Ausnutria Dairy And 2 Other Asian Penny Stocks To Watch

As global markets react to new U.S. tariffs, Asian markets are observing shifts that could present unique opportunities for investors. In the realm of penny stocks—typically smaller or newer companies—the term may seem outdated, but these stocks continue to offer intriguing possibilities for those willing to explore beyond the mainstream. This article examines three Asian penny stocks, including Ausnutria Dairy, that stand out with their potential financial resilience and growth prospects amidst current market dynamics.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.10 | SGD42.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.40 | HK$883.33M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.28 | HK$1.9B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.19 | HK$1.99B | ✅ 4 ⚠️ 1 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.61 | SGD581.56M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.30 | SGD9.05B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.92 | THB1.35B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.23 | SGD46.51M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.33 | SGD913.59M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 983 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ausnutria Dairy (SEHK:1717)

Simply Wall St Financial Health Rating: ★★★★☆☆

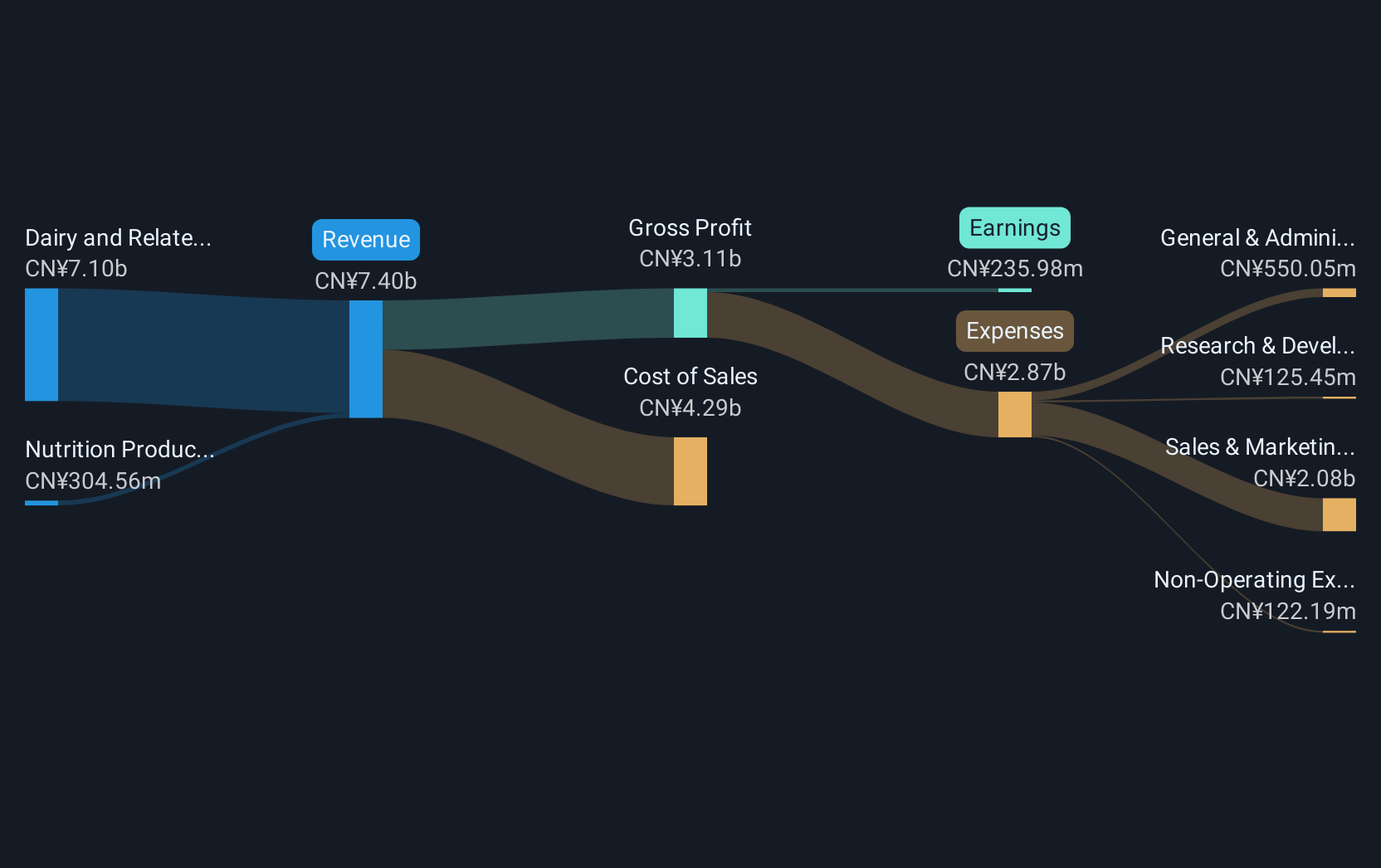

Overview: Ausnutria Dairy Corporation Ltd is an investment holding company involved in the research, development, production, marketing, processing, packaging, and distribution of dairy and nutrition products with a market cap of HK$3.84 billion.

