A Look at Baidu (BIDU) Valuation as Apollo Go Expands to Europe Through Landmark Lyft Partnership

Baidu (BIDU) just made waves with its announcement of a new strategic partnership with Lyft, aiming to bring its Apollo Go autonomous vehicles to Europe starting in 2026. For investors who have watched Baidu’s core advertising business struggle in recent years, this is a bold signal of the company’s ambition to find new growth engines. The rollout will begin in the UK and Germany and eventually scale across the continent. This marks a clear push by Baidu to tap into the fast-evolving world of global autonomous mobility and distance itself from past reliance on online marketing.

Even before this news, Baidu’s stock price was fighting to regain momentum after a tough stretch. Shares have climbed around 6% since the start of the year, yet are still down sharply, nearly 75% off from their all-time highs. The story over the last three years has been tough. While Apollo Go’s expansion hints at future growth potential, investors have remained cautious, especially with revenue growth modest and earnings under pressure from rising investment in AI and new technology. The latest partnership seems to have sparked renewed interest, even as the market tries to determine if this is a lasting turnaround or another headline in a volatile story.

So after all this, does Baidu’s international AV strategy offer a genuine opportunity, or is the market already factoring in the prospects for future growth?

Most Popular Narrative: 12.7% Undervalued

According to the most popular community narrative, Baidu is trading at a significant discount to its estimated fair value, driven by optimism about its AI and autonomous vehicle initiatives. Analysts believe current market prices may not fully capture the company's future growth potential as outlined in their projections.

Baidu's AI Cloud business is demonstrating strong momentum with a 26% year-over-year revenue growth, driven by market recognition of its AI capabilities and partnerships with leading enterprises. This growth is expected to positively impact Baidu's future revenue and margins.

Want a deeper look at the bullish outlook for Baidu? This narrative is built on aggressive AI penetration and transformative technology integrations. Curious to uncover which growth levers and ambitious projections lead analysts to bump up Baidu’s fair value above today’s price? The answers are all in the numbers behind this compelling forecast. Find out which key financial moves could change everything.

Result: Fair Value of $100.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued weakness in core marketing revenue and high AI infrastructure costs could quickly challenge the optimistic outlook that is now priced into Baidu’s shares.

Find out about the key risks to this Baidu narrative.

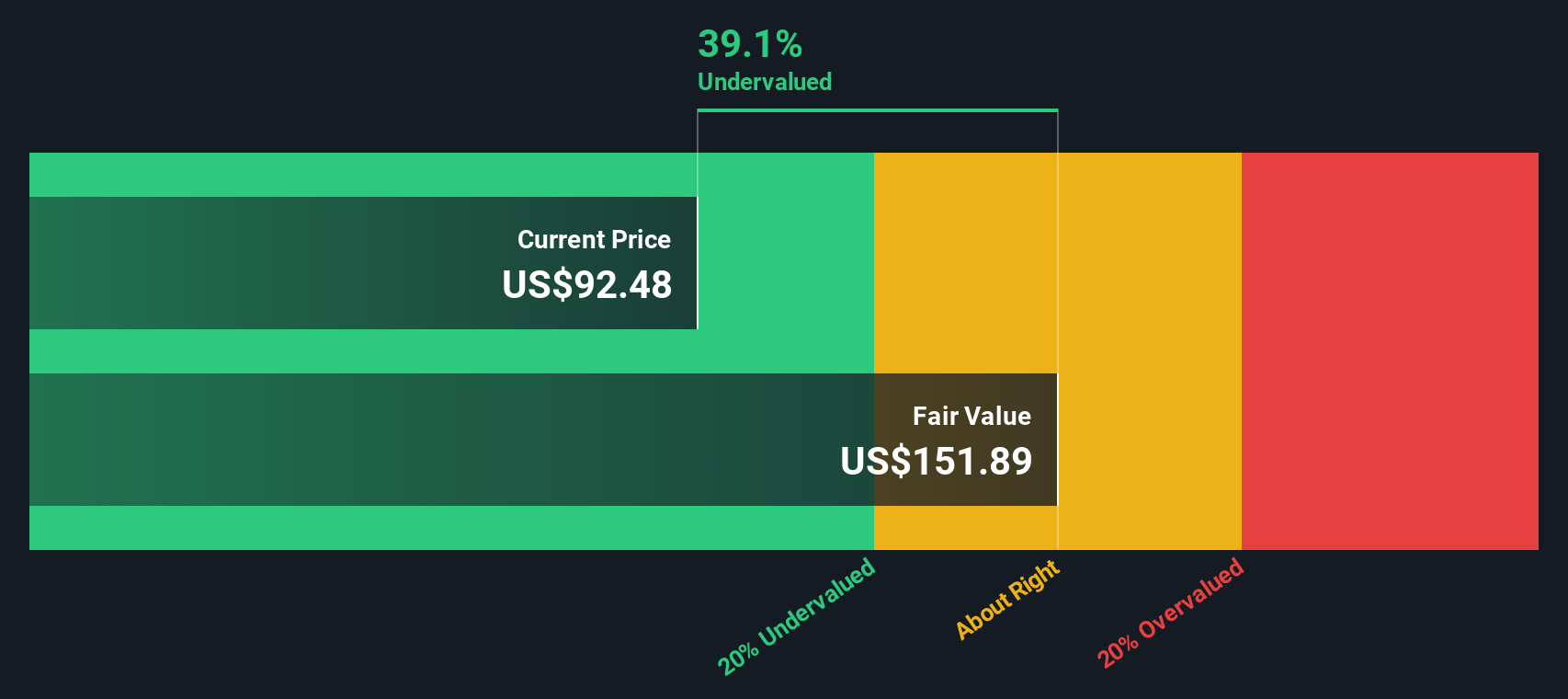

Another View: SWS DCF Model Suggests Even More Upside

Looking from another angle, the SWS DCF model points to Baidu being even more undervalued than suggested by analyst targets. Could this deeper discount point to hidden market risks, or is the opportunity greater than it appears?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Baidu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Baidu Narrative

If you have a different perspective or enjoy diving into the numbers yourself, you can explore the data and create your own analysis in just a few minutes.

Do it your way

A great starting point for your Baidu research is 3 key rewards and 1 important warning sign, which could impact your investment decision.

Ready for Your Next Investment Discovery?

If you are curious to uncover promising stocks beyond Baidu, the Simply Wall Street Screener can help you find fresh opportunities tailored to your interests. Whether you are after the next big tech trend, crave reliable income, or want to spot future financial stars, start your exploration here:

- Explore cutting-edge breakthroughs with our handpicked selection of quantum computing innovators: Quantum Computing Stocks

- Uncover steady income streams among companies offering attractive dividend yields: Dividend Stocks with Yields > 3%

- Find hidden gems that are displaying robust financial health at penny stock prices: Penny Stocks with Strong Financials

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10