Huntington Bancshares' (NASDAQ:HBAN) Dividend Will Be US$0.15

The board of Huntington Bancshares Incorporated (NASDAQ:HBAN) has announced that it will pay a dividend on the 1st of October, with investors receiving US$0.15 per share. The dividend yield will be 4.2% based on this payment which is still above the industry average.

Check out our latest analysis for Huntington Bancshares

Huntington Bancshares' Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Huntington Bancshares' dividend was only 60% of earnings, however it was paying out 152% of free cash flows. This signals that the company is more focused on returning cash flow to shareholders, but it could mean that the dividend is exposed to cuts in the future.

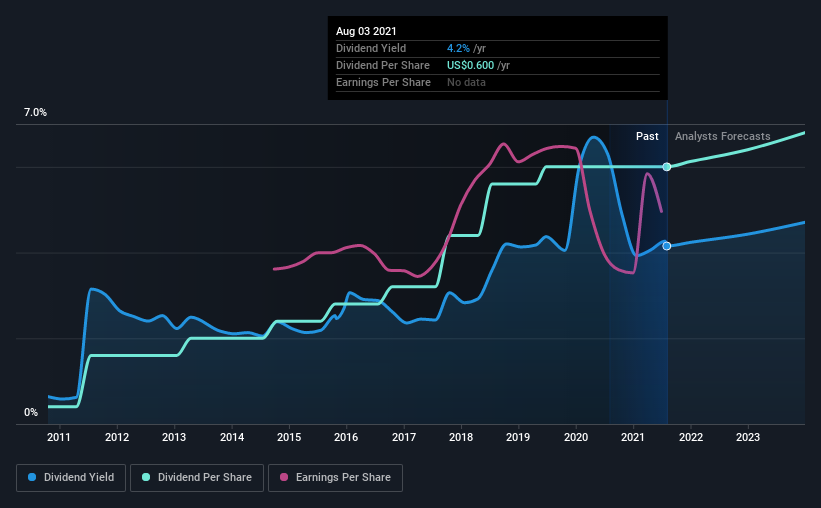

Looking forward, earnings per share is forecast to rise by 25.8% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 57% by next year, which is in a pretty sustainable range.

Huntington Bancshares Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2011, the first annual payment was US$0.04, compared to the most recent full-year payment of US$0.60. This works out to be a compound annual growth rate (CAGR) of approximately 31% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Huntington Bancshares May Find It Hard To Grow The Dividend

Investors could be attracted to the stock based on the quality of its payment history. However, Huntington Bancshares has only grown its earnings per share at 4.6% per annum over the past five years. Huntington Bancshares is struggling to find viable investments, so it is returning more to shareholders. This could mean the dividend doesn't have the growth potential we look for going into the future.

The company has also been raising capital by issuing stock equal to 45% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Our Thoughts On Huntington Bancshares' Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While Huntington Bancshares is earning enough to cover the payments, the cash flows are lacking. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for Huntington Bancshares that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10