With more and more overseas stock markets becoming available to both wholesale and retail investors, investing has become hugely popular amongst everyday Aussies. More and more Aussie investors are turning their attention to US stocks, drawn by opportunities in tech giants like Apple and Tesla, and e-commerce leaders like Amazon. With such a dynamic market, it’s no wonder people are eager to get involved.

If you're thinking about how to buy US stocks in Australia but don't know where to start, no worries! This easy guide will help beginners navigate the US market like a pro.

US stock trading rules: What Aussie investors must know

Before buying US stocks in Australia, every Aussie beginner must know some key American trading rules. Unlike the ASX, the US market has different hours, exchanges, and regulations that could make or break your trades. Don't worry - we'll break it all down in simple terms!

Trading hours

US stock trading hours vary throughout the year due to Daylight Saving Time changes in both the US and Australia. Depending on the season, the time difference between US Eastern Time and Australian Eastern Time can shift by up to two hours.

As a result, the time you can trade US stocks from Australia also shifts with the seasons. Here’s how the trading sessions align with AEST (Australian Eastern Standard Time) during winter months and AEDT (Australian Eastern Daylight Time) during summer months:

Trading hours | US Eastern Time | AEDT (First Sunday in November to the Second Sunday in March) | AEDT (Second Sunday of March to the First Sunday of April) |

Pre-market | 04:00-9:30 | 20:00-01:30 | 19:00-00:30 |

Regular hours | 09:30-16:00 | 01:30-8:00 | 00:30-07:00 |

Post-market | 16:00-20:00 | 08:00-12:00 | 07:00-11:00 |

Overnight | 20:00-04:00 | 12:00-20:00 | 11:00-19:00 |

Trading hours | AEST (First Sunday in April to the First Sunday in October) | AEDT ( First Sunday of October to the First Sunday of November ) |

Pre-market | 18:00-23:30 | 19:00-00:30 |

Regular hours | 23:30-06:00 | 00:30-07:00 |

Post-market | 06:00-10:00 | 07:00-11:00 |

Overnight | 10:00-18:00 | 11:00-19:00 |

Note: Aussie traders can trade US stocks 24/5 on Tiger Trade. So, you'll never miss an opportunity.

Market structure

The US stock market operates through multiple exchanges, each catering to different types of investments. Whether you're tracking US stock market live updates, looking to invest in the S&P 500, or planning to buy US stocks in Australia, it helps to understand where your stocks are listed:

NYSE: The oldest and second-largest exchange, home to blue-chip stocks like Coca-Cola and Disney.

NASDAQ: The largest exchange, with tech giant hubs such as Apple, Google, and Nvidia all listed.

AMEX: The third-largest exchange, focused on ETFs and small-cap stocks.

OTC: The informal market for unlisted stocks, suited for risk-tolerant investors. This includes marketplaces like the Pink Sheets, which have lower listing standards and higher risks.

Rules to watch

Before you hit that “Buy” button, make sure you know these two rules:

Day trading (T+0): Buy and sell the same stock within one day - perfect for quick moves, but watch out for volatility!

Settlement (T+1): Your trade executes instantly, but money and shares don't officially swap hands until the next business day. Plan your cash flow accordingly!

Note: Always check your broker's specific rules - some may have additional restrictions for new investors.

How to buy US stocks in Australia: Step-by-step guide

Now that you’re familiar with the essential rules for buying US stocks in Australia, it’s time to take the next step. Follow this simple guide to get started — from choosing the platform to managing your risks — and start investing with confidence!

Choose a trading platform

Pick a broker that lets you trade US stocks from Australia (like Tiger Brokers).

Make sure they offer zero commission or low fees.

Check if the platform lets you deposit AUD and convert it to USD.

Open an account

Sign up on the platform with your basic details, such as your name, address, and email.

Verify your identity, just like you would when opening a bank account.

Deposit money into your account by transferring money from your Australian bank account.

The platform will convert your AUD to USD for trading. If it doesn't do it automatically, make sure you convert the currency before trying to place an order.

Start investing (big companies or ETFs)

Choose what to invest in:

-Big Companies: If you have a preference for large, established companies, you can explore stocks from top sectors like technology, healthcare and consumer goods.

