Molekule Group (NASDAQ:MKUL) shareholders are up 13% this past week, but still in the red over the last year

Molekule Group, Inc. (NASDAQ:MKUL) shareholders should be happy to see the share price up 16% in the last month. But that is minimal compensation for the share price under-performance over the last year. In fact the stock is down 16% in the last year, well below the market return.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Molekule Group

SWOT Analysis for Molekule Group

- Debt is well covered by earnings.

- Balance sheet summary for MKUL.

- Shareholders have been diluted in the past year.

- MKUL's financial characteristics indicate limited near-term opportunities for shareholders.

- Debt is not well covered by operating cash flow.

- Has less than 3 years of cash runway based on current free cash flow.

- Is MKUL well equipped to handle threats?

Because Molekule Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Molekule Group increased its revenue by 1,275%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 16% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

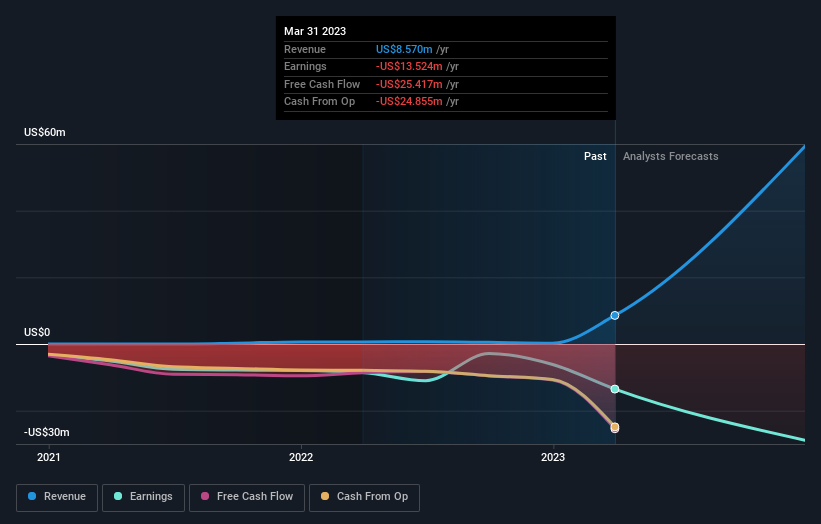

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Given that the market gained 0.8% in the last year, Molekule Group shareholders might be miffed that they lost 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Notably, the loss over the last year isn't as bad as the 19% drop in the last three months. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Molekule Group is showing 4 warning signs in our investment analysis , and 2 of those are a bit concerning...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

What are the risks and opportunities for Molekule Group?

NasdaqCM:MKUL

Molekule Group

Molekule Group, Inc., an interior space air purification technology company, provides air purification solutions for hospitals and other healthcare facilities.

Risks

Earnings have declined by 39.6% per year over past 5 years

Shareholders have been substantially diluted in the past year

Does not have a meaningful market cap ($67M)

Volatile share price over the past 3 months

Share Price

Market Cap

1Y Return

Further research onMolekule Group

ValuationFinancial HealthInsider TradingManagement TeamHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10