Summary: Bilibili Inc. will release its second-quarter 2025 financial report before the US stock market opens on August 21st. The market is focusing on whether its gross profit margin can continue to improve and the sustainability of its adjusted profitability.

First Quarter 2025 Highlights:

Total net revenues were RMB7.00 billion (US$965.1 million), representing an increase of 24% year over year.

Advertising revenues were RMB2.00 billion (US$275.3 million), representing an increase of 20% year over year.

Mobile games revenues were RMB1.73 billion (US$238.6 million), representing an increase of 76% year over year.

Gross profit was RMB2.54 billion (US$349.9 million), representing an increase of 58% year over year. Gross profit margin reached 36.3%, improving from 28.3% in the same period of 2024.

Net loss was RMB10.7 million (US$1.5 million), narrowing by 99% year over year.

Adjusted net profit1 was RMB361.5 million (US$49.8 million), compared with an adjusted net loss of RMB455.9 million in the same period of 2024.

Operating cash flow was RMB1.30 billion (US$179.4 million), compared with RMB637.7 million in the same period of 2024.

Average daily active users (DAUs) were 106.7 million, compared with 102.4 million in the same period of 2024.

Second Quarter Outlook

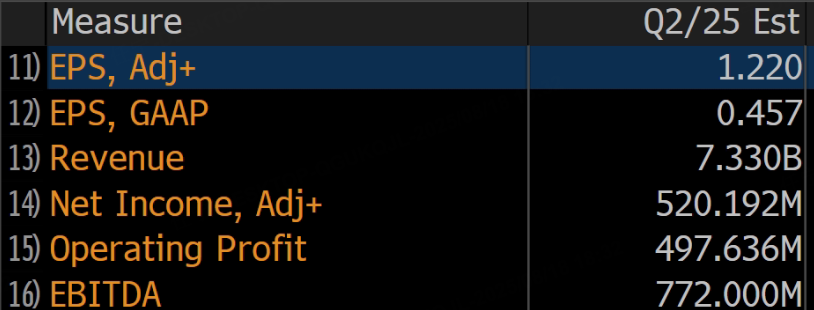

According to Bloomberg data, analysts generally expect Bilibili's second-quarter revenue to be RMB 7.33 billion, adjusted earnings per share to be RMB 1.22, EBITDA to be RMB 772 million, and adjusted net profit to be RMB 520 million.

AI Empowerment Accelerates Implementation: Three major AI-powered transformations in Bilibili's advertising have yielded results, with average click-through rates increasing by approximately 14%. Automatic delivery penetration is approximately 20%, ROI exceeds 75%, and deep conversion delivery accounts for over 55%. Advertising scale and profit quality remain resilient.

Operational Strategy Prioritizes "Efficiency First": Livestream monetization efficiency will be a key focus in Q2, with attention focused on optimizing the structure of the livestreamer base and the level of community engagement. Livestreaming stimulates advertising, helping to enhance user value.

Structural Improvement in Gross Margin: In the first quarter, advertising and mobile games boosted the overall gross margin to 36.3%. Institutional estimates for the second quarter gross margin range are generally between 36% and 37%, but whether this is achievable remains to be seen. Summer is a peak season for content and commercial investment. If this performs well, it will significantly boost market confidence in second-half profits.

Institutional Views

Deutsche Bank analyst Leo Chiang expects Bilibili's profit margin to continue expanding in the second quarter, driven by a shift in revenue structure toward higher-margin businesses and improved operating leverage. Maintain a Buy rating on the stock with a target price of HK$228.

Bank of America Securities: Reiterates its "Buy" rating on Bilibili. As management reiterated its confidence in profitability this year, the Hong Kong target price for Bilibili's shares was raised from HK$195 to HK$211.

CLSA: Maintains its "Outperform" rating on Bilibili and raises its US target price from US$24 to US$25.5.