Knowing what to invest in, when to invest and how to invest can be tricky - even for the experienced investor. When it comes to options trading, there are a myriad of strategies that can be used. In our previous articles, we covered some of the most common basic and income generating strategies used in options trading.

In this article, we take a general look at some of the more advanced strategies used by expert investors. We will explain the difference between bull and bear spreads and explore what benefits and risks these strategies present to the investor.

Before we jump into these strategies, here are some more key terms you may come across when exploring options strategies throughout this article:

Hedging: A strategy used to limit risks. When you hedge your investment or trade you offset losses in investments by taking an opposite position in a related asset.

Time decay: the rate of change in the value of the price of an option as it nears expiration.

Underlying asset: refers to the stock, bond, or commodity that is to be purchased.

Spread Strategies- Bull spreads, bear spreads

Bull Call Spread

Bull Call Spread: A smart strategy for moderate gains

A bull call spread is a simple yet effective options trading strategy that allows investors to profit from a moderate rise in a stock’s price while keeping risk under control. This strategy involves:

Buying a call option at a lower strike price.

Selling a call option at a higher strike price.

Both options must have the same expiration date and be based on the same stock. This approach helps lower the cost of trading compared to buying a single call option, making it a great choice for traders looking to balance profit potential with affordability.

Why use a bull call spread?

Better used when: You expect a stock’s price to go up moderately, not dramatically.

Key benefit: The premium will be less than buying a single call option while still allowing for profit.

Maximum risk: Limited to the amount paid for the spread (the net premium).

Example of a bull call spread:

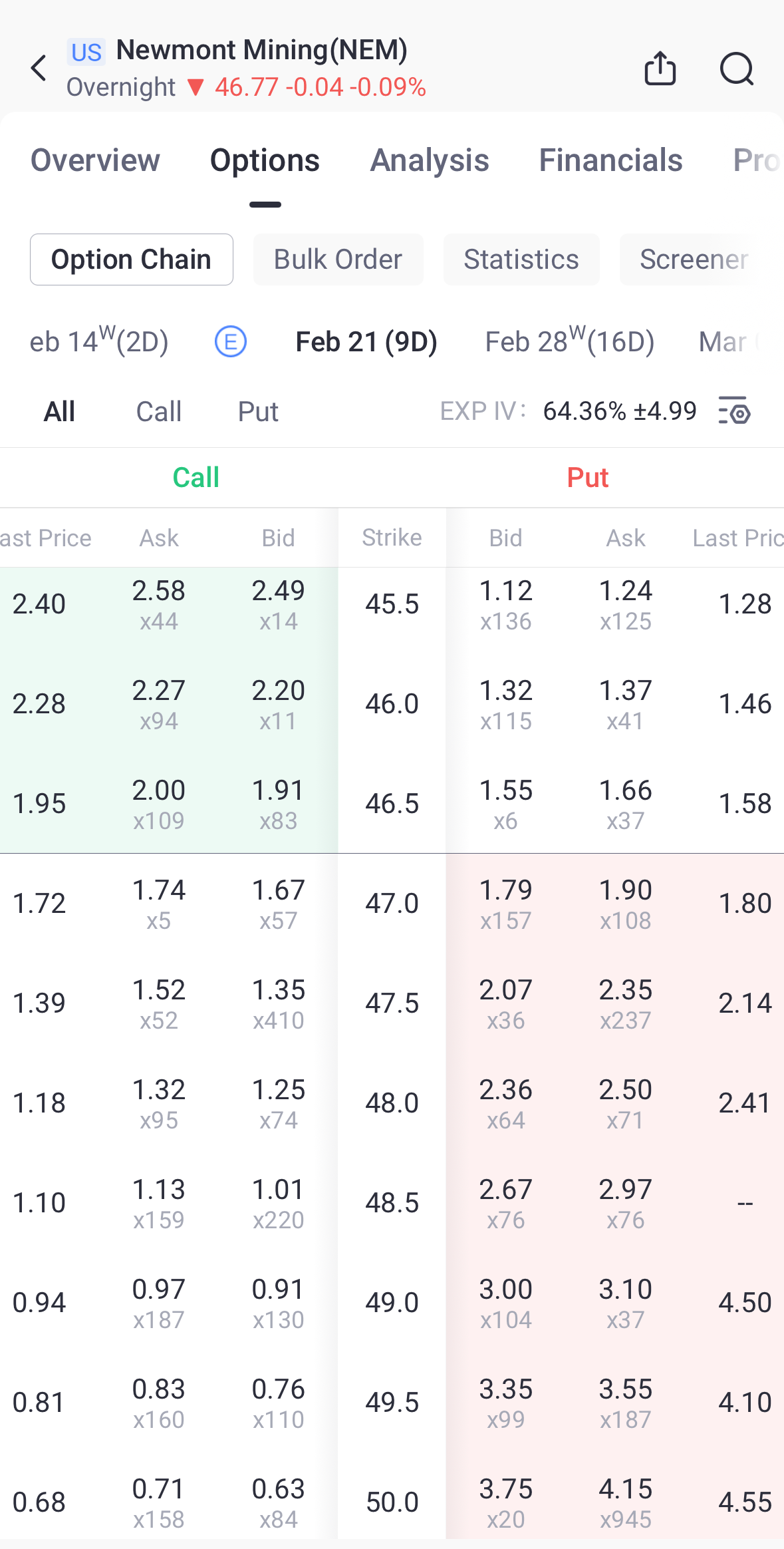

Imagine Newmont Mining (NEM) is currently trading at around $46.81. Based on market analysis, you believe its price will increase but not by a huge margin.

Trade Setup

Buy a $46 call for $2.28 (this gives you the right to buy at $46).

Sell a $50 call for $0.68 (this helps offset the cost of buying the first option).

Total Cost (Net Premium Paid): $2.28 - $0.68 = $1.60 per share ($160 for 1 contract of 100 shares).

How do you profit?

If the stock price rises above $50: Your profit is $2.40 per share ($240 per contract), which is the maximum gain being the difference between the strike price minus the premium paid.

If the stock stays between $46 and $50: You make a smaller profit above $47.60 and a smaller loss below $47.60, depending on the final price as $47.60 is breakeven being the lower strike price plus the premium paid.

If the stock stays below $46: The options expire worthless, and you lose only the initial cost of $1.60 per share.

The bull call spread is a smart strategy for traders who expect a moderate price increase and want to manage risk effectively. It provides a cost-efficient way to participate in the market while keeping losses limited.

Bull call spread example #2:

Imagine Chevron (CVX) is currently trading at $154.90. Based on market analysis, you believe its price will increase but not by a huge margin.

Trade Setup

Buy a $152.5 call for $2.93 (this gives you the right to buy at $152.5).

Sell a $157.5 call for $0.46 (this helps offset the cost of buying the first option).

Total cost (net premium paid): $2.93 - $0.46 = $2.47 per share ($247 for 1 contract of 100 shares).

How do you profit?

If the stock price rises above $157.5: Your profit is $2.53 per share ($253 per contract), which is the maximum gain.

If the stock stays between $152.5 and $157.5: You make a smaller profit, above $154.97 and a smaller loss below $154.97, depending on the final price as $154.97 is the breakeven being the lower strike price plus the premium paid.

If the stock stays below $152.5: The options expire worthless, and you lose only the initial cost of $2.47 per share.

The bull call spread is a smart strategy for traders who expect a moderate price increase and want to manage risk effectively. It provides a cost-efficient way to participate in the market while keeping losses limited.

Bull put spread

A bull put spread is an options trading strategy used when a trader expects a moderate rise in the price of an underlying asset. It involves selling a higher strike price put option and simultaneously buying a lower strike price put option with the same expiration date. This strategy is a type of credit spread, meaning the trader receives a net premium when initiating the position.

How it works

Sell a put option at a higher strike price.

Buy a put option at a lower strike price.

The net result is a credit (since the sold put has a higher premium than the bought put).

The maximum profit is limited to the net premium received.

The maximum loss is limited to the difference between the two strike prices minus the premium received.

Profit and loss scenarios

Max profit: Achieved if the stock price stays above the higher strike price at expiration (both options expire worthless).

Break-even price: Higher strike price minus the net premium received.

Max loss: Occurs if the stock price falls below the lower strike price (results in the maximum spread loss).

Example of a bull put spread:

Let’s say BHP Billiton (BHP) is trading at $51.83 per share, and you expect it to stay above $55:

• Sell a $55 put for $4.4.

• Buy a $50 put for $0.4.

• Net credit received: $4.00 per share, $400 per contract.

Potential outcomes

1. Stock stays above $55: Both puts expire worthless → You keep the $4 premium.

2. Stock is between $50 and $55:

Profit/loss calculation: (Strike price of sold put - stock price) - net premium received.

For example, if the stock price is $52:

$4.00 - ($55 - $52) = $1.00 per share profit.

Total profit: $1.00 x 100 = $100.

3. Stock at $50 or below: The $55 put is worth $5 and the $50 put is worth $0.00 → Max loss = $5 - $4 = $1

When to use it

• When you have a bullish to neutral outlook on the stock.

• To generate income in a sideways or slightly bullish market.

• As an alternative to buying the stock outright (lower capital risk if stock stays above the upper strike price).

