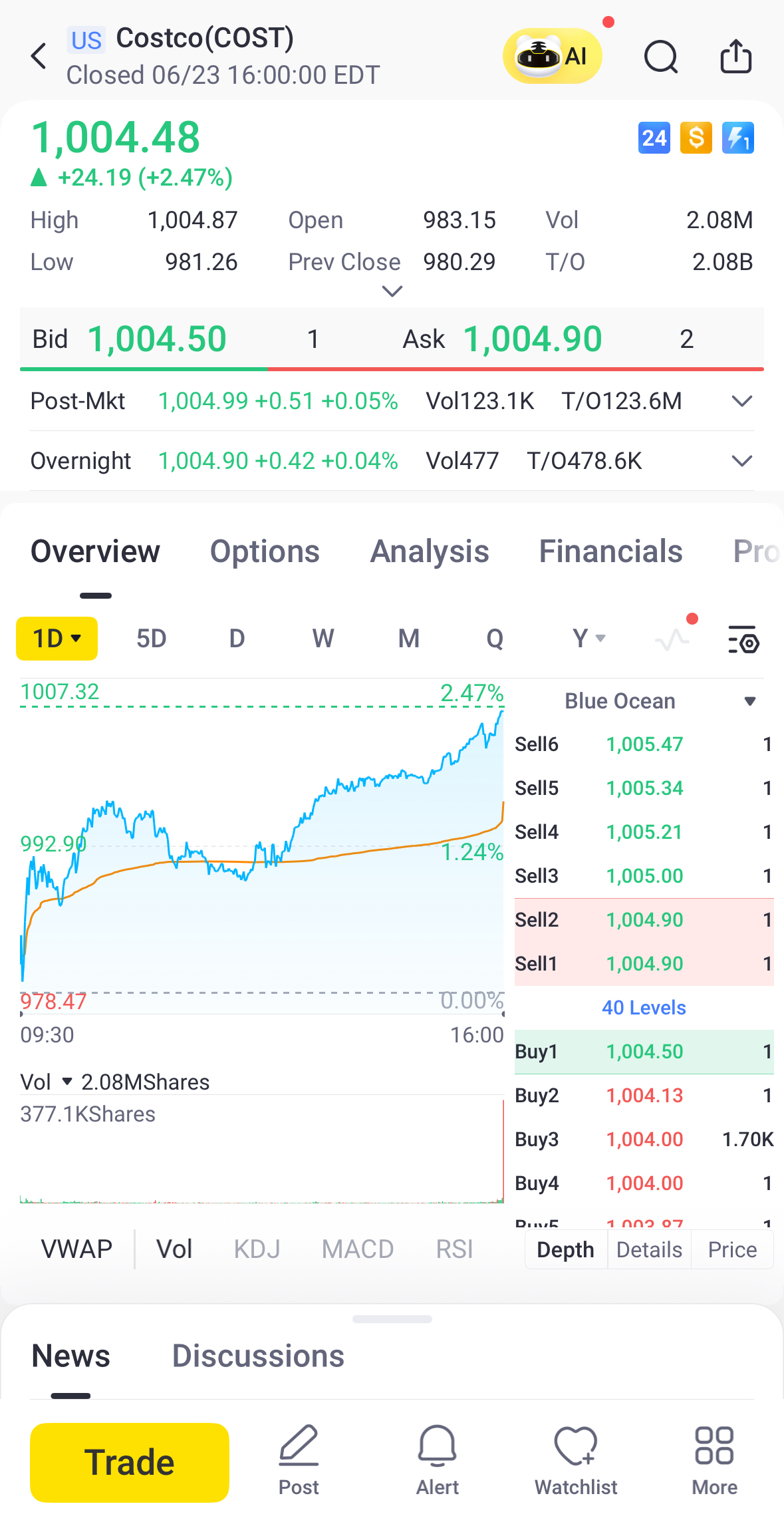

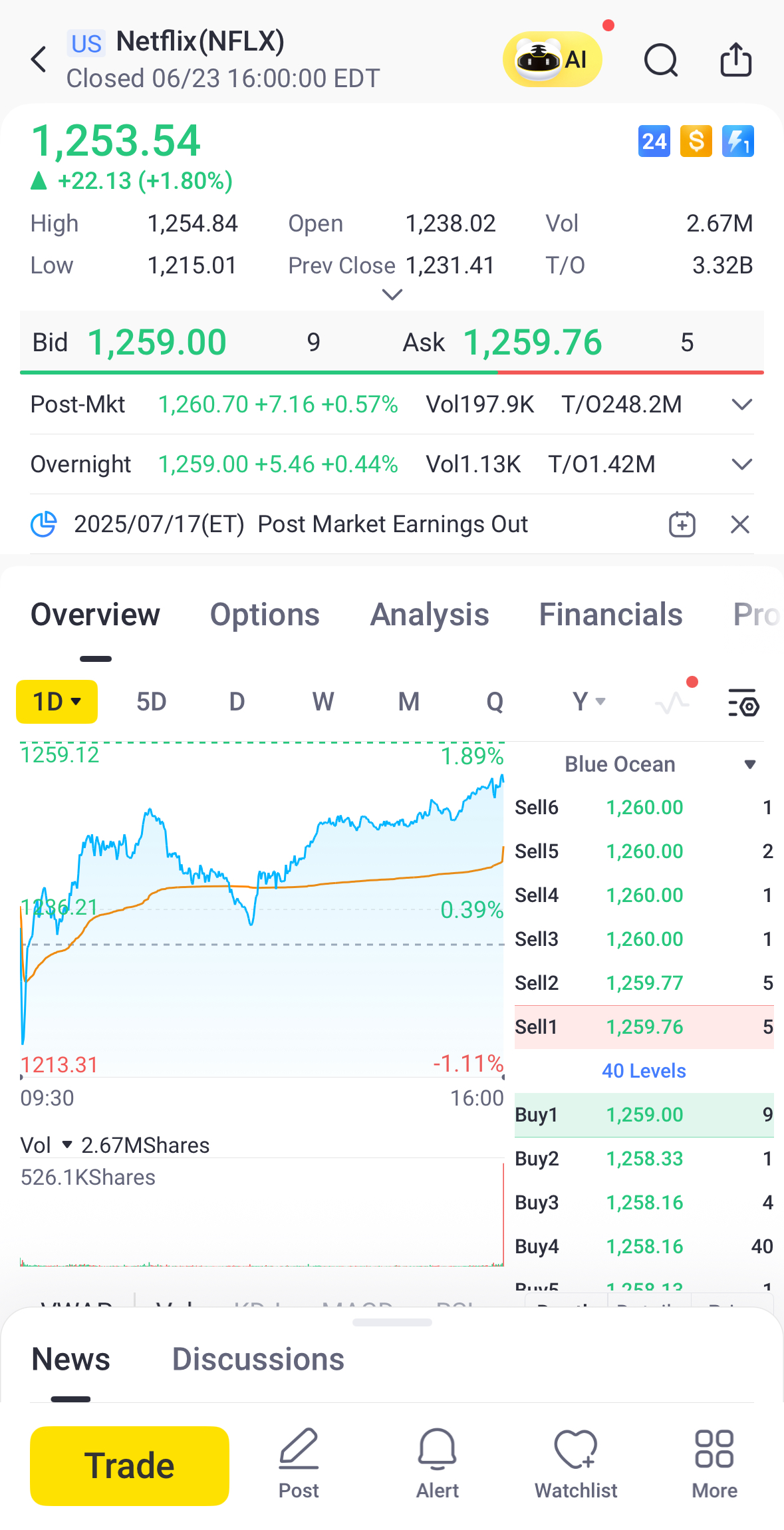

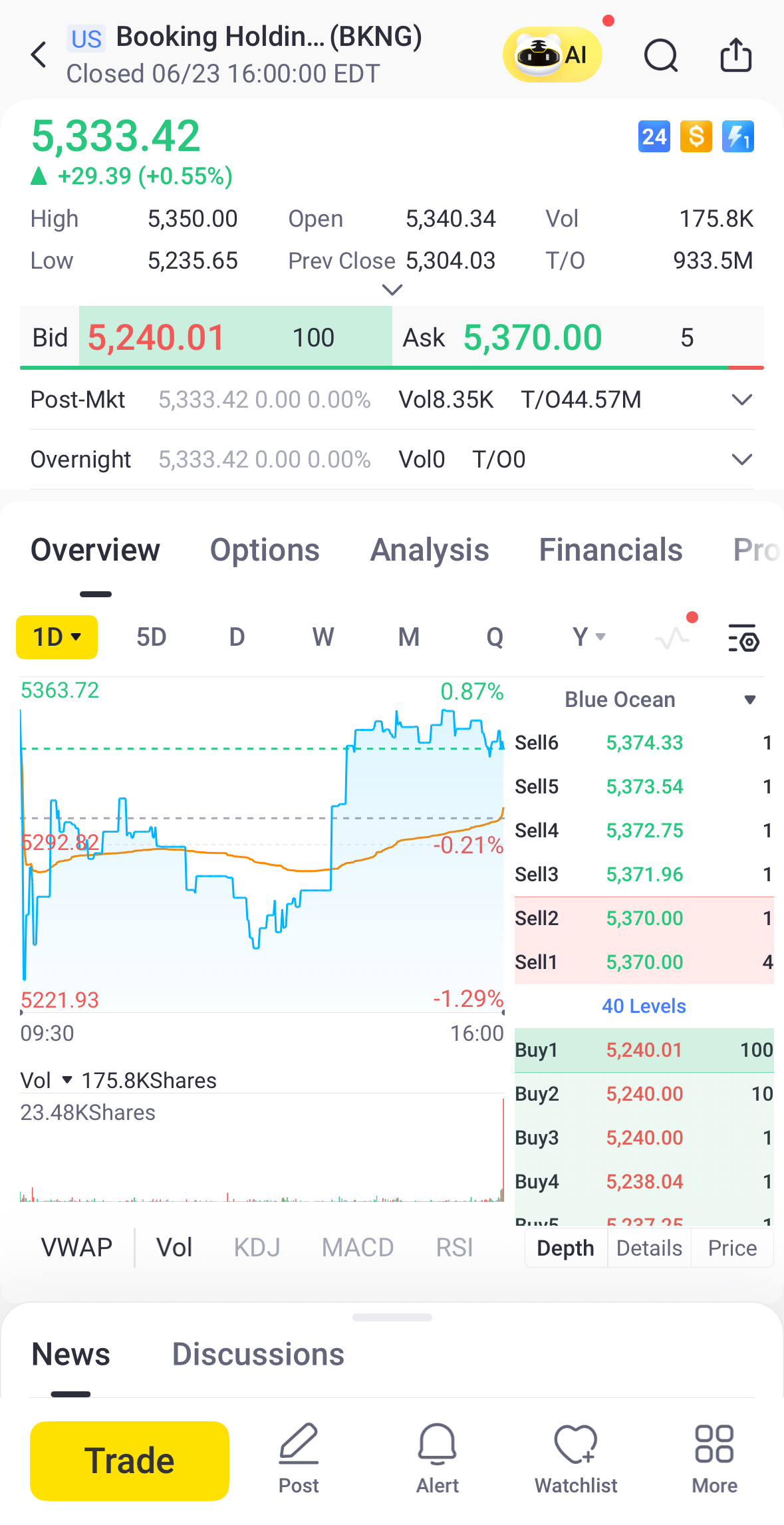

