What are US Treasury Bonds?

US Treasury bonds, commonly known as Treasuries (and sometimes called T-bonds), are a popular type of investment bond and are essentially a loan to the US government. Investors lend money to the government, earning fixed interest payments (coupons) and potentially profiting by trading them in the secondary market.

How are Treasury prices and yields determined?

While the face value of a bond is fixed, its purchase price fluctuates based on factors like time to maturity, coupon rate, and market expectations. For example, a bond with a face value of $1,000 might sell for $800 or $900, depending on these factors. If you hold the bond to maturity, your yield is essentially locked in. However, if you sell before maturity, market conditions impact your return: when interest rates fall, bond prices typically rise, resulting in higher returns; when rates rise, prices drop, potentially leading to lower returns or even losses.

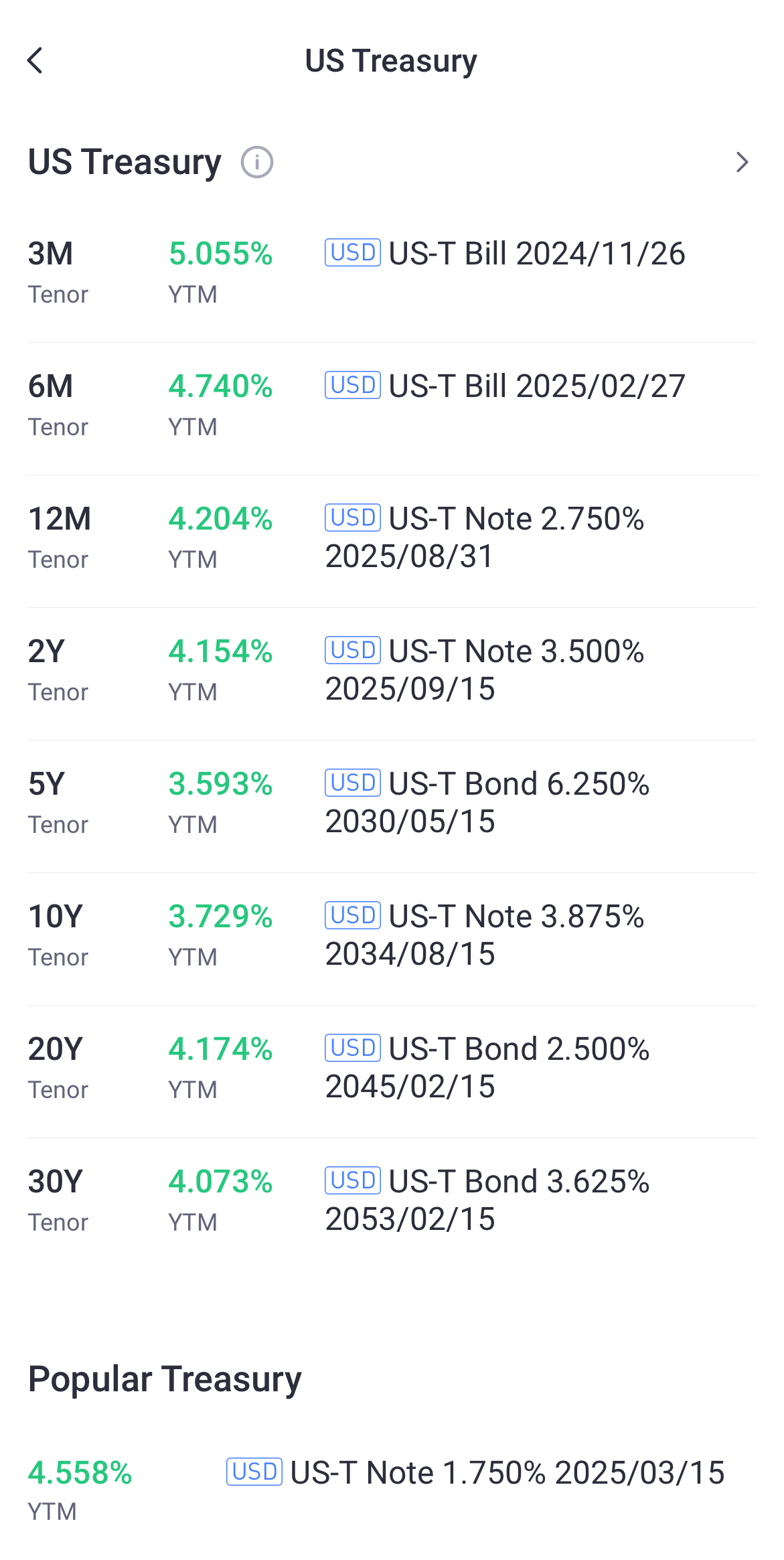

The chart below shows the annualised yield to maturity for a single Treasury bond (excluding fees).

What about US Treasury ETFs?

Unlike holding individual bonds, investing in Treasury ETFs means you don’t get the fixed coupon payments. Instead, your returns depend on price fluctuations in the bond market when you buy ETF shares. For instance, the chart below shows the performance of the 10-20 year US Treasury ETF (TLH), which dropped sharply during recent rate hikes and is currently at a historical low over the past decade. As rates decline, prices are expected to rise again.

