For beginners in options trading, there's a common belief that if your options are profitable, you either close the position or wait until expiration to exercise them. Early exercise, they think, is a waste of the option's time value. However, there are situations where exercising early is probably the smarter move.

Exercising an American-style option before expiration is known as early exercise. While it means giving up remaining time value, it can sometimes lock in better profits or capture dividends.

When is early exercise a smart move?

1. Deep in-the-money options and liquidity

Consider a scenario where the price of the underlying stock has surged, making a call option deeply in-the-money. While this is great news, deeply in-the-money options often suffer from poor liquidity. Exercising the option early can be more profitable since stocks generally have better liquidity than options.

2. Dividend capture opportunities

If the underlying stock pays a dividend, the stock price will drop post-ex-dividend, as will the price of a call option. Dividend profits go to stockholders, not option holders. By exercising early, you can potentially capture the dividend — a common reason for early exercise of call options.

Example: capturing dividends by exercising an in-the-money call option before the ex-dividend date.

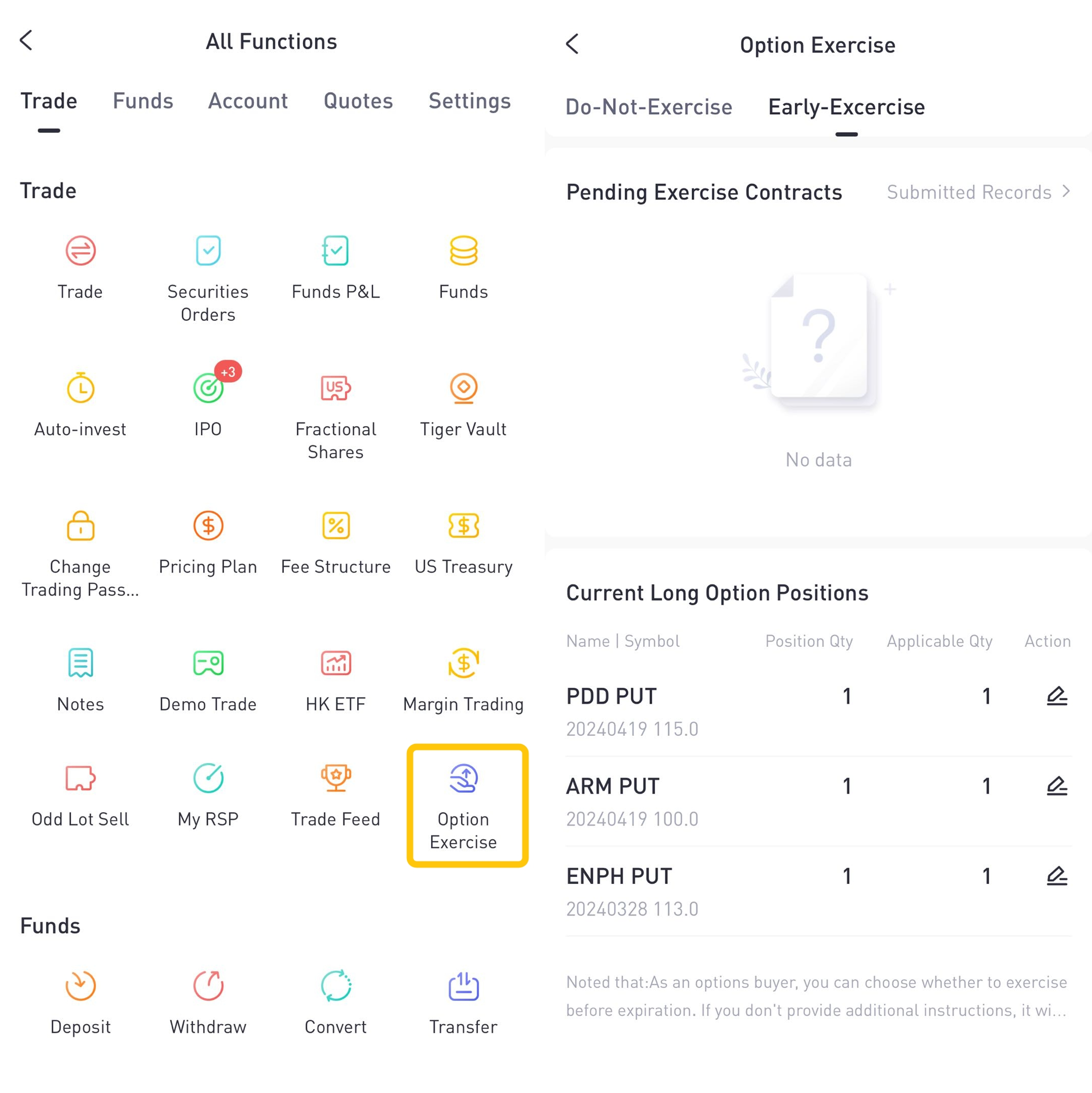

Tiger Trade’s early-exercise feature

While American-style options allow for early exercise, not all brokers support this feature. Tiger Trade introduced the early exercise feature in version 9.4.4, allowing users to execute early exercise directly within the app. Here's how to apply for early exercise.

You must hold a long position on an in-the-money American-style option with sufficient margin in your account. Applications must be submitted before the close of trading on the one trading day prior to expiration.

