Thinking of diversifying your portfolio beyond Australian shores? The HK stock market is often the first stop, offering a unique gateway for global investors to trade mainland China A shares. But successful trading isn't just about what you buy; it's also about when.

For Australian investors, timing is everything. Understanding the Hong Kong market's rhythm is the first crucial step to making informed decisions and capturing opportunities as they happen. So, when exactly can you trade, and why should you consider this bustling market in the first place?

This guide is your practical entry point. We'll break down the Hong Kong Stock Exchange (HKEX) trading hours and convert them to local Australian time. We'll also dive into the crucial link between Hong Kong and the mainland's equities market, and show you how you can start your trading journey. Let's get started.

HKEX trading hours for Australians

To capture the best opportunities, you need to be active when the market is. For Australian traders, this means aligning your schedule with the Hong Kong Stock Exchange (HKEX). Let's break down the trading day and translate it into your local time.

What does a typical trading day on the HKEX look like?

The HKEX trading day is structured into specific sessions, each with a distinct purpose.

Pre-opening Session (9:00 AM - 9:30 AM HKT): This is the warm-up period. Traders can place and cancel orders, which helps determine the market's opening prices.

Continuous Trading Session (9:30 AM - 12:00 PM & 1:00 PM - 4:00 PM HKT): This is the main event, split into a morning and afternoon session. The market is open for continuous buying and selling of securities.

Lunch break (12:00 PM - 1:00 PM HKT): Unlike the ASX, the Hong Kong market takes a one-hour pause for lunch. Trading is halted completely.

Closing Auction Session (CAS) (4:00 PM - 4:10 PM HKT): This final session allows traders to place orders at the day's closing price. Trading concludes at a random time between 4:08 PM and 4:10 PM HKT.

What are the HKEX trading hours in my Australian time zone?

Here is a clear breakdown of the core trading hours.

Important note on Daylight Saving*

The table below uses standard time. Remember that from the first Sunday in October to the first Sunday in April, clocks in New South Wales, Victoria, South Australia, Tasmania, and the ACT move forward one hour. During this period, add one extra hour to the AEST and ACST times listed.

HKEX Session | Hong Kong Time (HKT) | AWST (Perth) | ACST (Darwin/Adelaide) | AEST (Sydney/Melb/Bris) |

Pre-opening | 9:00 AM - 9:30 AM | 9:00 AM - 9:30 AM | 10:30 AM - 11:00 AM | 11:00 AM - 11:30 AM |

Morning Trading | 9:30 AM - 12:00 PM | 9:30 AM - 12:00 PM | 11:00 AM - 1:30 PM | 11:30 AM - 2:00 PM |

Lunch Break | 12:00 PM - 1:00 PM | 12:00 PM - 1:00 PM | 1:30 PM - 2:30 PM | 2:00 PM - 3:00 PM |

Afternoon Trading | 1:00 PM - 4:00 PM | 1:00 PM - 4:00 PM | 2:30 PM - 5:30 PM | 3:00 PM - 6:00 PM |

Closing Auction* | 4:00 PM - ~4:10 PM | 4:00 PM - ~4:10 PM | 5:30 PM - ~5:40 PM | 6:00 PM - ~6:10 PM |

*The Closing Auction Session ends at a random time between 4:08 PM and 4:10 PM Hong Kong Time.

As you can see, for traders on the east coast of Australia, the Hong Kong market conveniently opens in the late morning and runs into the evening, providing a great opportunity to trade after the ASX has closed for the day.

Hong Kong and mainland China's markets

To trade in Hong Kong is to be connected to the pulse of mainland China. The two markets are deeply intertwined, and understanding this relationship is key to your success.

Why is China's economy so important to the Hong Kong market?

Many of the largest companies listed in Hong Kong, like Tencent and Meituan, are Chinese giants whose fortunes are tied to the mainland's economic health.

When China's economy does well, or when the government announces new supportive policies, the entire Chinese equities market gets a boost, and this positive sentiment often spills over directly into Hong Kong, lifting stock prices.

Conversely, any economic slowdown in the mainland can cause ripples that are felt immediately on the HKEX.

How can I invest in mainland China through Hong Kong?

So you're wondering how to buy Chinese stock in Australia? The most direct answer is the Stock Connect program.

The Stock Connect is essentially a "trading bridge" linking the Hong Kong Stock Exchange with the mainland exchanges in Shanghai and Shenzhen. This program allows international investors, like you, to buy hundreds of eligible mainland-listed China A shares directly through a Hong Kong brokerage account. Before this program, accessing these shares was extremely difficult for outsiders. It’s the main and most accessible channel for tapping into the domestic growth of Chinese companies.

