Summary:Hello Group Inc will release its second-quarter 2025 financial results before the market opens on September 9th. The company saw strong year-on-year net profit growth in the first quarter, drawing positive market feedback. Second-quarter profits and the number of paying users will be key areas for observation.

Net revenues decreased by 1.5% year over year to RMB2,520.8 million (US$347.4 million*) in the first quarter of 2025.

Net income attributable to Hello Group Inc. increased to RMB358.0 million (US$49.3 million) in the first quarter of 2025, from RMB5.2 million in the same period of 2024.

Non-GAAP net income attributable to Hello Group Inc. (note 1) increased to RMB403.8 million (US$55.6 million) in the first quarter of 2025, from RMB59.9 million in the same period of 2024.

Diluted net income per American Depositary Share ("ADS") was RMB2.07 (US$0.29) in the first quarter of 2025, compared to RMB0.03 in the same period of 2024.

Non-GAAP diluted net income per ADS (note 1) was RMB2.34 (US$0.32) in the first quarter of 2025, compared to RMB0.31 in the same period of 2024.

Monthly Active Users ("MAU") on Tantan app were 10.7 million in March 2025, compared to 13.7 million in March 2024.

For the Momo app total paying users was 4.2 million for the first quarter of 2025, compared to 7.1 million for the same period last year. Tantan had 0.8 million paying users for the first quarter of 2025 compared to 1.1 million from the year ago period.

Second Quarter Outlook

Zhiwen Group expects total net revenue for the second quarter of 2025 to be between 2.57 billion yuan and 2.67 billion yuan, a year-on-year decrease of 4.5% to 0.8%.

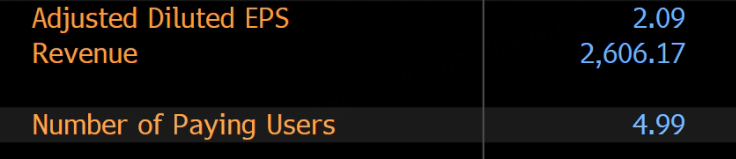

According to Bloomberg data, analysts generally expect Zhiwen Group's second-quarter revenue to be 2.606 billion yuan and adjusted earnings per share to be 2.09 yuan.

Key Points to Watch

Can Core Businesses Regain Strength?

Momo and Tantan, core businesses of Zhiwen Group, showed some weakness in the first quarter. Momo's total number of paying users reached 4.2 million in the first quarter, a decrease of 2.9 million from the same period last year; Tantan's total number of paying users was 800,000, a decrease of 300,000 from the same period last year.

The decline in monthly active users and paying users will directly impact the company's value-added service revenue. Zhiwen Group's value-added service revenue primarily consists of virtual gift revenue from various audio, video, and text scenarios, as well as membership subscription revenue. Therefore, the paying user performance of Momo and Tantan in the second quarter warrants close attention.

While profits showed strong growth in the first quarter of this year, whether this positive momentum can be sustained depends largely on changes in user base.

Building a "Deep Social" System

The number of paying users for Momo and Tantan has been declining over the past five years. The underlying reason is that users are no longer satisfied with superficial social interactions and are turning to deeper social interactions driven by interests and other factors. As a social brand with over a decade of history, Zhiwen Group faces a difficult task in maintaining its user base. The product team needs to be innovative in leveraging new technologies to enhance the user social experience. For example, leveraging AI tools to analyze users and generate targeted, personalized interactions. Progress in this area is crucial for the company.

In fact, the market is increasingly expecting the Momo and Tantan apps to move beyond their social nature and become the next generation of search engines. Whether the company can actively explore this direction will require further analysis from its financial reports.