Operations: The company generates revenue primarily from Dairy and Related Products amounting to CN¥7.10 billion and Nutrition Products totaling CN¥304.56 million.

Market Cap: HK$3.84B

Ausnutria Dairy Corporation Ltd, with a market cap of HK$3.84 billion, has shown notable earnings growth of 35.3% over the past year, surpassing industry averages despite a history of declining profits over five years. The company trades at an attractive valuation relative to peers and maintains stable short-term asset coverage for liabilities. However, its management team and board are relatively inexperienced with an average tenure under two years. Recent executive changes include the appointment of Ms. Yang Ruijie as CFO, bringing extensive financial management experience from previous roles in major corporations like Procter & Gamble and Yili Group.

- Click here to discover the nuances of Ausnutria Dairy with our detailed analytical financial health report.

- Examine Ausnutria Dairy's earnings growth report to understand how analysts expect it to perform.

Xinjiang Xinxin Mining Industry (SEHK:3833)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xinjiang Xinxin Mining Industry Co., Ltd. operates in the mining, ore processing, smelting, refining, and sale of nickel, copper, and other nonferrous metals with a market cap of HK$2.56 billion.

Operations: The company's revenue is primarily derived from its Metals & Mining - Miscellaneous segment, which generated CN¥2.28 billion.

Market Cap: HK$2.56B

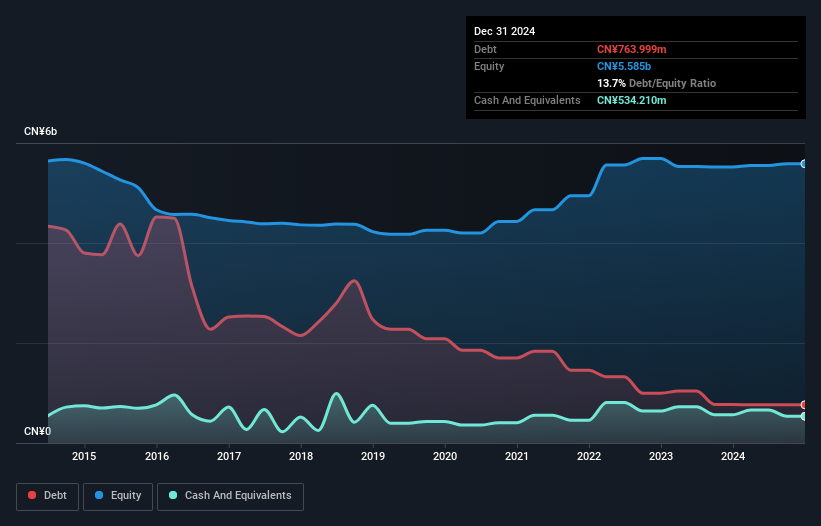

Xinjiang Xinxin Mining Industry, with a market cap of HK$2.56 billion, has demonstrated stable financial health, as its short-term assets (CN¥2.2 billion) exceed both short-term and long-term liabilities. The company has improved its debt profile significantly over the last five years, reducing its debt-to-equity ratio from 49% to 13.7%, and maintains satisfactory net debt levels covered by operating cash flow. Despite low return on equity at 3.1%, earnings have grown steadily by 6.2% annually over the past five years, with recent profit margins slightly improving to 8.1%. Recent board changes include appointing Ms. Zhang Li as an employee representative director without remuneration for her role.

- Dive into the specifics of Xinjiang Xinxin Mining Industry here with our thorough balance sheet health report.

- Explore historical data to track Xinjiang Xinxin Mining Industry's performance over time in our past results report.

Fangzhou (SEHK:6086)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fangzhou Inc. offers online chronic disease management services in China and has a market cap of HK$5.28 billion.