What should I watch to gauge the mainland market's health?

Just as you might watch the ASX 200 for a snapshot of the Australian market, you should keep an eye on the China CSI 300 index. This index tracks the performance of the top 300 stocks on the Shanghai and Shenzhen exchanges, making it the most critical benchmark for the mainland's stock market performance.

For investors who prefer broader exposure without picking individual stocks, another great option is a China A shares ETF (Exchange-Traded Fund). These funds bundle a wide range of A-shares into a single, tradable security, offering instant diversification across the mainland market.

Your first step into the Hong Kong market

You've learned the 'when' and 'why'. Now it's time for the 'how'. Before you invest your first dollar, the smartest move is to build confidence and test your strategy in a realistic, risk-free environment.

How can I practice trading Hong Kong stocks?

The best way is with a demo account, also known as paper trading. It’s a simulator that lets you trade with virtual money but uses real, live market data.

The Tiger Trade platform offers a comprehensive and easy-to-use demo account that's perfect for a beginner wondering how to buy Chinese stock in Australia. Getting started is simple:

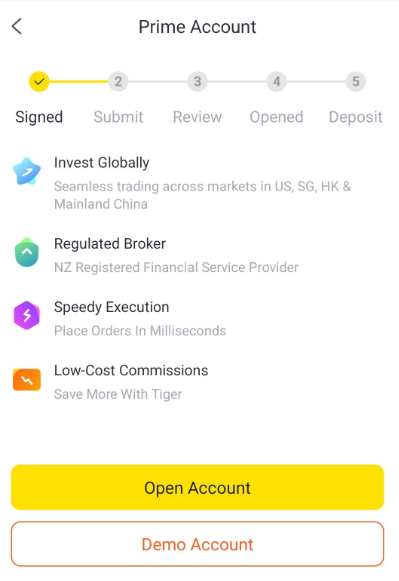

Get the app and register: First, download the Tiger Trade app on your phone or go to their desktop site. You will need to register for an account—during this process, you can select the option to open a Demo Account.

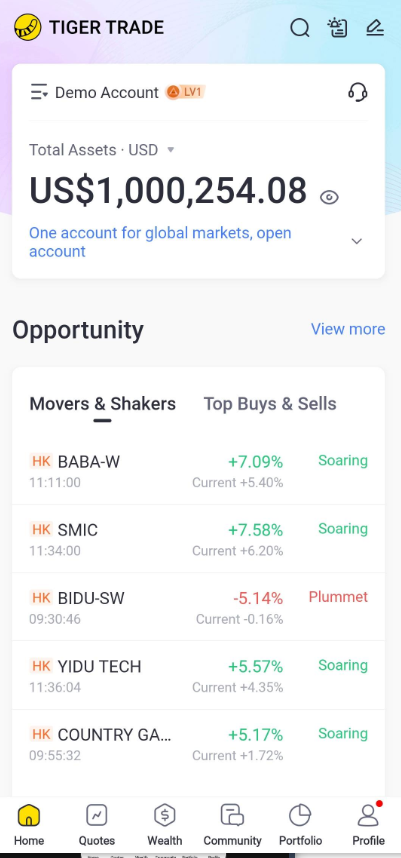

Activate paper trading: Once you're in the app, tap on the "Home" icon at the bottom of the screen. At the top left, you will see your Demo Account with the Opportunity suggestions list below.

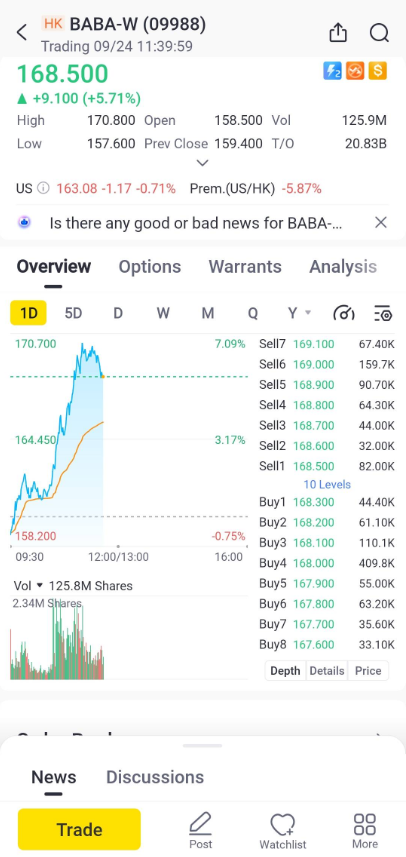

Find a stock to trade: Choose a stock and enter it. You can see a “Trade" button on your left-hand side.

