When the bell rings on Wall Street, the action doesn’t really stop. Pre-market and after-hours trading keep the market alive well beyond regular trading hours (RTH), and for Australian investors, it lines up with fresher, more alert hours, especially in after-market trading.

On paper, it seems like a golden opportunity for investors to navigate market movements before the bell. In reality, thinner liquidity and sharper price swings can make it a double-edged sword.

So, is extended-hours trading your secret weapon, or just a fast track to costly mistakes? Let’s find out.

What is pre-market and after-hours trading?

In the US, regular trading runs from 9:30 am to 4:00 pm Eastern Time. But the market doesn’t sleep. Extended hours trading happens outside this window and comes in two timeframes: US stocks pre-market and after-market trading.

Pre-market trading:

This is the trading session before the US stock market officially opens at 9:30 am ET, usually running from 4:00 am to 9:30 pm ET. Think of it as the market’s “warm-up”, where traders react early to overnight headlines, company earnings, or economic data.

After-market trading (post-market):

This takes place after the official close at 4:00 pm ET, and usually runs until 8:00 pm ET. It’s like the market working overtime: many companies release earnings after the bell, and you can act right away instead of waiting until the next session.

For Australian investors, you might be active in these sessions at much more convenient hours than the actual US market open hours. See below how the times align for Australia:

Session | US (ET) | Australia (AEDT) | Australia (AEST) |

Pre-market | 4:00 am – 9:30 am | 6:00 pm – 11:30 pm (same day) | 5:00 pm – 10:30 pm (same day) |

Regular market hours | 9:30 am – 4:00 pm | 11:30 pm – 6:00 am (overnight) | 10:30 pm – 5:00 am (overnight) |

After-hours (post-market) | 4:00 pm – 8:00 pm | 6:00 am – 10:00 am (next day) | 5:00 am – 9:00 am (next day) |

Advantages of pre-market and after-hours trading

Extended-hours trading opens opportunities you don’t get during regular market hours. Here’s how you can make the most of them:

React to breaking news: Earnings, guidance updates, or macro events don’t wait for the US market to open, and neither should you. Jump on them as they happen instead of sitting on overnight uncertainty.

Trade at Convenient Hours: No need to stay up late for the US open. Take positions during your daytime and make the market work around you.

Get ahead of gaps: Big news can send prices moving before the bell. Extended hours let you enter or exit early, so you’re not always chasing the open.

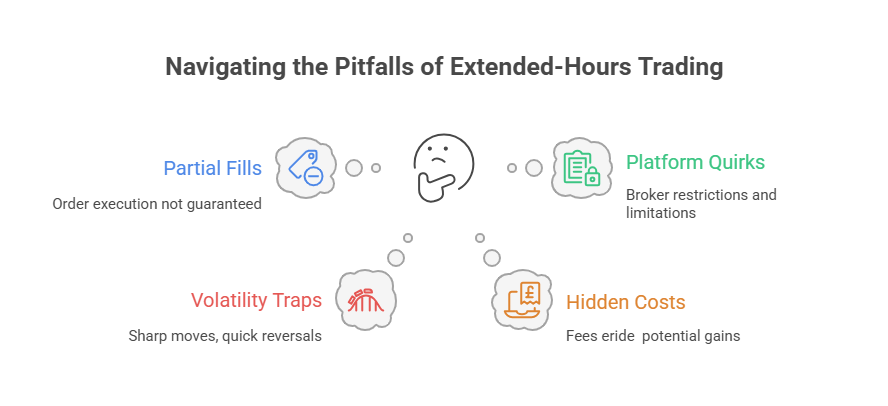

Risks and limitations of pre-market and after-hours trading

Trading outside regular hours can be tempting, but a few hidden traps mean it pays to stay alert and plan ahead.

Partial fills and ghost liquidity: Even if you see a price level, it doesn’t guarantee your order will fully execute. In thin pre-market or after-hours sessions, some quotes are more “phantom” than real.

Volatility traps: Sharp price moves can look like opportunities, but low volume means the swings often reverse once regular trading resumes. Chasing these moves without a plan can be costly.

