NIO is set to release its Q2 2025 earnings before the U.S. markets open on September 2. Market attention has shifted from "survival" to "when real profitability will be achieved." This earnings report will serve as a critical inflection point, determining the trajectory of the company's full-year performance and whether the capital market will reprice the stock.

According to Bloomberg consensus estimates, the company’s Q2 revenue is expected to reach 19.96 billion RMB, marking a year-over-year growth of 14.4%. Adjusted EPS loss is projected at 2.17 RMB.

In its earlier guidance, NIO forecasted Q2 deliveries to range between 72,000 and 75,000 vehicles, representing year-over-year growth of 25.5% to 30.7% and quarter-over-quarter growth of 71% to 78%. Revenue guidance was set between 19.51 billion and 20.07 billion RMB, reflecting year-over-year growth of 11.8% to 15.0%.

1. Sales Rebound: Potential Peak Revenue for Q2

According to actual delivery data, NIO delivered 72,056 vehicles in Q2, a year-over-year increase of 25.6%.

Two key drivers are behind this recovery in sales:

1. Accelerated Rollout of Brand Portfolio

In addition to its core NIO brand, the new brands Aldi and Firefly began mass deliveries in June, contributing significantly to overall sales. The Aldi L60, in particular, targets mainstream family markets in the 200,000–300,000 RMB price range, becoming a new growth engine.

2. Ongoing Strength in Product Competitiveness and Intelligence

Vehicles based on the NT2.0 platform continue to evolve in areas like intelligent cockpits, driver assistance, and handling performance. The standard inclusion of battery-swapping capabilities has also substantially improved user loyalty and repeat purchases.

While the recovery in sales has supported a rebound in revenue, the crux of investor confidence still lies in the improvement of profitability.

2. Profitability Still on the Horizon: NIO Must Deliver on Its “Q4 Profitability” Promise

Despite record-breaking sales, NIO continues to grapple with losses. The market expects its Q2 adjusted EPS loss to come in at approximately 2.17 RMB, still far from the breakeven point.

Looking back at Q1, NIO reported revenue of 12.035 billion RMB, a 21% year-over-year increase but a sharp 38.9% quarter-over-quarter decline. Net loss reached 6.75 billion RMB, a year-over-year increase of 30.2%, though narrowing slightly by 5.1% from the prior quarter.

In Q1, vehicle deliveries totaled 42,094 — up over 40% year-over-year but down 42.1% quarter-over-quarter due to seasonal and product-cycle factors.

What’s especially concerning is the persistently high level of losses:

Adjusted EPS loss was a staggering 3.29 RMB;

Even excluding stock-based compensation, the adjusted net loss still stood at 6.28 billion RMB, a year-over-year increase of 28.1%.

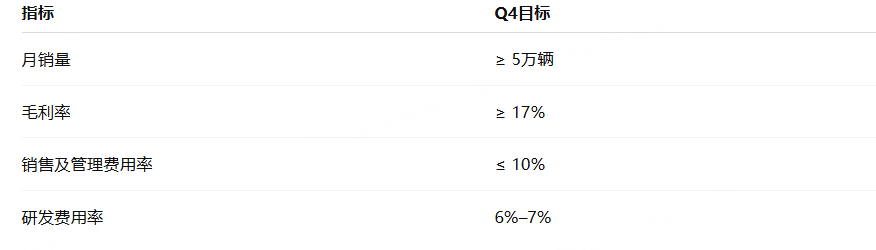

To address profitability pressures, NIO’s management has publicly committed to achieving breakeven by Q4 2025, setting four key benchmarks:

Currently, vehicle sales are approaching these targets, and Q2 gross margin is expected to rebound to above 10%. However, achieving breakeven will still require overcoming multiple challenges in cost control, margin improvement, and operational efficiency.

3. Self-Reliance, Cost Reduction, and Pricing: Gradual Clarity on Profitability Pathway

Contrary to its earlier high-investment strategy, NIO is now pursuing a more pragmatic model driven by both “technology” and “management.”

1. Progress in In-House Development

Development of key components, such as LiDAR controllers and cockpit chips, is now in-house;

Per-vehicle hardware costs have dropped by over 10,000 RMB;

Key systems (operating system, smart driving, chassis control) are now internally developed, significantly reducing supply-chain costs.

2. Cost Control Achievements Emerge

Sales and administrative expenses are gradually declining;

The direct sales system is becoming more focused, emphasizing per-square-meter efficiency and lifetime user value;

Service network optimization avoids inefficient over-expansion.

3. More Grounded Pricing Strategies

No longer pursuing aggressive pricing: For example, the Aldi L60 is priced about 10% below the Model Y but offers superior intelligent features;

Focus on "cost-effectiveness" and "price integration" to improve conversion rates and accelerate market penetration.

Strategically, NIO is addressing three fundamental issues: inadequate per-vehicle gross margins, a heavy cost structure, and mismatched pricing versus market needs. Although these adjustments will require time, the pathway to profitability is becoming increasingly clear.

4. Market Reevaluation of NIO: From Survival to Revival, But Deliverables Are Crucial

Since the second half of 2025, NIO's stock has rebounded nearly 100% from its early-year lows. Market perception of the company has shifted from “on the brink of collapse” to “a potential comeback.”

Optimism Among Analysts

Morgan Stanley recently upgraded NIO from "Hold" to "Overweight," citing “a clearer profitability pathway and robust volume growth potential.”

However, it’s important to note that this recent rally has been more about “expectation recovery” than fundamental performance improvement. Accordingly, the Q2 earnings report will serve as a key validation point for the next phase of trading:

Will net losses narrow quarter-over-quarter?

Will gross margins show continued improvement?

Can Q3 deliveries sustain growth momentum?

Will the Q4 profitability target be reaffirmed or revised upward?

Conclusion: From “Survival” to “Thriving,” NIO’s Real Battle Is Yet to Come

NIO has gradually emerged from its most challenging survival crisis, but to truly enter a cycle of sustainable profitability, it still needs to win the capital market's trust, quarter after quarter, with solid financial performance.

The Q2 earnings report is not just a performance review but also a test of trust.

The market will decide whether NIO is “an exception to fulfilling promises” or “just another storyteller.”

The answer will be revealed on September 2.

Content based on Tiger AI and Bloomberg data. For reference only.