PZC: I Still Wouldn't Choose This Fund For Muni Exposure

- PZC has seen a modest loss since my last review, and I'm not too optimistic about its future prospects either.

- The fund's discount to NAV could look compelling, but it is actually narrow compared to sister funds from PIMCO.

- California munis have plenty of merit right now for high-income residents, but there are risks to state and local government finances if the economy sours.

Klaus Vedfelt

Main Thesis & Background

The purpose of this article is to evaluate the PIMCO California Municipal Income Fund III (NYSE:PZC) as an investment option at its current market price. The fund invests primarily in California municipal bonds, and therefore "seeks to provide current income which is exempt from federal and California income tax, as well as the alternative minimum tax".

It has been a while since I covered PZC, but my followers know I keep a close eye on PIMCO's CEFs because they tend to be quite volatile. This can open up buying and trading opportunities that it is worth keeping them on my radar. However, PZC has rarely tempted me, and this was true when I wrote about it back in 2023. At that point, I was reluctant to recommend it and I have been proven right in hindsight:

Fund Performance (Seeking Alpha)

However, I find myself with a fairly bullish outlook on municipal bonds as a whole - including those from California - so I thought it was time to do another review of this particular option. However, after some thought, the risk-reward dynamic still doesn't seem worth it to me. While PZC will benefit from a broad muni rally, I don't think investors will find much "alpha" with this CEF. Therefore, I am keeping my "hold" rating in place, and I will explain the reasoning behind this decision in greater detail below.

Discount Present, But Narrow Compared To Peers

As readers of my work know, I am always keenly focused on valuation when it comes to CEF investing. This is inclusive of muni funds, and any other CEF for that matter. CEFs can give the rare opportunity to let investors buy in to the securities at a discount to NAV - and also at a premium - so understanding the current valuation when deciding to buy is an important consideration. In this respect, PZC may seem like a slam-dunk. It trades at a fairly wide discount to NAV, over 7%.

So, what is the problem? To me, it is that relative valuation is also important. While PZC has a discount to NAV, this is not unique to California-focused muni funds from PIMCO. This makes comparisons quite easy to make, in this case it is PZC with its two sister funds: PIMCO California Municipal Income Fund (PCQ) and PIMCO California Municipal Income Fund II (PCK). At present, we can see that PZC's discount is actually the narrowest of the three:

| Fund (California Muni CEF from PIMCO) | Current Discount to NAV (8/26) |

| PZC | (7.52%) |

| PCQ | (9.78%) |

| PCK | (11.78%) |

The takeaway is an easy one. If one wants exposure to California munis, there are cheaper options out there. This includes even the funds within the PIMCO family! So it is difficult to justify why one would want to own a position in PZC at the moment when comparable funds can be had for a better value. This alone helps support why I am neutral on this CEF.

California Is Very Economically Sensitive

A second factor to keep in mind when looking at California-specific muni funds is that this state has a slightly different risk profile than many other states or jurisdictions that muni investors consider. Of course, for in-state residents, the tax savings could more than justify any concentration risk from owning this type of fund. I won't argue against that at all. But investors should still be aware of what some of the risks are and what to monitor going forward.

So what are some of these risks? One of the primary ones relevant to the state of California is where they get their tax revenues from. The state gets the bulk of its revenues from the taxes imposed on the wealthy - both in income taxes and capital gains taxes. But then it gets another significant chunk from sales and use taxes. The summation of this means the state is heavily reliant on a strong economy. When the market is up and incomes are rising, the state collects a significant windfall. Similarly, when consumers feel good about their personal finances, they spend, pumping up sales/use tax revenues. This helps California have one of the largest budgets in the nation that can be funded easily when times are good.

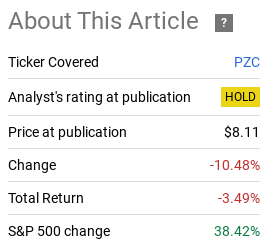

The challenge is when times are not "good". A softening market or broader economy puts a significant strain on the state's resources because income, capital gains, and sales taxes all decline. To see just how volatile revenues to the state can be from year to year, refer to the graphic below:

Percentage Change in Tax Receipts (California) (State of California Financial Report)

The point here is not to suggest that California is about to see a massive drop in revenue. That isn't my intention. But it is my intention to highlight how economically sensitive this state can be and how this concentration risk is a bit unique to owners of munis in this state in particular. Given that PZC focuses almost exclusively on California debt, this is a concern.

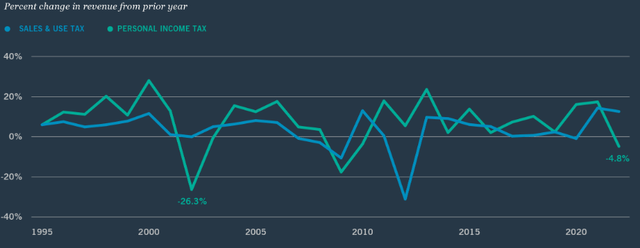

Further, almost 1/3 of the fund's assets are indeed backed by general tax reserves from state and local governments, so keep that in mind before you buy:

PZC's Sector Breakdown (PIMCO)

The ultimate takeaway for me is to understand the risks and weigh those against the benefit each individual receives from owning California munis. If you are high income and live in the state - the benefit probably outweighs the risk. But for those not in those categories, an upcoming recessionary cycle could be a reason to avoid too much concentration in this particular jurisdiction. Regardless, whichever decision you make, PZC may not be the best option to garner this exposure anyway.

