Ever wondered how the right order type can make or break your Hong Kong stock trade? Behind every successful HKEX transaction lies strategic execution - where standard limit/market orders only scratch the surface. While HKEX’s order types form the essential toolkit, their true potential emerges when brokers enhance them for modern trading realities.

This is where platforms differentiate themselves. Whether you're aiming to buy Hong Kong stocks or explore hkex stock option strategies, platform choice matters. For example, Tiger Trade not only supports HKEX’s order types but also takes them a step further with advanced features designed to give you an edge.

HKEX’s Order Types: The Building Blocks

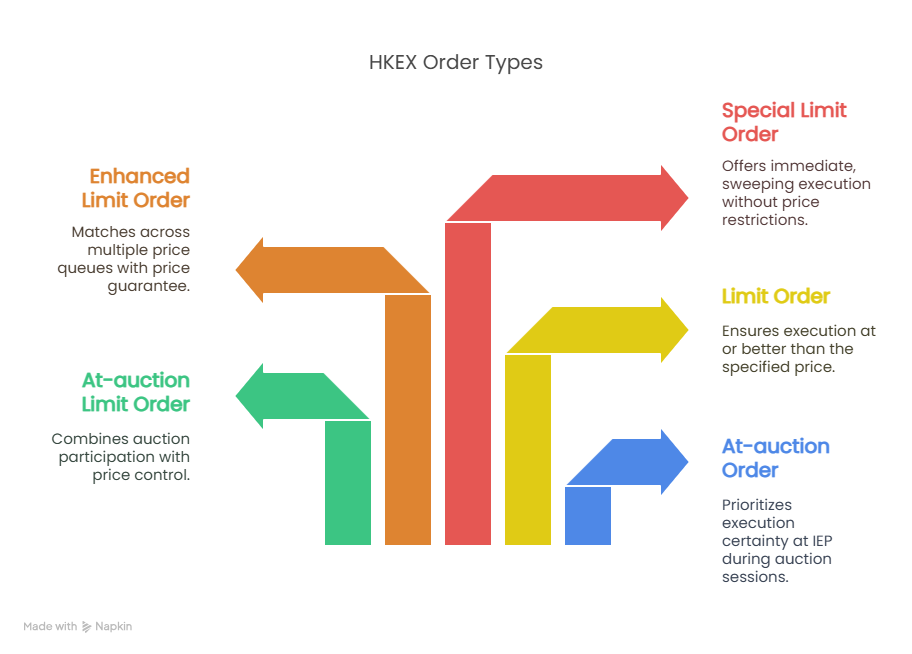

When trading HK stocks, understanding HKEX’s unique order types is crucial. Getting them right means smoother trades and fewer missed opportunities. Here are five primary HKEX order types[1], each tailored for specific trading scenarios:

1. At-auction Order

Designed for the Pre-opening and Closing Auction Sessions, an at-auction order is a price-agnostic instruction executed at the Indicative Equilibrium Price (IEP).

Its strength lies in priority: it supersedes at-auction limit orders and matches based on time priority at the IEP. Unmatched orders post-auction are automatically canceled, making this ideal for traders prioritizing execution certainty during price-discovery phases.

2. At-auction Limit Order

This hybrid order combines auction participation with price control. Traders specify a limit price, which must align with or improve upon the IEP (e.g., a buy order’s limit ≥ IEP). If the IEP matches or betters the limit, execution occurs at the IEP, adhering to price-time priority.

Unmatched orders may transition to the Continuous Session as standard limit orders, provided their price stays within 9 spreads of the nominal price—a feature balancing flexibility and risk management.

3. Limit Order

The cornerstone of precision, a limit order executes strictly at the specified price or better. It adheres to rigid price boundaries: sell orders cannot undercut the best bid, nor can buy orders exceed the best ask. Unfilled orders remain in their price queue, serving patient traders aiming to avoid slippage.

4. Enhanced Limit Order

This dynamic variant expands execution scope, matching across 10 price queues (up to 9 spreads from the best bid/ask) while guaranteeing no worse than the input price. However, input prices are capped at 10 spreads from the prevailing market price. Post-trading, unmatched portions revert to standard limit orders—a tool for balancing aggression with cost discipline.

5. Special Limit Order

The most flexible yet ephemeral type, a special limit order also scans 10 queues but imposes no input price restrictions beyond aligning with the best bid/ask. Unmatched portions are purged post-session, appealing to traders prioritizing immediate, sweeping execution over residual exposure.