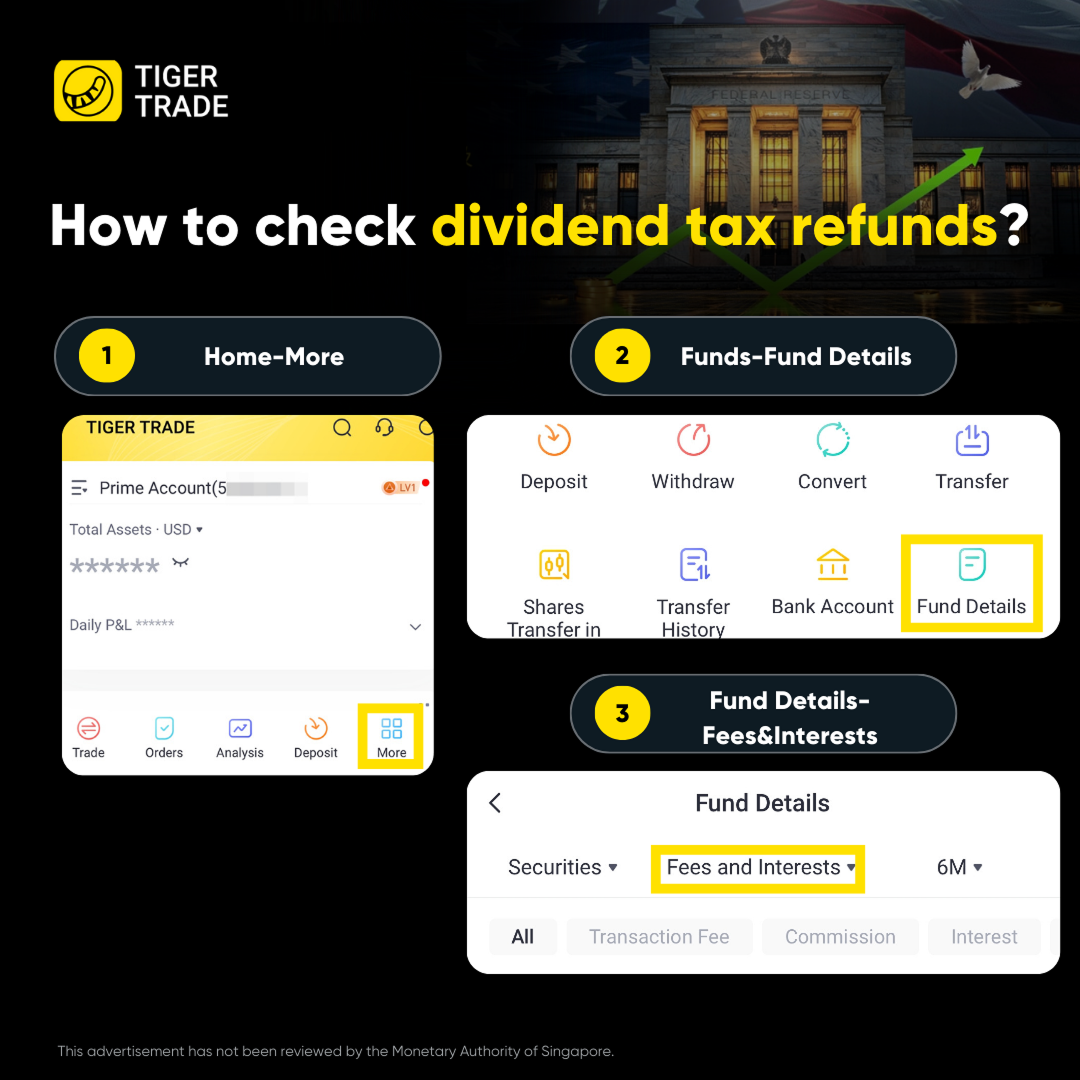

Dividend tax? Withholding tax will be fully refunded!

US Treasury bond ETFs typically pay continuous dividends, which are treated as dividends and subject to withholding tax. The tax rate varies by country. However, unlike stock dividends, the withholding tax on US Treasury bond ETFs will be refunded between February and April of the following year. You can view the refunded dividend tax in the Tiger Trade app.

Therefore, if you want to secure a long-term fixed income of over 4%, directly purchasing US Treasury bonds is the best option. However, if you’re optimistic about the performance of US Treasury bonds and can tolerate some volatility, buying TLH or TLT offers a relatively higher risk-reward ratio.

Of course, if you’re willing to take on more risk, US Treasury futures offer lower transaction costs and higher leverage.

Download the Tiger Trade app, an online investing platform, to open an account and access US Treasuries, ETFs, and Treasury-related futures all in one place. Join today and gain access to the ASX, US and Hong Kong stock markets. Plus, receive four $0 brokerage monthly trades on either ASX, US stock, ETFs or US options, when you open an account and complete your first deposit^.

^New clients & unfunded existing clients only. Only min. brokerage waived for 4 ASX, US stocks or ETFs or options trades. Third-party fees and other fees still apply. See T&Cs for details.

Disclaimer:This content is for information purposes only and does not constitute an offer to sell, buy, recommend or endorse any financial products. We make no representations or warranties regarding the accuracy, truthfulness, or legality of any comments and views shared in the interview. Capital at risk. We do not provide financial advice that considers your personal objectives, financial situations or needs. Past performance is no guarantee of future results. See risk disclosures, PDS, TMD, FSG and T&Cs via our website before trading and seek independent advice if necessary. Tiger Brokers (AU) Pty Limited ABN 12 007 268 386 AFSL 300767.