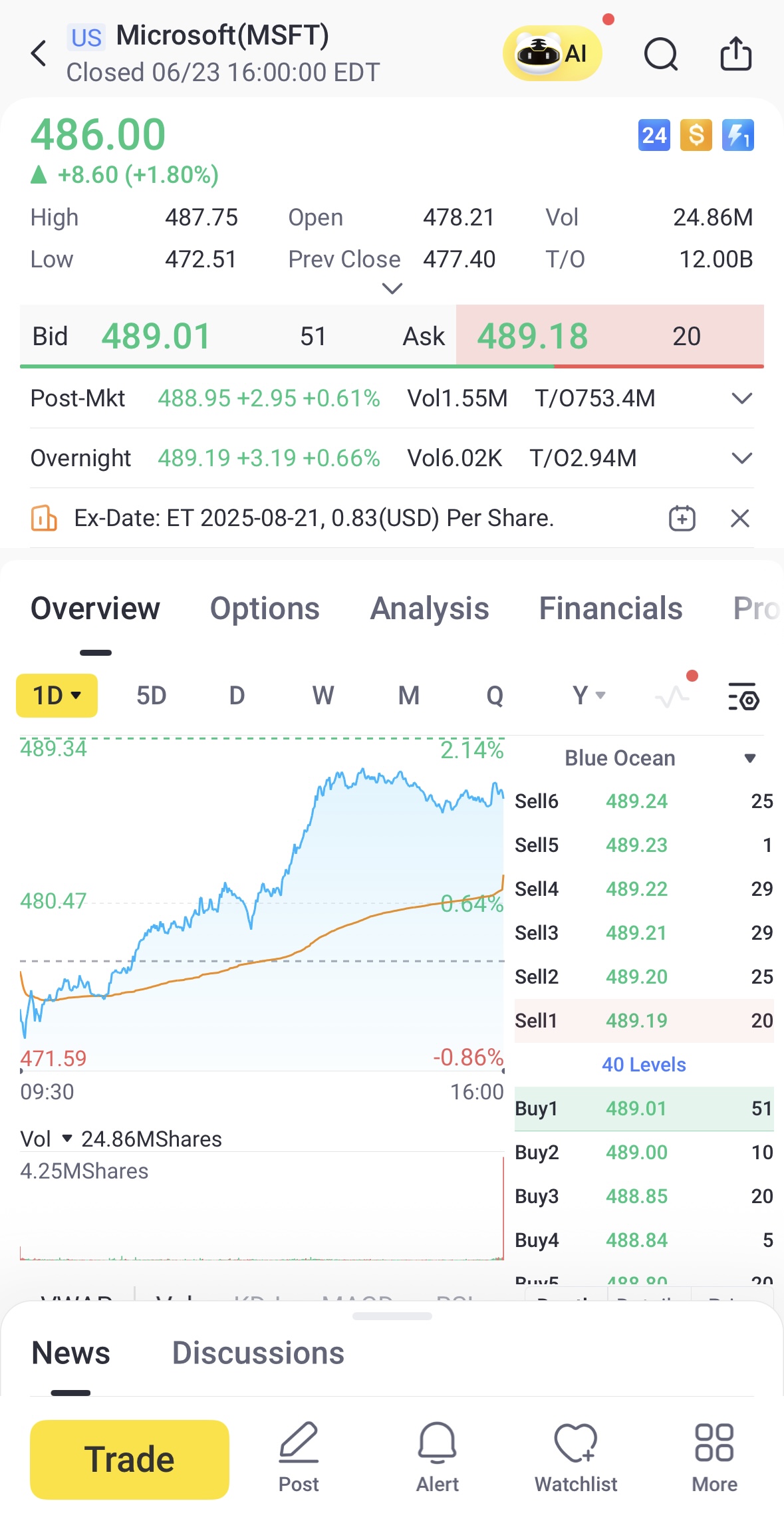

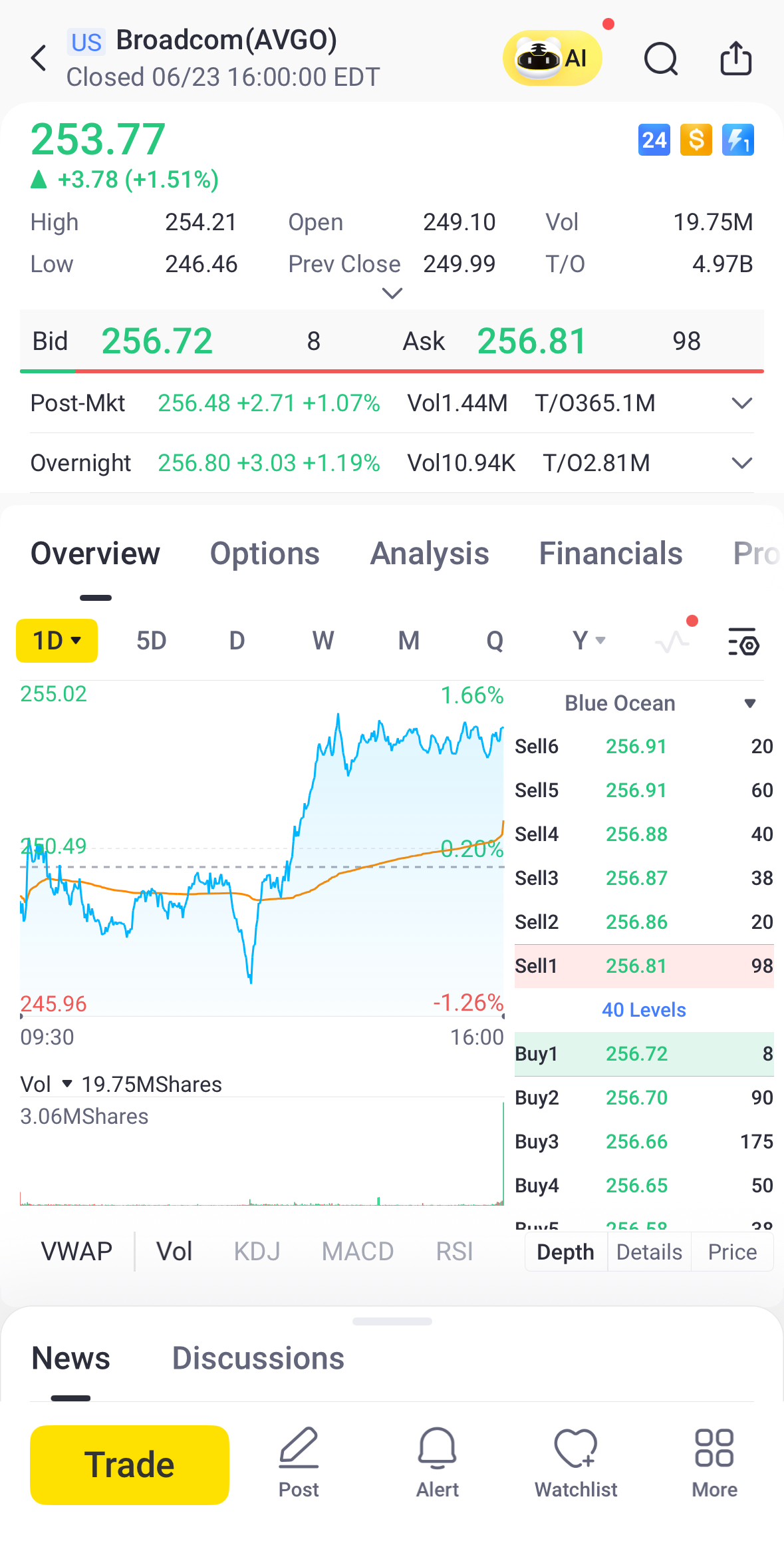

Buying a single US share in some companies that have no split stocks can be very expensive. To own just one share of a top company, you may need a large amount of capital. For example, here are a few top US companies with an expensive share price:

(The stock prices listed above are for illustrative purposes only and reflect historical price ranges at the time of writing. Prices may change over time. These examples are not recommendations to buy or sell any specific stocks.)