Bear call spread

A bear call spread is an options strategy designed for situations where you expect a stock’s price to remain below a certain level or decline moderately. This approach involves two steps:

Selling a call option at a lower strike price (collecting a premium).

Buying a call option at a higher strike price (paying a smaller premium to cap your risk).

Both options share the same expiration date and underlying stock. The goal is to receive a net credit (the premium collected from the sold call minus the premium paid for the purchased call). This net credit represents your maximum profit if the stock stays below the strike price of the call you sold.

Why use a bear call spread?

Best used when: You believe the stock will remain stable or decline moderately.

Key benefit: You receive an upfront net credit, providing immediate profit potential.

Maximum risk: Limited to the difference between the strike prices minus the net credit received.

Example of a bear call spread:

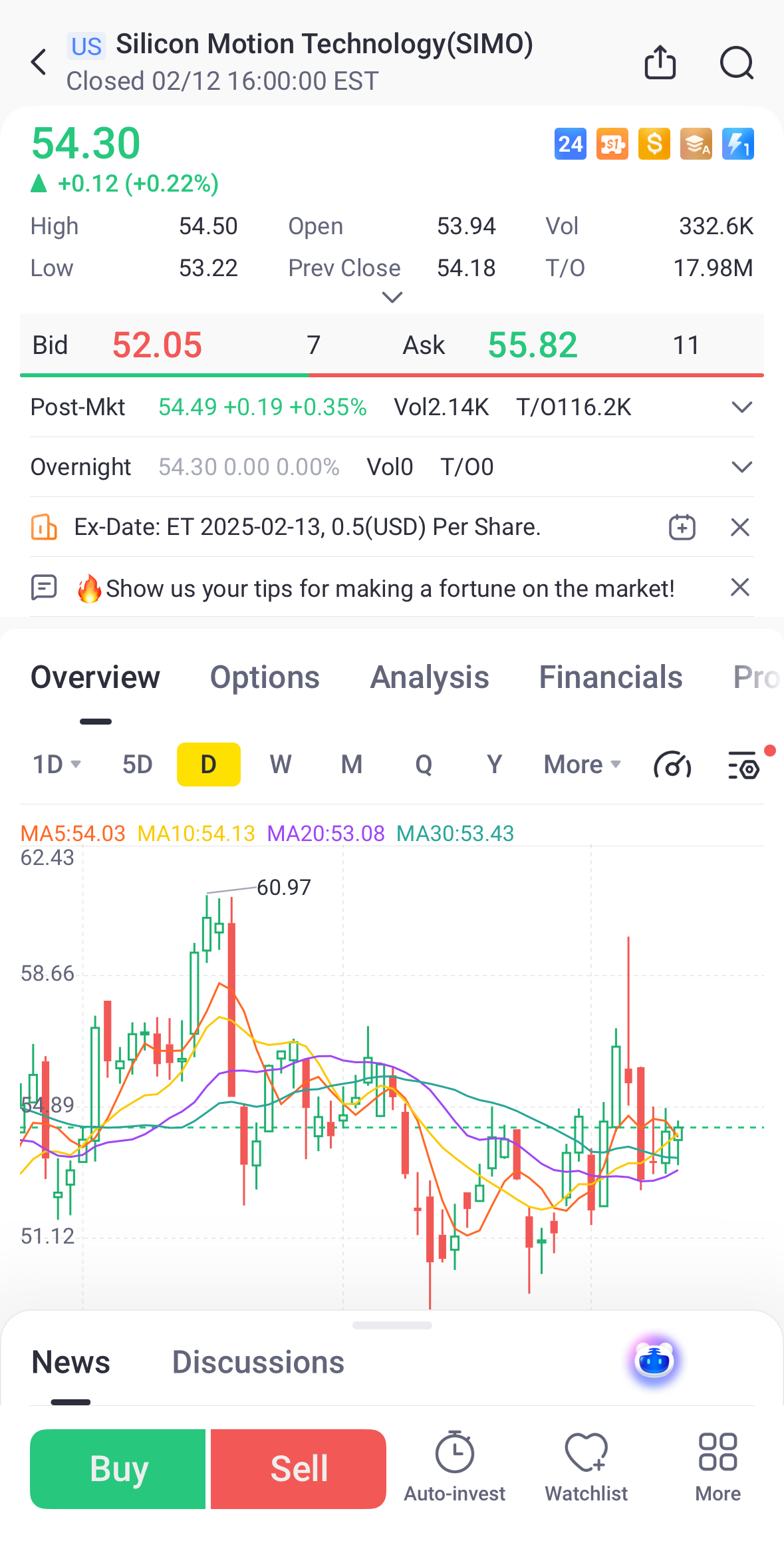

Imagine Silicon Motion Technology (SIMO) is trading at around $55. Based on your analysis, you believe the stock’s price will not rise significantly above this level.