Sector Performance Often Strong In Recession

While the tone so far in this review has been modest, I do want to point out some of the benefits of owning munis as a whole going forward. As mentioned, PZC has a pretty competitive yield and high income residents in California would see significant tax savings from owning it - or other comparable funds.

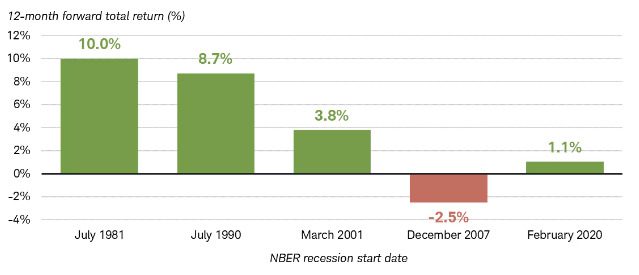

Beyond those investing in PZC or California specifically, there are other reasons to consider munis as a whole. This is especially true if we are going to see a recession in 2025, which some economists are indeed predicting. While a recession is rarely "positive", the good news is that munis actually tend to perform quite well during such a cycle. The reason is that munis - and fixed-income more broadly - tend to be a hedge against equities which falter during recessions. But munis are seen as a safer asset class, and investors like to rotate to income plays when recession fears bite.

But don't just take my word for it. History does the grunt work for us. If we look back at past recessionary cycles, we see the majority of the times munis do pump out positive returns - often quite strong returns!

Muni Sector Performance During Recessions (US) (Charles Schwab)

What I get from this is munis can often be an economic hedge and provide investors with not just income during tough times - but capital appreciation too. And isn't that really the name of the game - to get income while your investments also increase in value? I'd say so.

The net result is that investors can take some comfort in this sector if they are worried about economic volatility ahead. This is inclusive of PZC - which helps support my "hold" rating than one that is more bearish. I think this CEF has the potential to see gains going forward, I simply question if it is one of the best options with which to capitalize on this potential.

PZC's Income Metrics Another Mixed Bag

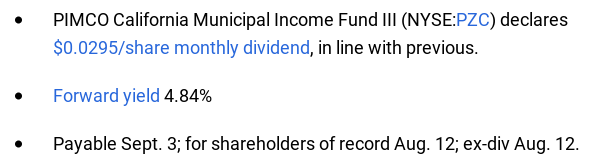

The last topic for this review that I will touch on is income production. On the surface, this is a big positive for PZC. The fund sports a yield near 5% and that results in a very strong after-tax yield for high income residents of California. That is certain to draw eyeballs to the fund, now and going forward:

Current Distribution (Seeking Alpha)

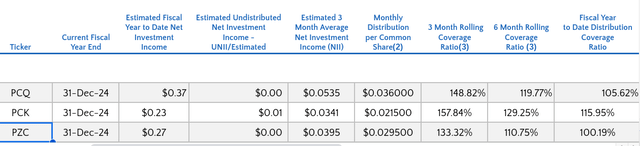

Of course, a high yield (whether before tax or after it) is not the only consideration. The sustainability of that yield is just as important. Fortunately, PZC looks set to continue this current distribution rate for now. Its current income production metrics suggest a lot of strength - with all the ratios over 100%. Importantly, the 3-month rolling coverage ratio comes in higher than the 6-month, showcasing improvement in the short term:

UNII Report - PIMCO's California Muni Funds (PIMCO)

All things considered, this is a pretty positive story for PZC. However, the reason why I called it a "mixed bag" at the onset of this paragraph has again to do with relativity. PZC's income metrics, while strong, are not as impressive as the other two PIMCO Cali CEFs. Both PCK and PCQ have income metrics that are excellent and best PZC at the moment.

Again, all this adds up to why one would favor PZC over its rivals. Both PCK and PCQ trade with larger discounts and have more impressive income metrics. It seems like a win-win for those funds, and it comes at the expense of PZC. This is why, despite how positive PZC's income story appears to be, I would still support a "hold" rating on it since better options seem to exist.

Bottom-line

PZC has performed underwhelming since my last article on it and while the future seems a bit brighter for the fund going forward, I simply see better value elsewhere. California-focused muni funds present unique risk - beyond just concentration risk - so selecting the right CEF to play this space is an important exercise. While the discount to NAV and the current yield are attractive, I see more attractive stories playing out elsewhere, including within the PIMCO family. As a result, I still believe "hold" is the correct rating for this fund. I would therefore urge my followers to approach any new positions very selectively at this time.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10