“Wait… is this a HIN or an SRN?” It’s a question that confuses a lot of Aussie investors who are setting out on their investment journey, and it’s easy to see why. Most people never think about how their ASX shares are registered, yet this small detail can make a big difference in how you trade, manage, and receive dividends.

Understanding whether your shares are tied to a HIN (through a broker) or an SRN (directly with the company) is simpler than it sounds, and knowing the difference puts you in control of your investments.

What is a HIN number?

A HIN, or Holder Identification Number, is like your personal ID for shares, given by the Australian Securities Exchange (ASX) if you go through a CHESS-sponsored broker.

Think of CHESS as ASX’s electronic system that keeps track of who owns which shares, so you don’t have to worry about juggling paper certificates or losing track of your investments.

What is an SRN number?

An SRN, or Securityholder Reference Number, is basically how your shares can be held directly with the company, instead of through CHESS. You’ll often see this if your shares are issuer-sponsored, for example, if you grabbed them in an IPO or decided not to go through a CHESS broker.

Comparison between HIN vs SRN at a glance

Feature | HIN | SRN |

Management system | Registered through CHESS, the ASX’s electronic system. Everything’s tracked in one place. | Registered directly with the company (issuer-sponsored). Each share comes with its own SRN. |

Ownership control | Full control, and you’re officially listed as the owner in CHESS. | Less centralised. You’re still the owner, but the company manages your registration. |

Ease of use | Super easy to buy, sell, or transfer shares via your broker’s platform. | A bit more hands-on. Selling or moving shares usually means contacting the company’s share registry. |

Ideal for | Investors who want a single, streamlined account and easy trading. | Investors holding shares directly with a company, or those who received shares outside CHESS. |

Security & transparency | High. Everything is electronically tracked and transparent in CHESS. | Less transparent than CHESS. Safe, but requires trust in the company’s registry. |

When should you use HIN or SRN?

So, how do you know which one’s right for you? Here’s a simple way to think about it:

Go with a HIN if you like everything in one place, want smoother and faster trading, or manage multiple stocks. It’s perfect for investors who are active and like to stay on top of their portfolio.

Stick with an SRN if you usually buy shares directly from IPOs or through a non-CHESS broker, or you don’t trade that often and just hold a few shares. It’s a bit more old-school, but fine if you’re happy to take it slow.

How to trade HIN and SRN shares?

No matter the type, shares need to be sold through a broker, who executes the trade on the Australian Securities Exchange.

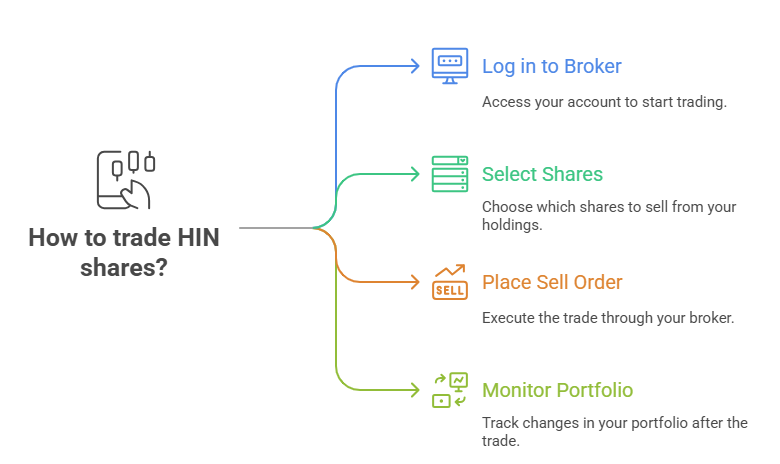

Trading HIN shares:

Log in to your broker’s platform: Your HIN number shares are held via CHESS, so everything is linked to your account.

Select the shares you want to sell: The HIN keeps all your holdings in one place, making it easy to choose what you want to trade.

Place a sell order: Trading is straightforward through your online broker, like Tiger Trade.

Watch your portfolio update: Transactions are usually fast and seamless, with your portfolio reflecting the changes almost instantly.

