With the second-largest economy and stock market in the world, China offers a compelling opportunity for portfolio diversification and growth that's hard to ignore.

However, the Chinese equities market can seem like a maze of different exchanges and share types, from domestically traded China A-shares to internationally accessible H-shares in Hong Kong. It's enough to make any new investor feel overwhelmed.

This guide is designed to be your roadmap. We’ll demystify the structure of the Chinese stock market and break down practical, step-by-step methods for investing directly from Australia. Let's get started.

What am I actually buying in the Chinese stock market

Before diving into the Chinese equities market, it's crucial to understand its unique structure. Unlike Australia's single major exchange (the ASX), China has several distinct stock markets, each with different types of companies and shares.

Let's break down the lay of the land.

Where are Chinese stocks traded?

There are four major exchanges, each with a different focus:

Shanghai Stock Exchange (SSE): This is home to China's giants—massive, state-owned enterprises in sectors like banking, energy, and industry.

Shenzhen Stock Exchange (SZSE): This market is known for its dynamic private companies and is often considered China's equivalent of the NASDAQ, with a strong focus on technology and innovation.

Hong Kong Stock Exchange (HKEX): As an international financial hub, the HKEX is the primary gateway for foreign investors. It lists both international companies and many of China's biggest tech and consumer giants (H-shares).

To track the performance of the mainland market, most investors watch the China CSI 300 index, which represents the top 300 stocks across both the Shanghai and Shenzhen exchanges.

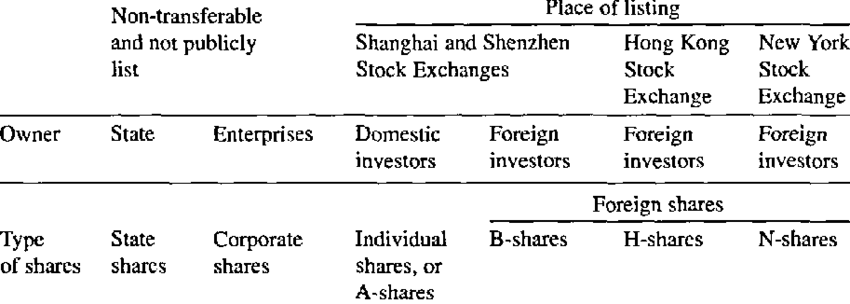

Copyright image from Ma, Shu-yun. (2007). The state, foreign capital and privatization in China. Journal of Communist Studies and Transition Politics. 15. 54-79. 10.1080/13523279908415413.

What are the different types of Chinese shares?

This is where it can get tricky, but it's simple once you know the language. The type of share determines who can trade it and where it's listed.

A-shares: These are the big ones. China A-shares are the stocks of mainland Chinese companies traded on the Shanghai and Shenzhen exchanges. They are denominated in Chinese Yuan (RMB) and were historically very difficult for foreign investors to access directly.

H-shares: These are shares of mainland Chinese companies that are listed and traded on the Hong Kong Stock Exchange. They are priced in Hong Kong Dollars (HKD) and are freely accessible to international investors.

Red Chips & P Chips: These are also listed in Hong Kong. They represent mainland Chinese companies that are incorporated internationally, often for tax or administrative reasons.

US-listed Chinese stocks (ADRs): These are certificates representing shares in a foreign (Chinese) company that are traded on American stock exchanges like the NYSE or NASDAQ. Alibaba (BABA) is a famous example.

Now that you know the what and the where, the next question is how you can access these stocks from Australia.

How can I invest in Chinese stocks from Australia?

You know the what and the where. Now, let's get to the most important part: The how. For Australian investors, there are several pathways to enter the Chinese equities market through platforms like Tiger Trade.

