Prescient (ASX:PTX) ends last quarter on firm financial footing and key clinical developments

Prescient Therapeutics (ASX:PTX) has reported another quarter of significant progress towards its goal of developing personalised therapies to treat cancer. As per the clinical-stage oncology company, the December 2022 quarter accomplishments strengthened its mark as an emerging leader in the next generation of personalised therapies for cancer.

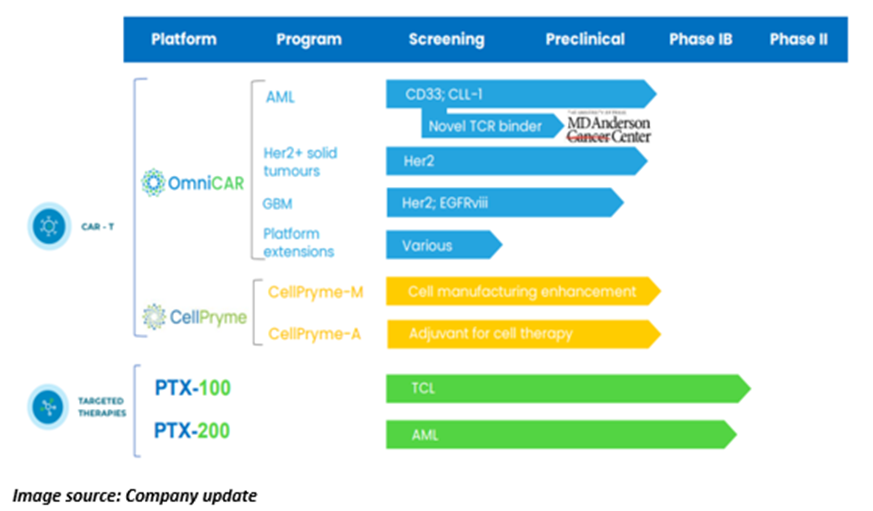

Prescient’s innovative pipeline in personalised medicine includes targeted therapies (PTX 100 and PTX 200) and Chimeric Antigen Receptors (CAR)-T platforms (OmniCAR and CellPryme).

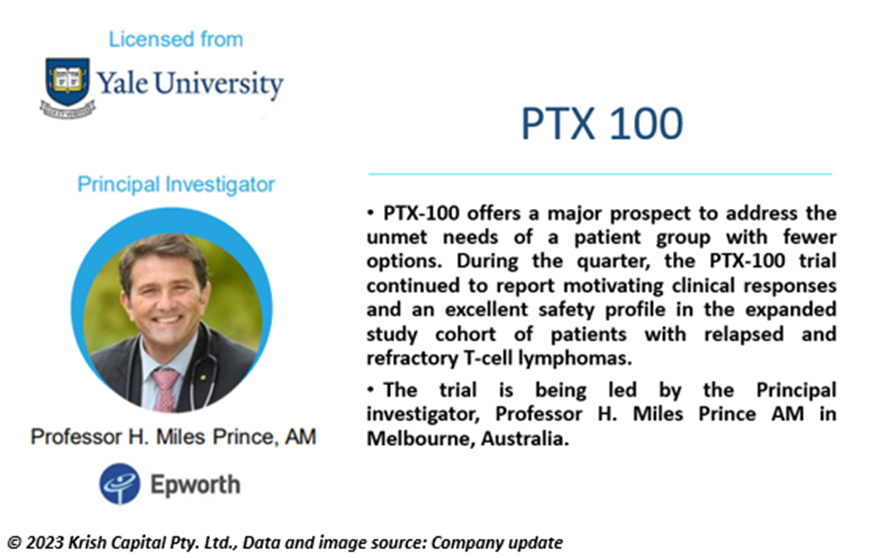

Developments across targeted therapies

OmniCAR progress lights up the quarter

OmniCAR is a universal immune receptor, next-generation platform that seeks to enable controllable T-cell activity and targets multiple antigens with a single-cell product.

During the quarter, Prescient and its partners continued to research and demonstrate how the OmniCAR universal CAR platform can allow for higher control and more efficient aiming of a broader range of cancer tumours compared to the existing first-generation CAR-T treatments. The platform progressed across numerous essential pre-clinical proof-of-concept trials.

It is to be noted that Q-Gen Cell Therapeutics has manufactured clinical-grade cells that are needed for clinical study.

CellPryme to improve current and future cell therapy treatments

Prescient’s CellPryme technologies were created to address the limitations of CAR-T therapies, including production, durability, and efficacy.

The company’s portfolio includes CellPryme-M (cell manufacturing enhancement) and CellPryme-A (adjuvant for enhancing cell therapies). PTX highlights that these platforms are now ready and available for assessment by prospective commercial allies.

Prior to the reported period, CellPryme-A was introduced at a renowned international cell therapy conference.

PTX believes that CellPryme platforms would make way for potential licensing and commercial partnerships. The company has also achieved encouraging interactions so far.

As prospective commercial partners are eyeing enhancements in the currently available CAR-T treatments and new patient populations, the company has been focusing on increasing awareness of these programs. PTX says that it is targeting investors, global medical community, and the biotechnology industry.

Solid financial base

At the end of December quarter, PTX had a cash balance of AU$20.9 million. The company highlights that raising AU$11.3 million via a share purchase plan and a top-up placement has boosted its financial security amidst macroeconomic uncertainty. The company also received AU$1.6 million in tax refund for research & development activities from the government during the last quarter.

Investments directed towards research and development activities stood at AU$1.5 million.

Prescient highlights that it is backed by a strong financial base and global-leading partners. Moreover, the company is steered by a cohesive and experienced leadership team committed towards the development of assets that aim to address the unmet needs in the oncology space.

During the upcoming period, PTX will continue to progress its considerable pipeline in both targeted therapies, OmniCAR and CellPryme.

PTX shares were trading at AU$0.122 midday on 1 February 2023, up more than 2% from the last close.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10