Knowing what to invest in, especially in the US, can be tricky with so many big global companies; it can be difficult to navigate where to allocate capital, especially if you're an investor who's just starting out. As a starting point, beginner investors looking at the US markets may want to explore the S&P 500. The S&P 500 (short for “Standard & Poor’s 500”) is an index that tracks the performance of 500 of the largest publicly listed companies, including Apple, Microsoft, Amazon, and Google’s parent company, Alphabet.

Created in 1957 by financial services firm Standard & Poor's, the index is widely considered a benchmark for the US stock market and also the global economy, as many companies operate globally. Although it only includes the 500 top US stocks, it actually represents about 80% of the total value of the entire US stock market.

For Australian beginner investors, the S&P 500 may be a way to diversify beyond local markets and gain exposure to some of the world’s most successful companies.

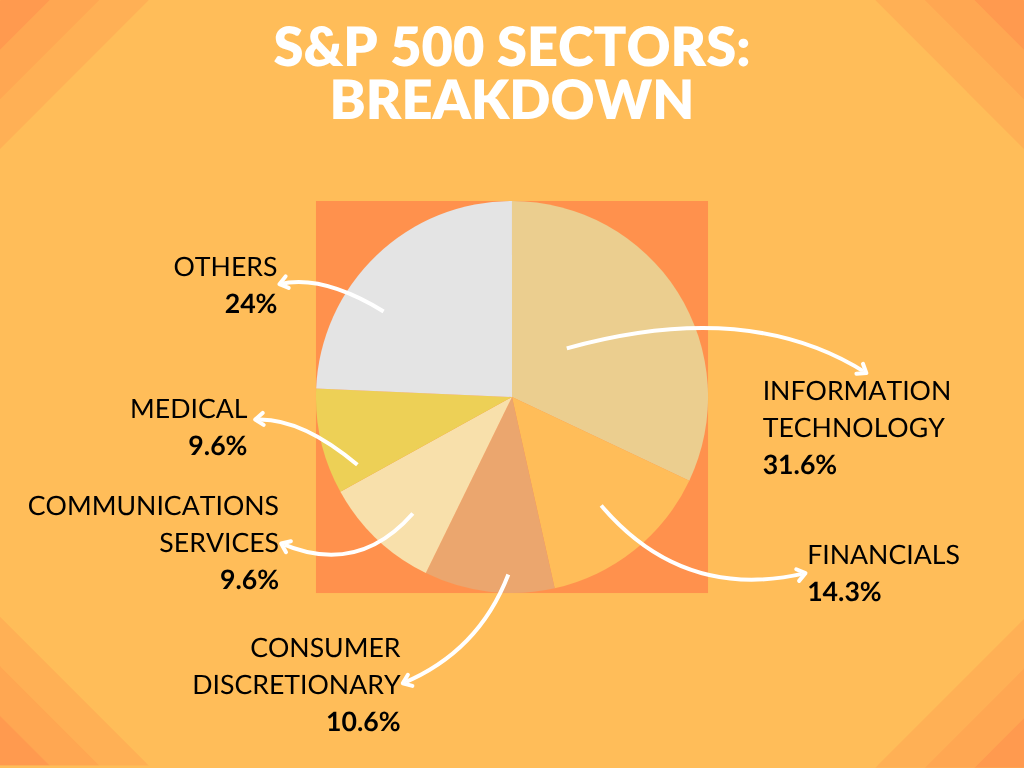

Sector breakdown of the S&P 500

Before investing in the S&P 500, investors should gain an understanding of which companies they're putting their money into. The index is made up of large businesses from different sectors of the economy.

Who’s driving the market?

Below is a look at the top 5 sectors of the S&P 500 by weight, as of 30 May 2025:

Information Technology: This forms the largest part of the S&P 500. This sector includes global giants. These companies are at the forefront of digital growth, cloud services, and innovation.

Financials: This group covers big banks, insurance companies, and asset managers. It plays a key role in economic health and reacts closely to interest rate changes.

Consumer Discretionary: These are companies that sell non-essential goods, such as car manufacturers, hotels, online retailers, and entertainment firms. Their performance often mirrors consumer confidence.

Communication Services: A newer sector that includes social media, telecoms, and entertainment streaming platforms.

Healthcare: With pharmaceutical firms, biotech companies, and medical device makers, this sector offers stability and growth driven by global health demands.

How do these sectors' weights affect index volatility?

Not all parts of the S&P 500 have the same influence. Some sectors are much bigger than others, so their ups and downs affect the index more. For investors, this means:

Big sectors move the whole index

When large sectors like tech or finance go up or down, they can cause the entire S&P 500 to rise or fall. For example, if Apple or Microsoft drops, the index might fall too, even if many smaller companies are doing well.

Small sectors can be overlooked

Sectors that are smaller, like Utilities or Real Estate, may do well, but because they make up only a small part of the index, their impact may go unnoticed. This can cause investors to miss out on good investment opportunities in those sectors.

The Index can be sensitive to news

While big sectors have more power, news like a company’s earnings report or a change in interest rates can have an effect and cause big changes in the index. That’s why sometimes the market moves sharply, even if the news doesn’t seem that big.

