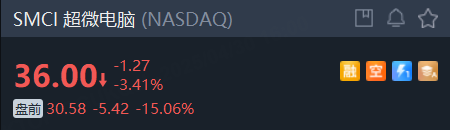

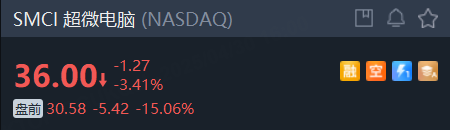

周三,超微电脑盘前大跌超15%,公司第三财季营收、调整后每股收益均低于预期,下调业绩指引。

公司第三财季调整后EPS预计为0.29至0.31美元,远低于分析师平均预期的0.53美元;营收区间为45亿至46亿美元,较此前市场预测的53.5亿美元大幅缩水。公司同时下调截至3月31日的财季业绩指引,最新营收指引对应的同比增速为18%,较2023年同期200%的爆发式增长显著放缓。

超微电脑在声明中称,业绩不及预期的主要原因为部分客户平台采购决策延迟,导致约10%的订单从第三财季顺延至第四财季。此外,老旧产品库存积压与加急费用支出增加,进一步挤压公司利润空间。数据显示,公司第三财季毛利率较上一季度收窄220个基点,反映供应链成本上升与产品组合调整的双重压力。

此次业绩预警是超微电脑近一年来遭遇的第三次重大冲击。2023年,受益于AI算力需求爆发及英伟达芯片订单激增,公司股价全年涨幅超300%。然而进入2024年下半年,受财务报告延迟、治理争议及做空机构质疑影响,公司股价累计跌幅超80%,市值大幅缩水。

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.