Not All Platforms Are Created Equal

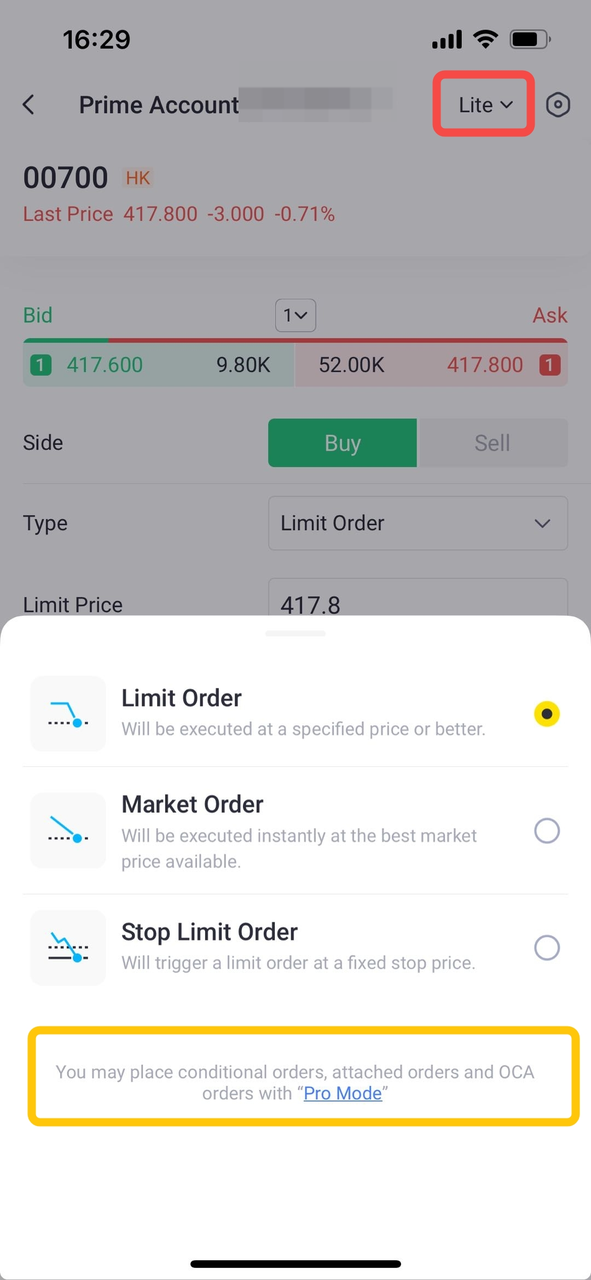

While HKEX defines these order types, how they are implemented can vary across online trading platforms. Some HK stock brokers may offer limited functionalities, while others, like Tiger Brokers, enhance these order types with additional features to provide a more robust trading experience.

Tiger Brokers: Elevating Your Trading Game

Beyond the standard HKEX order types, Tiger Brokers offers a suite of self-developed advanced order types. These tools are especially valuable for active investors looking to optimize strategy under various market conditions:

Stop-Loss Order

Automatically sells a security when its price falls to a predetermined level, helping you limit potential losses without constant market monitoring.

Trailing Stop Order

Unlike a fixed stop-loss, this order adjusts dynamically with market movements, locking in profits as the price rises while still protecting against downturns.

Conditional Order

These orders execute only when specific market conditions are met, allowing you to automate strategies based on price movements, volume changes, or other predefined criteria.

VWAP Order

Standing for Volume Weighted Average Price, this order type aims to execute trades in line with the average price over a specified period, minimizing market impact and achieving better pricing.

To explore the full range of our intelligent order types and how they can elevate your Hong Kong stock trading strategy, click here to read the full article.

Conclusion: Master the Tools, Maximize the Gains

Hong Kong’s markets don’t sleep—and neither should your order strategy. While HKEX’s order types lay the groundwork, they’re built for a rulebook, not the real-time chaos of live trading.

However, a Hong Kong broker like Tiger Brokers—which offers enhanced tools and advanced order types—can significantly amplify your trading efficiency and effectiveness. By combining foundational knowledge with innovative trading solutions, you’re better positioned to seize opportunities in a dynamic market environment.

Ready to take your trading to the next level? Visit our website today to explore our advanced features and experience a smarter way to buy Hong Kong stocks.

Reference

https://www.hkex.com.hk/Services/Trading/Securities/Overview/Trading-Mechanism?sc_lang=en (Accessed: 13th, May)

Disclaimer:

Investing involves risks, and past performance does not reflect future results. Tiger Brokers makes no warranty as to the accuracy, completeness, or timeliness of the information, and none of this constitutes any investment advice or opinion. Screenshots are provided for illustrative purposes only. Before investing, please consider your own risk tolerance and refer to the relevant risk disclosures for more details.