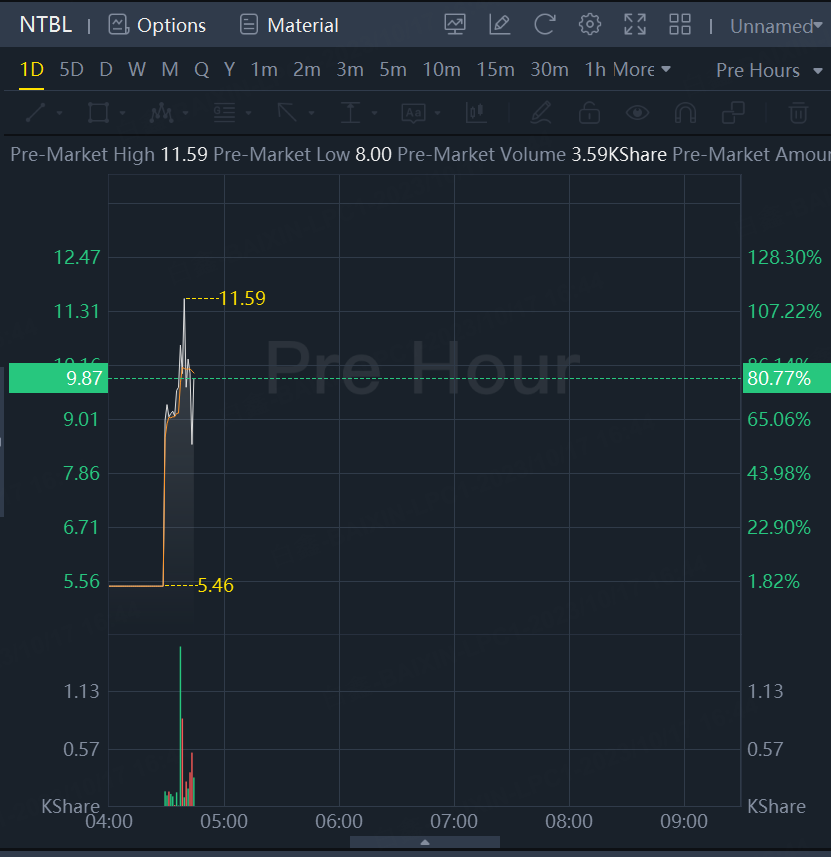

Notable Labs Shares Surged Over 80% after Closing Merger Transaction With VBL Therapeutics

Notable Labs, Inc. (“Notable”), a clinical stage therapeutic platform company developing predictive precision medicines for cancer patients, announced the completion of its merger transaction with VBL Therapeutics (“VBL”) (Nasdaq: VBLT) and associated financing.

Notable Labs shares surged over 80% on the news.

The combined company will focus on the advancement of Notable’s proprietary Predictive Precision Medicines Platform (“PPMP”) and therapeutic pipeline focused on cancer patients with high unmet medical needs while completing the development of Volasertib for the treatment of acute myeloid leukemia (“AML”) in platform-predicted responders as the flagship program. The ordinary shares of the combined company (renamed Notable Labs, Ltd.) are expected to commence trading on The Nasdaq Capital Market, on a 1-for-35 reverse split basis, under the ticker symbol “NTBL” and a new CUSIP number at the open of market trading on October 17, 2023.

“This is an important milestone for Notable as we continue to advance the demonstrated value of the PPMP,” said Thomas Bock, M.D., Chief Executive Officer of Notable. “The merger will add additional capital to accelerate our continued development of Volasertib for the treatment of AML in PPMP-predicted responding patients. As a publicly traded company, we will continue to evaluate potential additional programs and assets where PPMP is especially suited for risk-reducing and fast-tracking therapeutic development.”

With the completion of the merger transaction and $10.3 million in new capital invested prior to the closing by a healthtech-focused investor syndicate, including existing Notable stockholders Builders VC, B Capital Group, Y Combinator, First Round Capital, and Founders Fund, the combined company is now expected to be capitalized through multiple clinical milestones with a cash runway into 2025.

Notable’s PPMP combines multi-dimensional biological assays and machine learning to bio-simulate a patient’s cancer treatment and predict their clinical response to the actual treatment. Four clinical validation studies with recognized academic centers have demonstrated PPMP’s high predictive precision in identifying clinical responders before treatment. PPMP has guided Notable in the selection and development of two clinical-stage therapeutic candidates in platform-predicted responding patients with AML.

Notable’s lead asset derived from PPMP is Volasertib, a highly potent PLK1 inhibitor proven to induce cell cycle arrest and apoptosis in various cancer cells. Phase 2a results for Volasertib in adult AML are expected in 3Q 2024. Notable expects to use PPMP to identify, in-license, and fast-track additional undervalued assets as it builds out its development pipeline.

“I want to thank the entire Notable team for their commitment to our mission to save and improve the lives of cancer patients, as well as our shareholders for their support throughout the years,” remarked Prof. Dror Harats, M.D., Chief Executive Officer of VBL Therapeutics.

About the Merger Transaction and Reverse Share Split

The merger agreement was previously announced on February 23, 2023 with unanimous approval by the Board of Directors of each company. Under the terms of the agreement, Notable Labs, Inc. has merged with a wholly-owned Delaware subsidiary of VBL, and stockholders of Notable have received newly issued ordinary shares of VBL. Notable stockholders now own approximately 75% and VBL shareholders own approximately 25% of the combined company, in each case on a fully diluted basis as set forth in the merger agreement. Ordinary shares of the combined company are expected to commence trading on The Nasdaq Capital Market under the ticker symbol “NTBL” at the open of market trading on October 17. The combined company now has approximately 8,936,448 shares outstanding.

On October 16, 2023, prior to the closing of the merger, VBL completed a one-for-35 reverse share split. As a result of the reverse share split, every 35 ordinary shares of VBL, par value NIS 0.01 per share, outstanding immediately prior to the merger were combined and reclassified into one ordinary share, par value NIS 0.35 per share, of VBL. Any fractional shares in connection with the reverse share split were rounded up to the nearest whole share.

JMP Securities, A Citizens Company, served as exclusive financial advisor for Notable and Wiggin and Dana LLP and Meitar Law Offices served as legal counsel to Notable. Chardan served as exclusive financial advisor to VBL Therapeutics and Goodwin Procter LLP and Horn & Co. served as legal counsel to VBL Therapeutics.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10