Investing in the S&P 500 from Australia

Thinking about investing in the S&P 500 from Australia? It's better to understand the risks before investing in it.

What are the risks of investing in the S&P 500 from Australia?

A heavy focus on big tech companies

As mentioned above, the S&P 500 index is mostly made up of tech and financial companies. If they do well, the index will likely go up. But if they fall, the whole index could drop significantly. This is called concentration risk, meaning too much depends on just a few companies.

Currency risk (AUD vs USD)

The S&P 500 is priced in USD. If you’re investing from Australia using AUD, the exchange rate matters. For instance, if the Aussie dollar falls against the US dollar, you might get less back, even if the S&P 500 goes up. To reduce this, some investment options offer currency hedging (protection against currency swings). Tiger Trade provides fast and convenient conversion of USD at 55 PIPS, allowing investors to be ready to trade the US in no time!

Big picture risks (policies and global events)

There are several global and local factors that could affect the US market, such as interest rate changes, government policies, the words of heavyweights, or world events. These macro risks are hard to predict; however, they can quickly change how the market behaves.

Can you trade the S&P 500 index?

In short, the answer is no. That’s because the S&P 500 is not a stock or a fund, but rather an index. It acts like a scoreboard that shows how 500 big US companies are doing. You can’t buy the scoreboard itself.

Instead, if you want to invest in the S&P 500, you need to look for specific companies that are listed on it or invest in ETFs (exchange-traded funds)that replicate or follow the index.

What are the ways to invest in the S&P 500 indirectly?

Buy shares of individual companies in the S&P 500

Obviously, one option is to buy stocks of companies that are part of the S&P 500. These are the actual businesses the index tracks. You can choose a few well-known names based on your interests or goals. Examples of some of the more popular companies can be seen below.

Company Name | Ticker | Sector |

Apple | AAPL | Information Technology |

JPMorgan Chase | JPM | Financials |

Johnson & Johnson | JNJ | Health Care |

Starbucks | SBUX | Consumer Discretionary |

AT&T | T | Communication Services |

Table 1: Examples of individual companies in the S&P 500

(The companies presented above are provided only as examples to help explain the shares of the S&P 500. This is not financial advice and should not be seen as a recommendation to buy any specific stock. Always do your own research or speak with a financial advisor before making investment decisions.)

Buy an S&P 500-tracking ETF

A simpler and more popular way is to buy an ETF that copies the S&P 500. These funds automatically follow the index, so you don’t need to pick and choose stocks yourself. Listed below are examples of ETFs that Aussies can access via the ASX:

iShares S&P 500 ETF (ASX: IVV): A popular fund that closely follows the performance of the S&P 500.

SPDR® S&P 500 ETF (ASX: SPY): One of the world’s oldest and largest ETFs tracking the S&P 500.

BetaShares US Equities Strong Bear Hedge Fund (ASX: BBUS): This one is for advanced investors. It gives inverse or hedged exposure to US markets, which means it may go up when the S&P 500 goes down.

Investing in the S&P 500 stocks and ETFs with Tiger Trade

Tiger Trade offers investors convenient access to S&P 500-listed companies and ETFS that track the index. Join Tiger Trade to explore opportunities and unlock features, including:

24/5 trading access

Free Level 2 market data

Clear and competitive brokerage pricing

Trading less than or equal to 200 shares in one order: USD 2 / order

Trading more than 200 shares in one order: USD 0.01 / share

Trading fractional shares (less than 1 share): Max. USD 1 / order

Welcome Rewards

Join to receive 4x zero brokerage trades* and zero FX fees for exchanging up to AUD 2,000** every month. Deposit to receive AUD 20 cash voucher^.

If you're starting out and are looking for a better way to invest in big US companies or S&P 500 ETFs, Tiger Trade keeps it simple and flexible. Download the app now to learn more about the S&P 500 index and find your next investment opportunity!

^New clients & unfunded existing clients only. Only min. brokerage waived for 4 ASX, US stocks or ETFs or options trades. Third-party fees and other fees still apply. See T&Cs for details.

**0 added spread and for AUD⇆USD only. Pass-through bid-ask spread still apply. ^Withdrawal restrictions apply. See T&Cs and pricing page.

Reference

[1] Available at: https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview

[2] Available at: https://www.investopedia.com/the-best-25-sp500-stocks-8778635

[3] Available at: https://www.moomoo.com/au/learn/detail-sp-500-australia-117767-241225106

[4] Available at: https://hellostake.com/au/blog/trending/how-to-invest-sp-500

[5] Available at: https://www.blackrock.com/au/insights/ishares/sp-etfs#Fishing-in-a-bigger-pond

[6] Available at: https://www.itiger.com/quote/us

Disclaimer:

Capital at risk. You should only trade with money you can afford to lose. See FSG, PDS, TMD and T&Cs via our website before trading. Information provided may contain general advice without taking into account your objectives, financial situations or needs. Past performance is no guarantee of future results. Graphics and charts are for illustrative purposes only. Tiger Brokers (AU) Pty Limited. ABN 12 007 268 386 AFSL 300767.