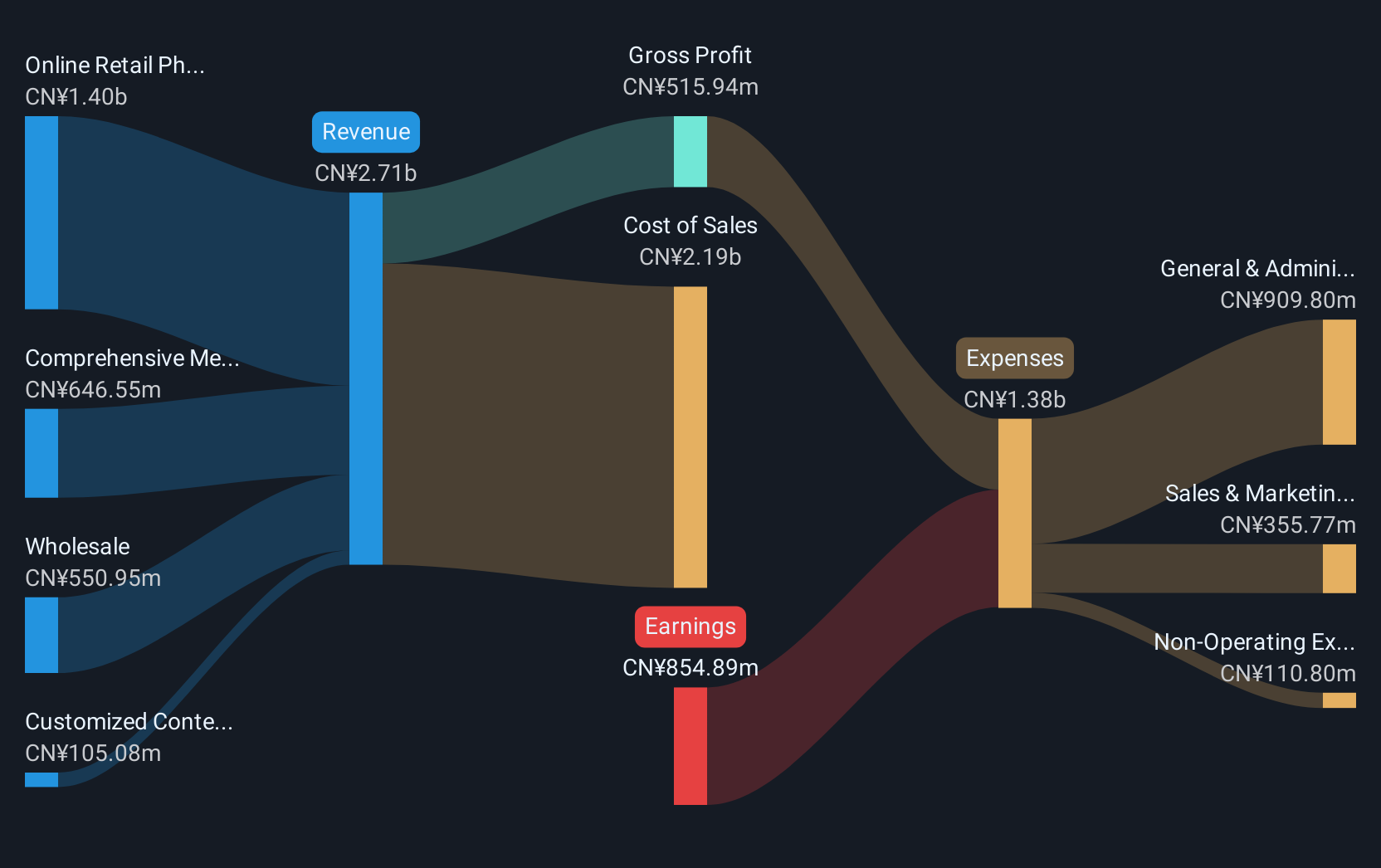

Operations: The company generates revenue from several segments, including Online Retail Pharmacy Services (CN¥1.40 billion), Comprehensive Medical Services (CN¥646.55 million), Wholesale (CN¥550.95 million), and Customized Content and Marketing Solutions (CN¥105.08 million).

Market Cap: HK$5.28B

Fangzhou Inc., with a market cap of HK$5.28 billion, is navigating the volatile penny stock landscape by leveraging its diverse revenue streams and innovative AI initiatives. The company generates significant revenue from online retail pharmacy services (CN¥1.40 billion) and comprehensive medical services (CN¥646.55 million). Despite being unprofitable, Fangzhou maintains a stable financial position with short-term assets exceeding liabilities and more cash than debt, ensuring a cash runway for over three years. Recent strategic moves include expanding treatment options through partnerships like Otsuka Pharmaceutical's Iclusig® and launching an AI-driven liver disease management center in collaboration with Guangdong Provincial Liver Disease Institute.

- Jump into the full analysis health report here for a deeper understanding of Fangzhou.

- Review our historical performance report to gain insights into Fangzhou's track record.

Summing It All Up

- Jump into our full catalog of 983 Asian Penny Stocks here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10