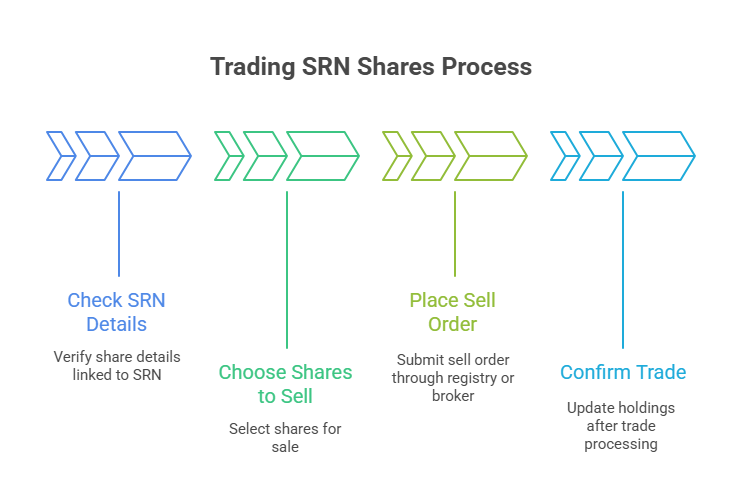

Trading SRN shares:

Check your SRN details: Your shares are issuer-sponsored and linked to a Securityholder Reference Number (SRN), so each company holds its own record of your shares.

Choose your shares to sell: Unlike HIN, you may need to contact the company’s share registry or use a broker that can handle issuer-sponsored shares.

Place your sell order: The process may take a bit longer and can involve some extra paperwork, but it gets the job done.

Confirm the trade: Once processed, your holdings are updated, though it may not be as instant as placing HIN trades.

How can Tiger Brokers help?

If keeping track of your shares ever feels confusing, Tiger Brokers has your back. From HIN management to low-cost trading and handy analysis tools, here’s what they can do for you.

Full support for CHESS-sponsored HIN accounts: Tiger Brokers lets you consolidate all your CHESS-sponsored HIN shares under one account. All shares you buy, sell, or hold are registered directly with the ASX under your name and unique HIN, giving you full control, transparency, and peace of mind.

Assistance with transferring SRN shares: If you hold issuer-sponsored SRN shares, Tiger Brokers can help move them into your HIN account, giving you a neat, unified portfolio.

Fast and smooth trading experience: With Tiger Trade, Tiger Brokers’ online platform, your buy and sell orders are executed in real time with low latency, so you won’t miss any market opportunities. And the interface is intuitive and responsive, making it easy to navigate your portfolio and trade efficiently.

Low fees and handy tools: Tiger Trade offers low, transparent fees that create less impact on your returns, allowing a larger share of gains to remain in your portfolio. On top of that, you get free Level 2 market depth, stock data, and a bunch of easy-to-use analysis tools, so you can learn how to trade ASX and make smarter moves without stressing.

Supported by CSLR: CSLR is an Australian Government initiative designed to protect investors and foster trust in the finance industry, providing eligible investors with compensation of up to AUD 150,000 for unpaid determinations from the AFCA. CSLR strengthens investor trust and confidence in Australia's financial system.

So, here’s the deal with HIN vs SRN: if you like keeping all your shares in one neat place, HIN is your friend. It’s all managed through CHESS, super straightforward. SRN? Each company keeps your shares separately, which can get a little messy.

Why not make life easier? With the current Tiger Brokers stock transfer promotion, you can try managing your HIN shares, trade smoothly, and keep everything organised — give it a go and see how simple it can be!

If you're new to Tiger Brokers, you may also be eligible to receive welcome rewards. Join Tiger Trade today and gain access to the ASX, US and Hong Kong stock markets. Receive four $0 brokerage monthly trades on either ASX, US stock, ETFs or US options, when you open an account and complete your first deposit^.

^New clients & unfunded existing clients only. Only min. brokerage waived for 4 ASX, US stocks or ETFs or options trades. Third-party fees and other fees still apply. See T&Cs for details.

Disclaimer

Capital at risk. See FSG, risk disclosures, PDS, TMD and T&Cs via our website before trading.

Tiger Brokers (AU) Pty Limited ABN 12 007 268 386 AFSL 300767