1. Direct Investment with an International Broker

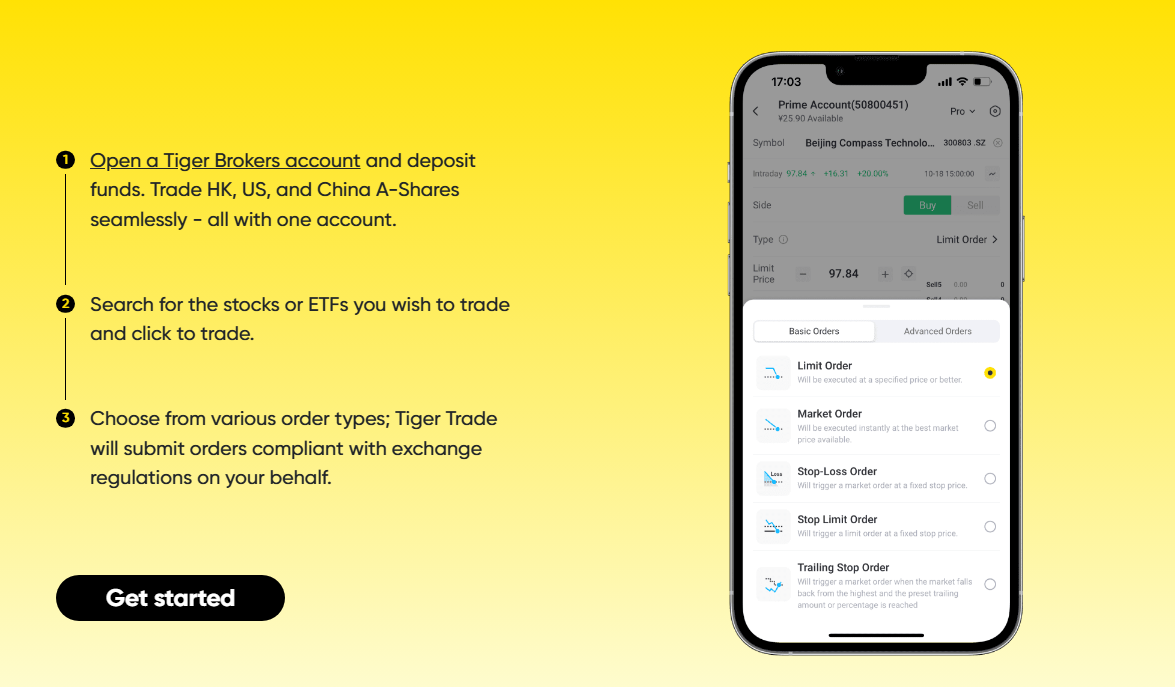

This is the most hands-on approach, allowing you to buy and sell individual shares of specific companies. Platforms like Tiger Trade are designed for this, giving Australian investors a direct gateway to Asian markets.

With an international broker, you can:

Buy H-shares and Red Chips directly on the Hong Kong Stock Exchange (HKEX).

Access China A-shares on the Shanghai and Shenzhen exchanges through the Stock Connect program.