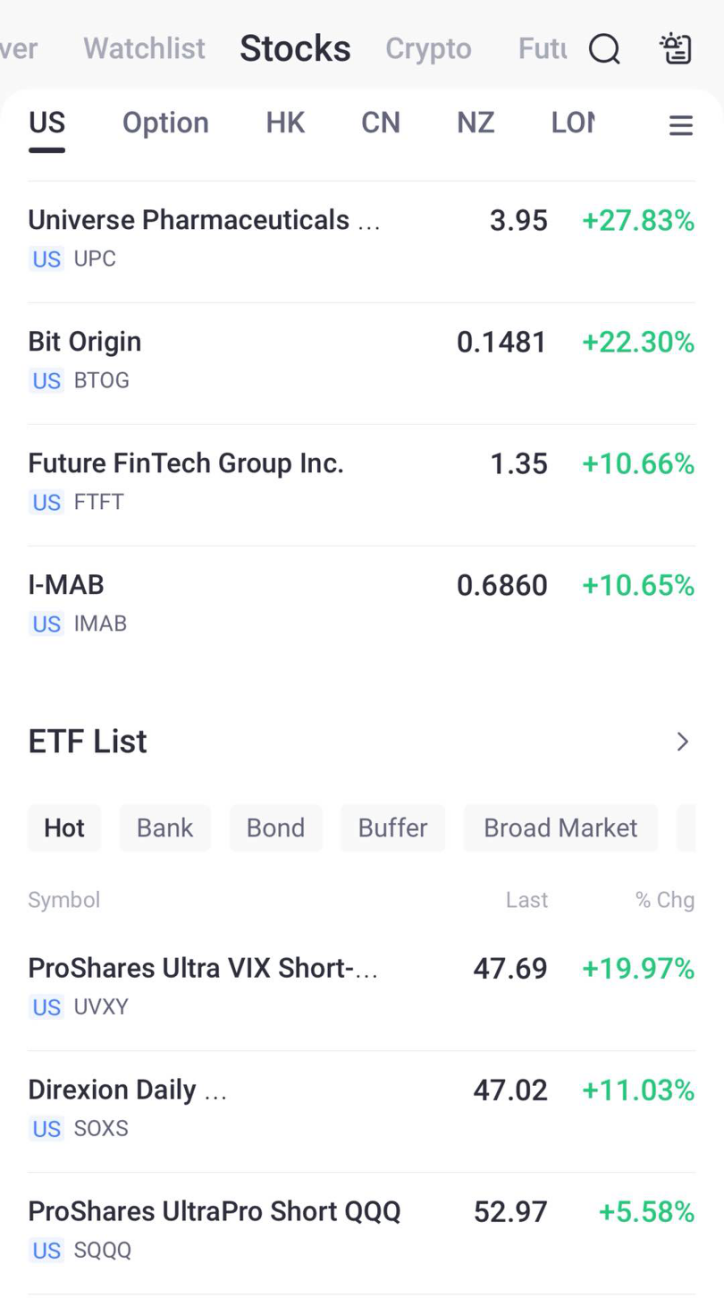

-ETFs (Exchange-Traded Funds): For broader market exposure, ETFs can offer diversification by tracking the performance of a group of companies or focusing on specific industries.

Buy: Simply choose the stock or ETF you want and click to buy.

Risk management

Stop-Loss: Set a limit on how much you’re willing to lose. If the stock price falls to that level, the platform will automatically sell it for you to avoid bigger losses.

Diversify: Don’t put all your money in one stock. Spread it out across different stocks or ETFs to reduce risk.

Why choose Tiger Trade

With your new knowledge of US stock investing, the final piece is choosing a platform that works as hard as you do. The Tiger Trade platform combines all these essential features Australian investors need to buy US stocks in Australia:

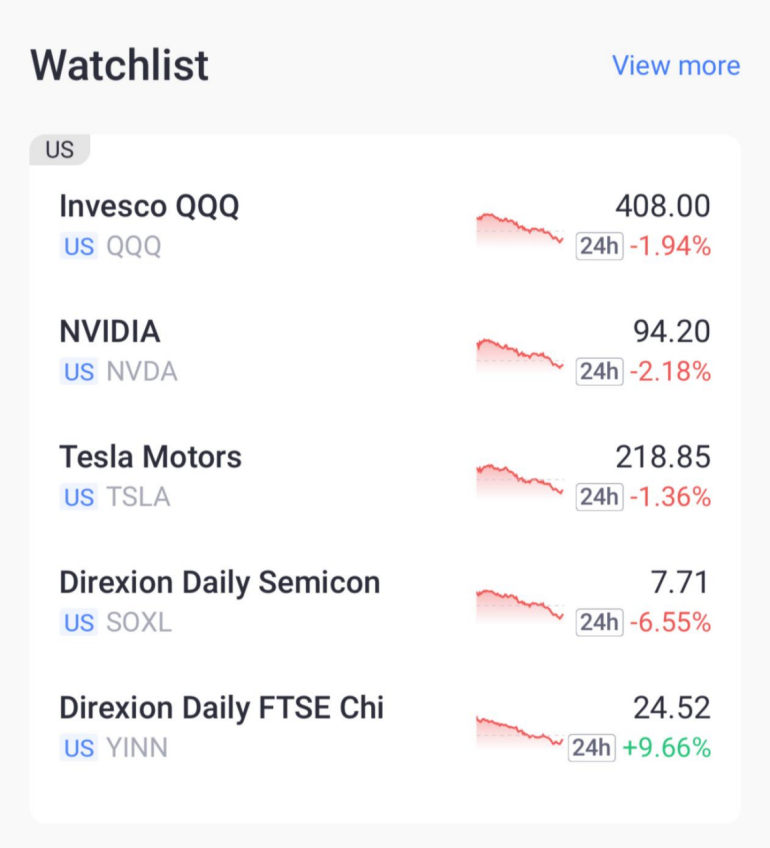

24/5 trading hours

No more late nights! Trade US stocks at convenient times with more opportunities and never miss out on the action.

USD 1 minimum investment

Start small and take your first step into the market with just USD 1* — perfect for beginners.

* Fractional shares are available for selected stocks only.

Free real-time quotes

Stay on top of the market with live, real-time data without the extra costs.

User-friendly & powerful

Whether you’re a beginner or a pro, Tiger Trade is easy to use and packed with features, including advanced tools like depth charts for smarter trades.

Low fees

With Tiger Trade, you’ll pay lower stockbroker fees in Australia compared to other Aussie brokers, saving more on commissions and keeping more of your profits.

Start your US stock journey with Tiger Trade

Investing in US stocks doesn’t have to be complicated. With the right knowledge—trading hours, market rules, and real-time data—You can buy US stocks in Australia with confidence, and with a platform like Tiger Trade, offering low fees and powerful tools. Ready to start? Download Tiger Trade today and take your first step into the US market!

Disclaimer:

Capital at risk. See FSG, risk disclosures, PDS, TMD, and T&Cs via our website before trading.

Tiger Brokers (AU) Pty Limited ABN 12 007 268 386 AFSL 300767.