Hidden cost layers: Wider spreads, slippage, and extended-hours fees can quietly eat into your gains. Treat these trades differently from regular hours, or you might be in for a shock.

Platform quirks and broker restrictions: Not every broker handles extended-hours orders the same way. Some reject market orders, delay confirmations, or charge extra—so check the fine print before diving in.

Should you include pre-market and after-hours trading in your strategy?

Extended hours trading can offer an edge, but it’s not for everyone. Think of it as a tool in your toolkit, not a magic shortcut. It tends to suit traders who:

Have access to timely information and can act fast: You need to know what’s happening as it happens. If a big earnings surprise drops at 7 am Sydney time, you want to be ready, not scrambling.

Maintain discipline under higher volatility: Prices can swing sharply in thin sessions. It’s easy to get caught up in the excitement, so sticking to your plan and using limit orders can save you from nasty surprises.

Treat extended hours as part of a strategy, not a gamble: These sessions are great for fine-tuning your position or hedging, but they shouldn’t replace careful research or long-term planning.

If you dive in without a clear plan, you’re more likely to get burned than to get ahead, so take the time to understand how these sessions fit into your overall trading approach.

Access pre-market and after-hours trading with Tiger Trade

Ever felt like a big move happened while you were asleep or away from your screen? With Tiger Trade, those opportunities don’t have to pass you by. It can offer you:

Supported by CSLR: CSLR is an Australian Government initiative designed to protect investors and foster trust in the finance industry, providing eligible investors with compensation of up to AUD 150,000 for unpaid determinations from the AFCA.

24/5 trading access: Trade on your own schedule—pre-market, after-hours, and even US stocks overnight—all during your Australian daytime. No need to rearrange your life to stay on top of the action.

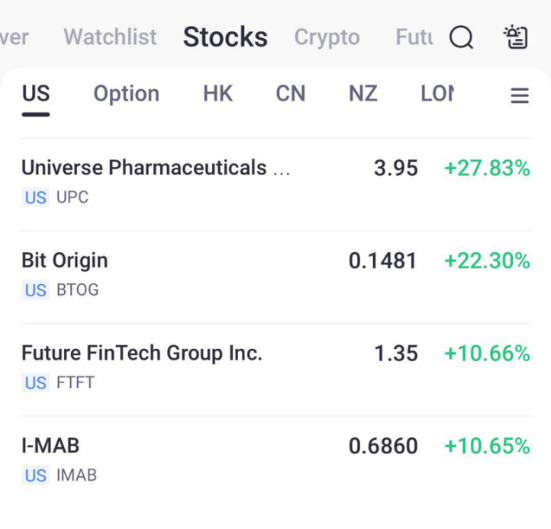

Free market data: Missed a big earnings surprise while you were asleep? With Tiger Trade, you’ll see it as it happens. Free market quotes keep you in control, allowing you to react fast instead of chasing the market.

Invest in major US Stocks from just USD 1: Start small and keep costs low. Even in thinly traded sessions, your investments stay efficient and meaningful. It’s an easy way to make the market work for you, without overthinking.

So, can pre-market and after-hours trading give you an edge? Definitely, but only if you know what you’re doing and have a plan. There are great opportunities out there, but they come with risks, too.

If you’ve got a clear strategy and keep an eye on risk, extended-hours trading can really give your portfolio a boost. And with the Tiger Trade app, it’s easier to stay in the game outside RTH—free market data, 24/5 access, and low-cost trading all at your fingertips. Don’t let the market move without you!

If you join Tiger Trade, you'll also gain access to the ASX, US and Hong Kong stock markets. Plus, receive four $0 brokerage monthly trades on either ASX, US stock, ETFs or US options, when you open an account and complete your first deposit^.

^New clients & unfunded existing clients only. Only min. brokerage waived for 4 ASX, US stocks or ETFs or options trades. Third-party fees and other fees still apply. See T&Cs for details.

Disclaimer

Capital at risk. See FSG, risk disclosures, PDS, TMD, and T&Cs via our website before trading.

Tiger Brokers (AU) Pty Limited ABN 12 007 268 386 AFSL 300767