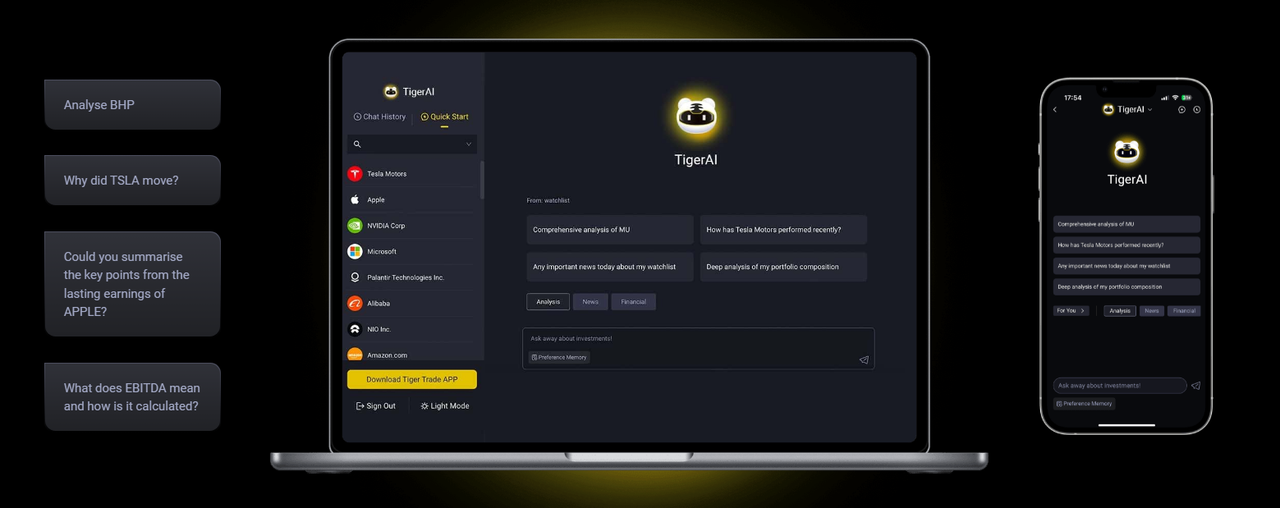

Use user-friendly tools to research companies. Features like Tiger AI (a trading tool at Tiger Trade) can help you analyse data and stay on top of market news, which is crucial for a beginner.

Tiger AI is provided as a research tool and the accuracy of information generated is not guaranteed. It should not be deemed as an investment advice nor relied upon to make any financial or investment decision.

This method gives you the most control over your portfolio, but it also requires the most research.

2. Invest in China-focused ETFs on the ASX

An ETF is a single fund that holds a basket of dozens or even hundreds of different stocks.

Right here on the ASX, you can find China-focused ETFs. For example, the SPDR S&P China ETF (GXC) provides investment results that correspond to the total return performance of the S&P China BMI Index.

3. Use broad emerging markets ETFs

This is the most passive, hands-off approach.

You can buy a global or emerging markets ETF on the ASX that invests in companies from many different countries. Because of its economic size, China typically makes up a significant portion of any emerging markets fund. While you get less concentrated exposure to China, you also get broader global diversification.

4. Chinese companies or China-focused US-based ETFs

It's not just the ASX that has China-focused ETFs. With Tiger Trade, you can also invest in US-based ETFs that are China-focused, such as iShares MSCI China ETF (MCHI), sector-specific funds like the KraneShares CSI China Internet ETF (KWEB), and the Invesco China Technology ETF (CQQQ) and others. These US-based ETFs offer diversification and exposure to a wide range of Chinese sectors.

What are the risks I should know about?

Investing in China offers significant growth potential, but it's important to be aware of the unique risks involved.

Market and policy risk: The Chinese equities market can be more volatile than developed markets. Furthermore, policy change is another consideration.

Liquidity and trading barriers: While major stocks are heavily traded, some smaller Chinese companies may have lower trading volumes (liquidity), which can make it harder to sell your shares quickly at a good price. You also need to be mindful of different market holidays and trading hours.

Taxation and trading fees: Investing internationally comes with tax obligations. You may have to pay tax on dividends in both China and Australia, though tax treaties can reduce this. It's also vital to understand the trading fees your broker charges, such as currency conversion fees and trade commissions. Always consider consulting with a tax professional.

Download Tiger Trade – Your first step to investing in China

For those ready to take direct control of their investments, using a powerful and user-friendly platform is the most important step. A broker like Tiger Brokers provides Australian investors with direct access to the Hong Kong and mainland China markets, equipped with the tools and insights to navigate their investment journey.

The path is clear. Your journey into the Chinese equities market can start today.

Disclaimer*

Capital at risk. See FSG, risk disclosures, PDS, TMD and T&Cs via our website before trading. Information provided may contain general advice without taking into account your objectives, financial situations or needs. Past performance is no guarantee of future results.Graphics and charts are for illustrative purposes only.

Tiger Brokers (AU) Pty Limited ABN 12 007 268 386 AFSL 300767