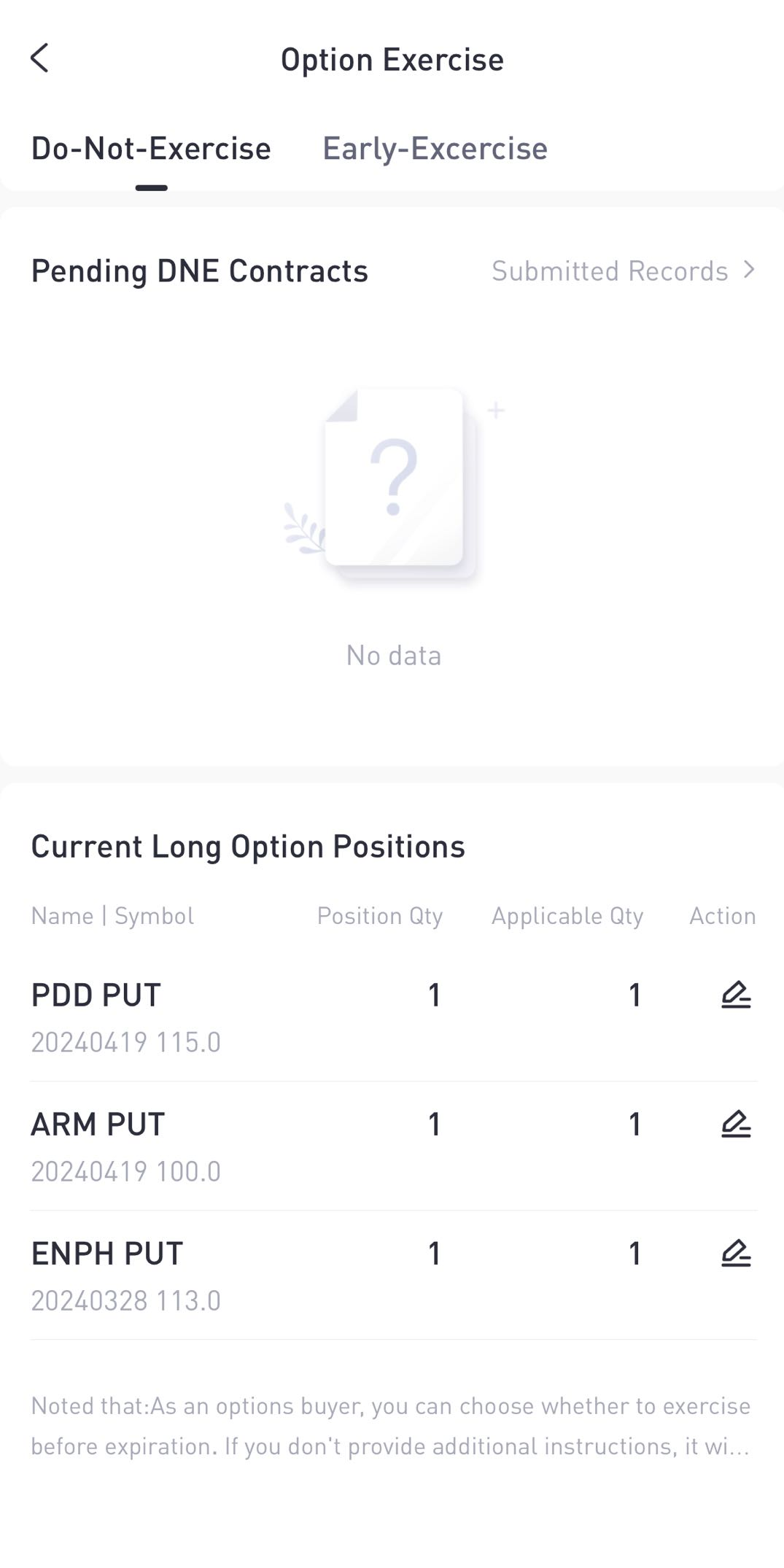

Who might need the Do-not-Exercise feature?

For short-term traders who are more interested in profiting from market volatility rather than holding stocks, exercising options that are slightly in-the-money might not be worth the additional capital required. Moreover, stock price fluctuations could potentially lead to losses by the next trading day. Opting to Do-not-Exercise can provide greater flexibility for your capital. It also avoids forced liquidation due to an insufficient margin and saves on potential additional trading costs.

These examples highlight that strictly adhering to the simplest and seemingly "correct" rules of investment might lead to confusion and losses when exceptions arise.

Upgrade to Tiger Trade 9.1.7 for a more comprehensive approach to your options trading.

Early exercise vs Do-not-Exercise: feature comparison

Feature | When to Use | Benefit |

Early Exercise | Deep in-the-money American-style options; before the ex-dividend date | Capture dividends, avoid wide bid-ask spreads, and improve liquidity |

Do-not-Exercise | Short-term traders or low-margin accounts | Maintain capital flexibility, avoid forced liquidation and extra costs |

FAQs about Early Option Exercise

What are the requirements for early exercise?

You must hold a long position(including long calls and long puts) on an in-the-money American-style option with sufficient margin in your account. Applications must be submitted before the close of trading on the one trading day prior to expiration.

What are the requirements for applying for Do-not-Exercise?

You need to hold a long position (including long calls and long puts) on the option in your account. Applications must be submitted before the close of trading on the expiration day.

Can I apply for early exercise or Do-not-Exercise for individual legs of a multi-leg option?

Yes, but if this would lead to exceeding the account's risk warning threshold, the application may be rejected.

Can an application be cancelled once approved?

Early exercise applications can be cancelled before the closing of trading on the day of application, but not after. Applications for Do-not-Exercise can be cancelled at any time before the close of trading on the exercise day.

For more details, visit our Help Centre or contact our Client Service team.

To read more on options trading, check out our articles in our options trading series, 'Mastering Options', found on our Learn page.

Disclaimer: This content is for information purposes only and does not constitute an offer to sell, buy, recommend or endorse any financial products. We make no representations or warranties regarding the accuracy, truthfulness, or legality of any comments and views shared in the interview. Capital at risk. Options trading carries high level of risk and may not be suitable for all investors. You should only trade with money you can afford to lose. We do not provide financial advice that considers your personal objectives, financial situations or needs. Past performance is no guarantee of future results. See risk disclosures, PDS, TMD, FSG and T&Cs via our website before trading and seek independent advice if necessary. Tiger Brokers (AU) Pty Limited ABN 12 007 268 386 AFSL 300767.