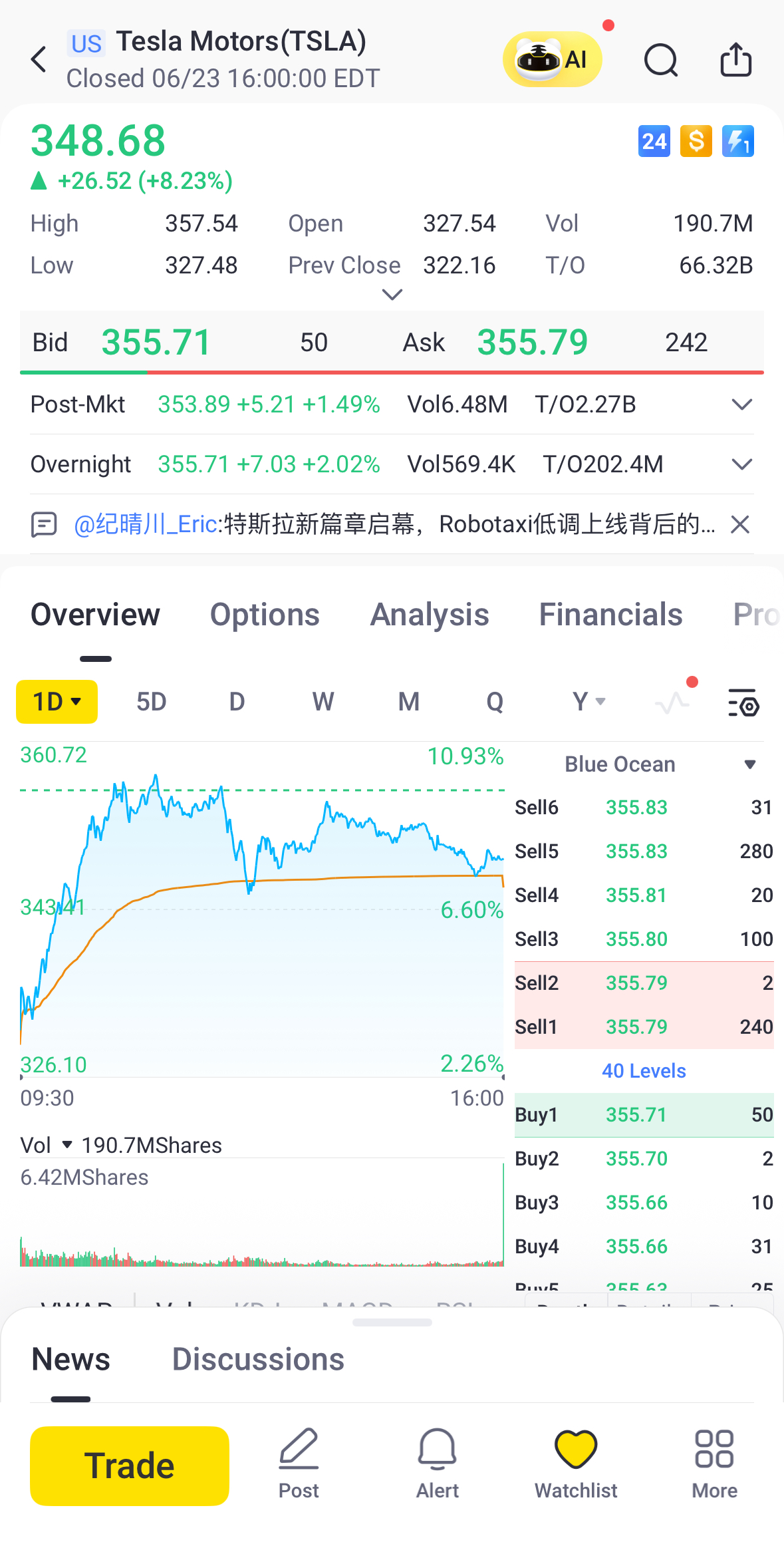

Even the companies that have completed a split stock can be expensive, and investors may still need to invest a considerable amount of money in the stock market:

(The stock prices listed above are for illustrative purposes only and reflect historical price ranges at the time of writing. Prices may change over time. These examples are not recommendations to buy or sell any specific stocks.)

