The sports streaming platform FuboTV will announce its third-quarter fiscal 2025 earnings before the U.S. stock market opens on August 8 Eastern Time.

Before the official earnings release, the company disclosed preliminary second-quarter results on July 30, showing that both revenue and user growth exceeded market expectations, serving as a significant catalyst for the stock's price surge.

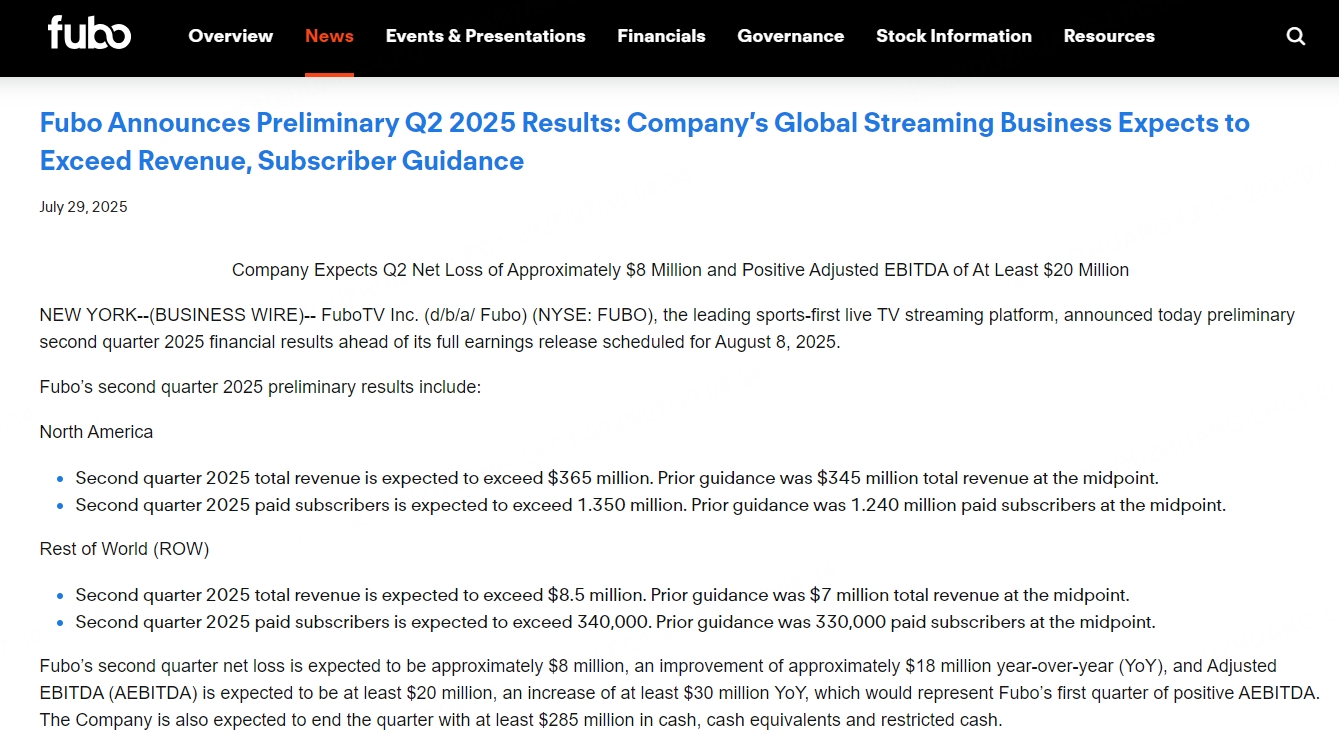

Impressive Preliminary Report: Surpassing Revenue and User Expectations

Strong Performance in North America

FuboTV expects North American total revenue for the second quarter of 2025 to exceed $365 million, significantly higher than the previous median expectation of $345 million. The number of paying users is expected to surpass 1.35 million, exceeding the previous median expectation of 1.24 million, highlighting the company’s continuous growth momentum in its primary market.

Stable Expansion in International Markets

In the "Rest of World (ROW)" markets, Fubo expects quarterly revenue to surpass $8.5 million, much higher than the previous expectation of $7 million. The number of paying users is anticipated to reach 340,000, exceeding the earlier forecast of 330,000, indicating initial success in its international expansion strategy.

Significant Growth in Total User Base and Subscriptions

The company’s total user count is expected to reach 1.69 million, far higher than the prior management forecast of 1.57 million. This signifies that FuboTV has effectively achieved a dual strategy of user acquisition and retention through its content strategy and marketing layout in the competitive streaming market.

Effective Cost Control Leads to Narrowed Quarterly Loss

FuboTV anticipates a second-quarter net loss of about $8 million, down $18 million year-over-year, a decrease of 56% in the loss margin. Notably, Adjusted EBITDA (AEBITDA) is expected to be at least $20 million, improving over $30 million year-over-year, marking the company's first-ever positive AEBITDA for the quarter.

This signifies substantial achievements in cost control and operational optimization, providing a solid foundation for future profitability.

Additionally, the company expects to hold at least $285 million in cash, cash equivalents, and restricted cash by the end of the quarter, further strengthening its financial stability.

Suspension of Earnings Guidance, Focus on Strategic Flexibility

FuboTV stated that due to the ongoing proposed merger with Hulu + Live TV, the company will suspend providing future earnings guidance and has withdrawn its previously announced fiscal 2025 profitability targets. Management emphasized the need to maintain strategic flexibility ahead of potential significant business changes, while focusing on maximizing long-term shareholder value.

Positive Wall Street Response: Target Price Raised to $6

After the release of the preliminary earnings report, Wall Street analysts promptly responded positively. Wedbush analyst Dan Ives maintained an "outperform" rating for Fubo, raising the target price from $5 to $6, indicating significant upside potential compared to the closing price that week.

Ives noted that the company's preliminary results were encouraging and that management's conservative forecast strategy could continue to exceed market expectations across multiple forthcoming quarters, providing upward momentum for the stock price.

Robust Rebound in 2025, Demonstrating Market Confidence

Following a 60% stock price decline in 2024, FuboTV saw a strong rebound in 2025, with a year-to-date increase of 240%, making it one of the strongest performers in the streaming media sector this year. The stock price recovery reflects investors' broad recognition of the company’s strategic transformation, improved profitability, and growth potential.

Streamlined Package Strategy to Become a New Growth Engine

Looking ahead, FuboTV plans to launch a "streamlined package" later this year, offering users more competitively priced content options to attract a cost-conscious audience. This initiative is expected to help the company expand its user base further, enhance customer engagement, and build a new growth engine amid a slowdown in user growth.

Industry analysts generally believe that the streamlined package will be a crucial catalyst for user growth and financial performance improvements over the next several quarters.

Summary: FuboTV's impending third-quarter fiscal 2025 earnings report is highly anticipated by the market. The preliminary data is strong, with revenue and user numbers exceeding expectations, a significant narrowing of losses, and the achievement of a positive AEBITDA for the first time, signaling the company's gradual emergence from an adjustment period and its move towards sustainable growth and profitability. With new strategies like streamlined packages coming into effect and enhanced expectations for business integration, FuboTV is entering a structural turnaround opportunity, warranting continued investor attention.

This content is based on Tiger AI and Bloomberg data and is provided for reference only.