Tsakos Energy Navigation Limited's (NYSE:TNP) Business And Shares Still Trailing The Industry

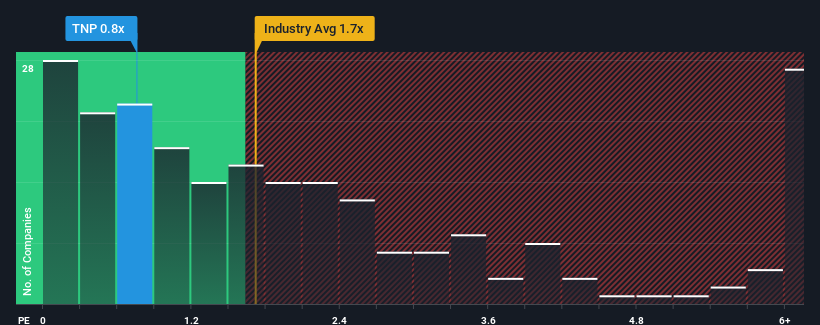

Tsakos Energy Navigation Limited's (NYSE:TNP) price-to-sales (or "P/S") ratio of 0.8x might make it look like a buy right now compared to the Oil and Gas industry in the United States, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Tsakos Energy Navigation

What Does Tsakos Energy Navigation's P/S Mean For Shareholders?

Tsakos Energy Navigation certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Tsakos Energy Navigation will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Tsakos Energy Navigation would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. The latest three year period has also seen an excellent 37% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 17% as estimated by the dual analysts watching the company. Meanwhile, the broader industry is forecast to expand by 2.8%, which paints a poor picture.

With this in consideration, we find it intriguing that Tsakos Energy Navigation's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Tsakos Energy Navigation's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Tsakos Energy Navigation's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Tsakos Energy Navigation has 4 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

What are the risks and opportunities for Tsakos Energy Navigation?

NYSE:TNP

Tsakos Energy Navigation

Tsakos Energy Navigation Limited provides seaborne crude oil and petroleum product transportation services worldwide.

Rewards

Trading at 49.9% below our estimate of its fair value

Earnings are forecast to grow 5.97% per year

Became profitable this year

Risks

Shareholders have been diluted in the past year

Large one-off items impacting financial results

Has a high level of debt

Share Price

Market Cap

1Y Return

Further research onTsakos Energy Navigation

ValuationFinancial HealthInsider TradingManagement TeamHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10