For beginner investors, this can create a mental barrier to entry. For many, there may be a need to save up before affording such an investment, whilst also taking into account market rises. This can mean missed opportunities.

Fractional shares

With fractional shares, you can invest in the same big-name stocks for just a few dollars. Through Tiger Brokers, you can open the door to investing in fractional shares in Australia, starting at USD 1! This allows investors to invest within their means and purchase fractional shares, which can also be especially useful for:

Fixed investments: Set up a recurring investment (weekly/monthly) to grow your portfolio over time

Step-by-step buying: Add to your investment gradually or set up an auto investment function instead of all at once—less pressure, better control

Smoothing your costs: Buy over time to balance out price ups and downs (this is called “dollar-cost averaging”)

Consider transaction costs

In Australia, over 50% of investors buy or sell stocks via share trading platforms. The rise in the use of trading platforms compared to conventional brokerage firms has meant that investing in global markets has become more convenient and easier for people. This increase in retail investing means that it is essential to understand the transaction costs involved, no matter which method is chosen. And these costs can differ depending on whether you’re buying whole shares or fractional shares.

Feature | Whole Shares | Fractional Shares |

Fee Transparency | Usually clear, shown upfront | May include hidden costs or built-in spreads |

Brokerage Fees | Often a flat fee | Often marketed as “zero commission,” but costs may apply |

Market Price Accuracy | Matches real-time exchange prices | Slight markups may occur; price not always real-time |

Order Types | Can choose market or limit orders | Some limited to market orders only |

Table 2: Whole vs. fractional share trading costs

Tiger Brokers offers a transparent and competitive pricing solution for all Australians to invest in US fractional shares and whole shares. Tiger Brokers' trading platform, Tiger Trade, offers four $0 brokerage monthly trades on either ASX, US stock, ETFs or US options, when you open an account and complete your first deposit^.

Brokerage Fees | Whole Shares | Fractional Shares |

≥1 share and ≤200 shares | USD 2 / Order | / |

> 200 shares | USD 0.01 / Share | / |

<1 share | / | 1% × Trade Value |

Table 3: whole vs. fractional share fee comparison

Consider via Tiger Brokers

Besides transparent and competitive brokerage pricing, Tiger Brokers Australia also provides a mix of access, speed, and value for Australians that's hard to beat!

Tiger Brokers gives you the chance to explore over 19,000 US stocks, ETFs, and even OTC securities, all in one app, Tiger Trade! Chasing tech giants, investing in S&P 500 ETFs, watching blue-chip, or other niche sectors? There's something for every type of investor.

Want to trade outside of US market hours? No problem! Tiger offers 24-hour trading on more than 9,500 stocks and ETFs, so you can act on global news, earnings updates, or price dips—whenever they happen. (Trading fractional shares would be excluded)

Get free access to Level 2 market data from Tiger Brokers! You’ll see the full order book and how deep the market actually is, giving you better insight and allowing for smarter decision-making!

Reference

[1] Available at: https://www.itiger.com/au/help/detail/19154664

[2] Available at: https://www.finder.com.au/share-trading/investment-platform-statistics

Disclaimer:

^New clients & unfunded existing clients only. Only min. brokerage waived for 4 ASX, US stocks or ETFs or options trades. Third-party fees and other fees still apply. See T&Cs for details.

Capital at risk. You should only trade with money you can afford to lose. See FSG, PDS, TMD and T&Cs via our website before trading. Information provided may contain general advice without taking into account your objectives, financial situations or needs. Past performance is no guarantee of future results. Graphics and charts are for illustrative purposes only. Tiger Brokers (AU) Pty Limited. ABN 12 007 268 386 AFSL 300767