Looking to earn more than just modest gains from your share portfolio? Options trading might be the strategy you’ve been searching for. But trading options isn’t like buying regular shares. The risks are higher, the rules are different, and getting it wrong can be costly.

Before you dive in, here are five things every Australian investor must know to trade options with confidence.

What are options?

Options are financial contracts that give you the right, but not the obligation, to buy or sell an asset at a set price within a specific time frame. Think of them as tools to potentially boost returns or protect your portfolio.

Call option (Buy): Gives you the right to buy an asset at a set price before a specific date. You might use this if you believe the stock is about to rise.

Put option (Sell): Gives you the right to sell an asset at a set price before a specific date. This is handy if you want to hedge against a potential drop in your holdings.

For example, you could buy a call option on a US-listed stock you expect to climb, or a put option to shield your investments from a sudden market dip.

Know the Australian regulations — even when trading in the US

It’s essential to be familiar with the protective regulations before engaging in US options trading. In Australia, US options trading is still regulated by the Australian Securities and Investments Commission (ASIC), which keeps the market fair and transparent.

For your portfolio, this means your broker must hold an Australian Financial Services (AFS) licence and assess whether options trading is suitable for you. You should be aware of the tax implications that come with different strategies. Some more advanced plays may involve over-the-counter (OTC) contracts, which carry additional risks and operate under slightly different rules than standard options*.

Trading US options investors are subject to the laws, regulations and taxes of the US government when trading these instruments. It's always advised that if you are not sure, you should check with your financial advisor or accounting professional regarding your obligations.

Minimum requirements for options trading

Trading US options in Australia isn’t just about picking the right stock, and you also need to make sure you meet some key requirements before you get started. Here’s what Australian investors typically need to access US options trading:

1. Complete KYC (Know your customer)

You’ll need to verify your identity and financial background. This is a standard legal AML and KYC requirement, and also helps your broker understand your trading profile.

2. Investor suitability assessment

Brokers may ask investors to provide additional information in relation to the financial capacity, risk tolerance, option trading experience and/or understanding to assess your eligibility to trade options.

3. Platform support

Not all brokers offer options trading. In Australia, popular ASIC-regulated platforms like CommSec, CMC Markets, IG, and Tiger Brokers give you access to a full range of US options.

4. Trading experience

Options are more complex than standard shares. If you haven’t traded options before, consider practising on a demo trading account first—this lets you get comfortable without putting your capital at risk.

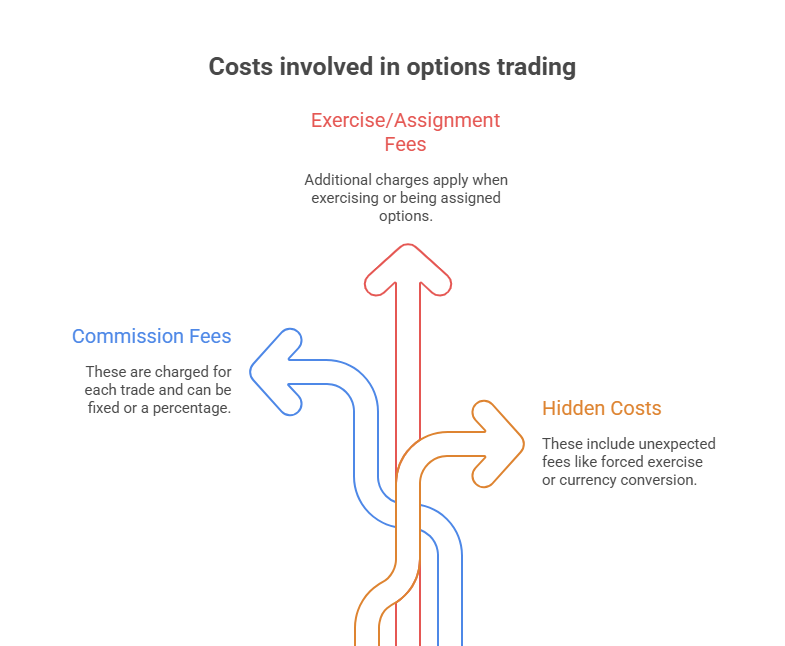

Costs involved in options trading

When you trade US options in Australia, several types of costs can affect your returns, so it’s important to know what to expect:

Commission fees

A commission fee is charged for each trade you make, usually a fixed amount or a small percentage of your trade.

Exercise/assignment fees

If you decide to exercise an option, or if one is assigned to you, additional charges may apply.

Hidden costs

These might include forced exercise fees, account maintenance or inactivity fees, and currency conversion charges.

Being aware of these costs helps you plan your trades more carefully and avoid surprises.

Choose the right trading platform

Picking a platform that meets these points keeps you in control and better equipped to manage your options trading effectively.

Regulation

Ensure your broker is ASIC-regulated and holds an AFS licence, providing legal oversight and protection.

Product range

Look for a wide variety of options, especially on US-listed securities, to support different strategies.

User interface & tools

A clean, intuitive trading platform with useful tools like risk calculators, charting, and alerts helps you trade smarter.

Customer support

Effective customer support helps you avoid delays and stress by assisting with account management, platform troubleshooting, and complex trade inquiries.

Tiger Trade: Trusted platform for options trading in Australia

Tiger Trade is an online trading platform developed by Tiger Brokers, an ASIC-regulated broker. It provides handy features that make online options trading easier and more flexible:

Various options strategies: Advanced options strategies like spreads, straddles, and other multi-leg trades will be available when Tiger Trade launches margin accounts.

Demo account: Want to test strategies without risking money? Try trading in a safe environment before investing any capital.

Alerts on large order movements: Don’t miss market signals. Receive alerts on unusual activity to react quickly to opportunities.

Low trading fees: Clear, upfront brokerage fees let you know exactly what you’re paying, while staying highly competitive.

Everyone talks about growing their portfolio, but few actually take the step to understand options and use them wisely. Yes, options trading can be complex. But it may also give you control, flexibility, and a new way to think about risk and reward.

Don’t just follow the market. Learn how it moves. Test strategies. Start with a demo account. And see how Tiger Trade's US options feature can support your investment journey.

* Tiger Trade does not offer OTC options. This mention is for general educational purposes only.

Capital at risk. Options trading carries a high level of risk and may not be suitable for all investors. You should only trade with money you can afford to lose. See FSG, PDS, TMD and T&Cs via our website before trading. Information provided may contain general advice without taking into account your objectives, financial situations or needs. Past performance is no guarantee of future results. Graphics and charts are for illustrative purposes only. Tiger Brokers (AU) Pty Limited. ABN 12 007 268 386 AFSL 300767