Trade setup:

Sell a $52.5 call for a premium of $1.84.

(This means you grant someone else the right to buy SIMO from you at $52.5.)

Buy a $55 call for a premium of $0.70.

(This protects you if the stock rises too high.)

Net Credit Received: $1.84 - $0.70 = $1.14 per share

(Or $114 total for 1 standard options contract representing 100 shares.)

Potential outcomes:

Stock price remains below $52.5 at expiration:

Both options expire worthless.

You keep the net credit of $1.14 per share as your profit.

Stock price rises above $52.5 but stays below $55 at expiration:

The $52.5 call you sold may be exercised, resulting in a loss.

The $55 call you bought offsets some of that loss.

Your total loss is capped, calculated as:

Maximum Loss = (Difference between strike prices) - (Net credit) = ($55 - $52.5) - $1.14 = $1.36 per share

(Or $136 total for one options contract.)

Stock price rises above $55 at expiration:

Both options are exercised.

Your loss remains capped at $1.36 per share (or $136 total).

Summary:

Maximum profit: Net credit received = $1.14 per share ($114 total).

Maximum loss: Difference between strike prices minus net credit = $1.36 per share ($136 total).

Breakeven point: Strike price of the short call plus net credit = $52.5+$1.14= $53.64.

The bear call spread is an excellent strategy for traders who expect a stock’s price to stay stable or drop slightly. By collecting a net credit upfront and capping your potential loss, you benefit from time decay while keeping your risk in check.

Bear Put Spread

A bear put spread is an options strategy used when you expect a stock’s price to decline moderately. This approach helps limit both your potential loss and profit by combining two actions:

Buy a put option at a higher strike price (giving you the right to sell at that price).

Sell a put option at a lower strike price (which helps reduce the overall cost but gives you an obligation to buy at that price).

Both options have the same expiration date, making this strategy a cost-effective way to benefit from a bearish outlook.

Why use a bear put spread?

Ideal scenario: Best used when you are moderately bearish on a stock.

Key benefit: Lower cost than buying a single put option.

Maximum risk: Limited to the net cost (the premium paid minus the premium received).

Example of a bear put spread:

Imagine Arcosa Inc (ACA) is currently trading at $100 and you expect its price to decline further.

Trade Setup:

Buy 1 put option:

Strike Price: $105

Premium: $7

Sell 1 put option:

Strike Price: $95

Premium: $3

Net Cost (Debit):

Calculation: $7 (paid) - $3 (received) = $4 per share

For 1 contract (100 shares): $4 x 100 = $400

This net debit of $400 represents your maximum loss if the trade does not work out.

Potential Outcomes:

If the stock of ACA is above $105 at expiration:

Both options expire worthless.

Loss: Net debit of $400.

If the stock ACA is between $95 and $105 at expiration:

The long put (strike $105) gains some value, while the short put (strike $95) expires worthless.

You will have a partial profit or loss, depending on the stock’s final price.

If the stock of ACA is below $95 at expiration:

The long put gains full value, and the short put is exercised.

Maximum profit: Calculated as the difference between the strike prices minus the net debit.

Calculation: ($105 - $95) - $4 = $6 per share

For one contract, the total maximum profit is $6 x 100 = $600.

Summary:

Maximum profit: $600 (if the stock price is at or below $95 at expiration).

Maximum loss: $400 (if the stock price is at or above $105 at expiration).

Breakeven point: $105 - $4 = $101 (the stock price at which you break even).

The bear put spread is a practical strategy for traders expecting a moderate decline in a stock’s price. It provides a balanced approach by limiting both potential gains and losses. All options trading carries risk and the bear put spread is limited to the net cost (the premium paid minus the premium received).

To practice your options trading, Tiger Trade offers a free demo account where users can explore strategies and opportunities without risk to real capital. Once you are comfortable with your strategies and want to look into diversifying your portfolio you can trade with 4 x zero monthly brokerage for options, US or ASX stocks or ETFs*.

*New clients & unfunded existing clients only. Only min. brokerage waived for 4 ASX, US stocks or options trades. Third-party fees and other fees still apply. See T&Cs for details.

Please note that not all option strategies are available on Tiger Trade, however, have been included for education purposes.

Capital at risk. Options trading carries a high level of risk and may not be suitable for all investors. You should only trade with money you can afford to lose. See FSG, PDS, TMD and T&Cs via our website before trading. Information provided may contain general advice without taking into account your objectives, financial situations or needs. Past performance is no guarantee of future results. Graphics and charts are for illustrative purposes only. Tiger Brokers (AU) Pty Limited. ABN 12 007 268 386 AFSL 300767