Place your first practice order: Once you're viewing a stock, you will see "Paper Buy" and "Paper Sell" buttons at the bottom. Tap one to open the order panel, where you can set the price and quantity for your practice trade, then confirm the transaction. Your order will be executed just like a real one.

What makes the Tiger Trade demo account a good tool?

It's a complete training ground. You can:

Trade with real market data: Practice buying and selling stocks and ETFs using live prices from the HKEX. This helps you understand how quickly the market moves and how to execute orders effectively.

Explore the full platform: You get access to the same powerful features as real-money traders. You can learn to use charting tools, set different order types, and get comfortable with the platform's layout before there's any financial risk.

Test your strategies: Have an idea about how to trade the China CSI 300? Want to see how a China A shares ETF performs? A demo account lets you test these strategies and learn from the results without any consequences.

Leverage advanced tools: You can even explore innovative features like Tiger AI, which assists with investment research and data analysis, helping you build the skills to make more informed decisions.

Tiger AI is provided as a research tool and the accuracy of information generated is not guaranteed. It should not be deemed as an investment advice nor relied upon to make any financial or investment decision.

How do I switch to real trading?

Once you're experienced and feel confident in your ability to navigate the platform and the market, you can apply to open a live account.

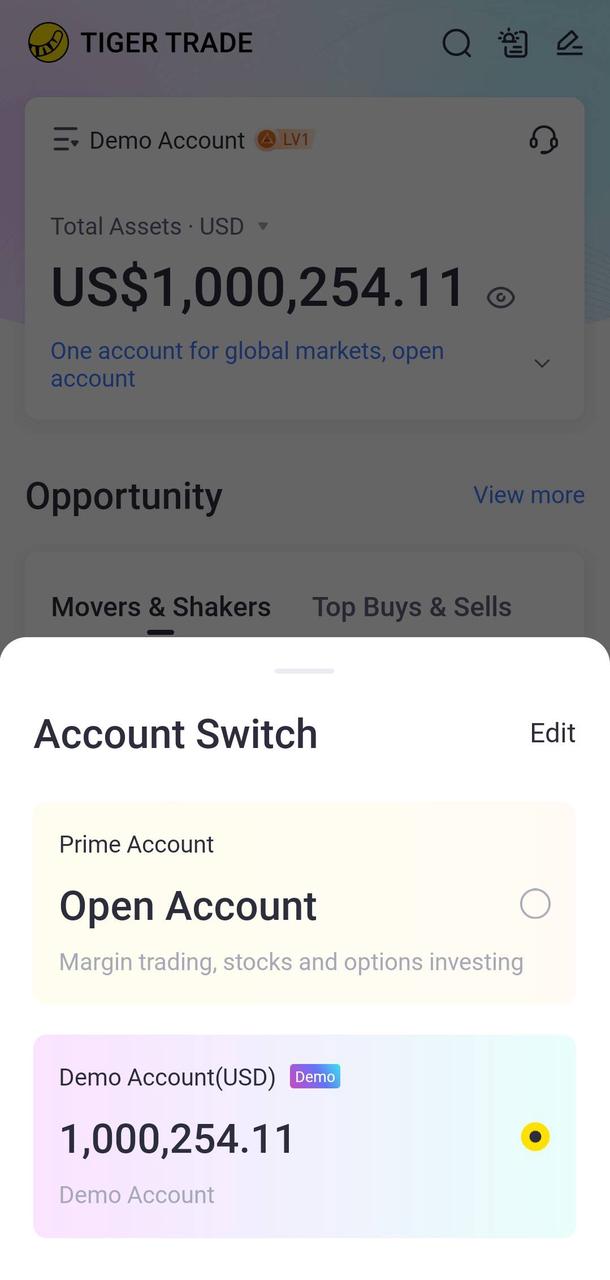

At the “Home” page, click the icon on the left side of the “Demo Account”. There is an Account Switch option. Get your Prime Account and start your trading journey.

Your journey into the Hong Kong market starts here

Don't just read about trading—experience it.

[Download the Tiger Trade and start trading.]

Need some help starting trading in Tiger Trade? Click here.

Disclaimer*

Capital at risk. You should only trade with money you can afford to lose. See FSG, PDS, TMD and T&Cs via our website before trading. Information provided may contain general advice without taking into account your objectives, financial situations or needs. Past performance is no guarantee of future results. Graphics and charts are for illustrative purposes only. Tiger Brokers (AU) Pty Limited. ABN 12 007 268 386 AFSL 300767