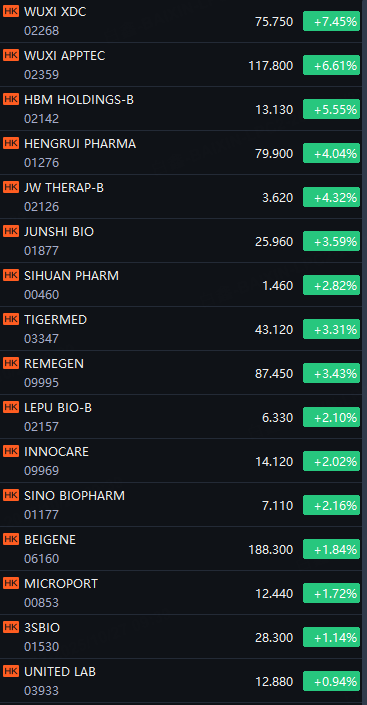

On October 27, Hong Kong Stock Market's innovative pharmaceutical concept stocks rose at market open, with WUXI XDC and WUXI AppTec up 7%; HBM Holdings up 6%; Hengrui Pharma and JW Therap up 4%; TIGERMED, Junshi and RemeGen increased more than 3%.

On the news front, Wuxi Biologics recently announced that for the first three quarters of 2025, it achieved operating revenue of RMB 32.86 billion, a year-on-year increase of 18.6%, and a 22.5% year-on-year increase in revenue from continuing operations. Net profit attributable to shareholders of the listed company was RMB 12.076 billion, up 84.84% year-on-year. The company expects the revenue from continuing operations to resume double-digit growth in 2025, with growth rates adjusted from 13-17% to 17-18%. The company anticipates full-year total revenue to be adjusted from RMB 42.5-43.5 billion to RMB 43.5-44.0 billion. The company will focus on its core CRDMO business and continue to improve production and operational efficiency.

By the end of September 2025, Wuxi Biologics had orders in hand for continuing operations totaling RMB 59.88 billion, up 41.2% year-on-year. For the first three quarters of 2025, the company's revenue from continuing operations was RMB 32.45 billion, with revenue from US clients reaching RMB 22.15 billion, up 31.9% year-on-year; revenue from European clients amounted to RMB 3.84 billion, up 13.5% year-on-year; revenue from Chinese clients was RMB 5.04 billion, up 0.5% year-on-year; and revenue from clients in other regions was RMB 1.42 billion, up 9.2% year-on-year.