YMAX: Diversification Makes This Strategy Attractive

Richard Drury

Introduction

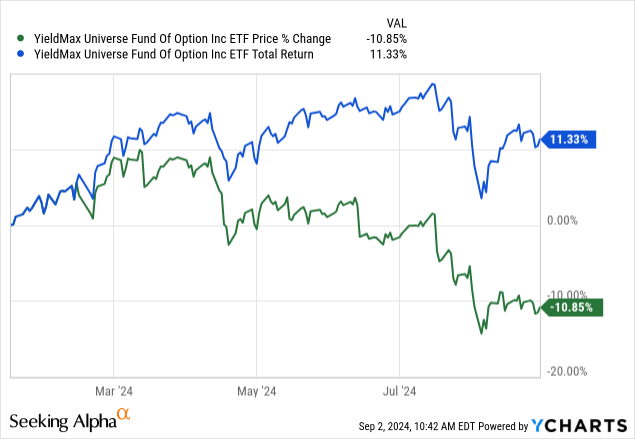

The YieldMax Universe Fund of Option Income ETFs (NYSEARCA:YMAX) is a fund-of-funds, in this case meaning an ETF that only owns other ETFs, that was launched by controversial ETF provider YieldMax in January earlier this year. Since it's launch, it has performed about as I have expected: it has returned positively in total return, but has lost in price.

The fund is an equal-weighted fund of all of YieldMax's option income style ETFs, which includes 22 YieldMax ETFs all held around 4-4.5% of assets.

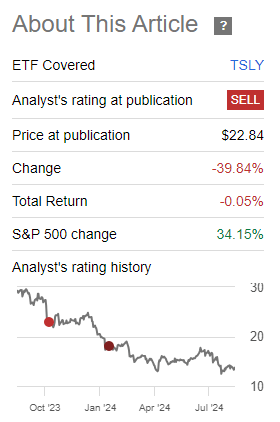

My regular readers will know that I am historically a YieldMax hater. I've written about a couple of their funds, none of which were positive in tone. In fact, my first Seeking Alpha article on a YieldMax fund was my first sell rating.

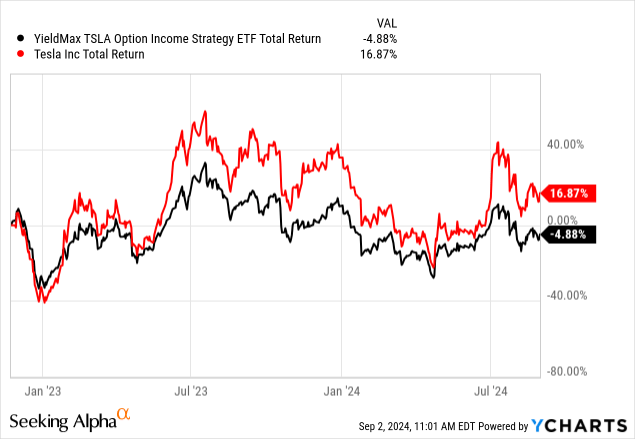

- 10/23/23 - TSLY: Income Investors Beware, A Potential Trap Awaits You With This ETF

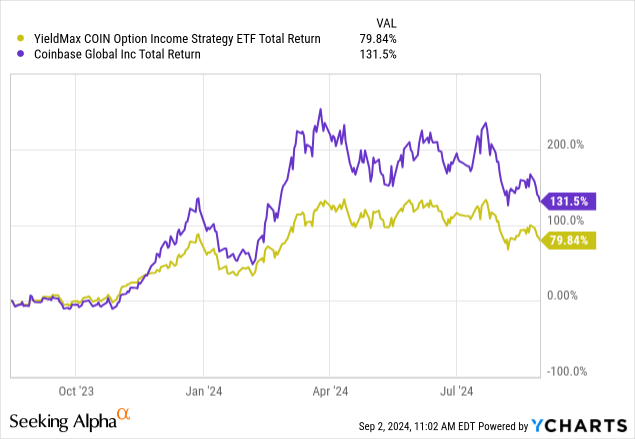

- 12/1/23 - YieldMax Strikes Out Again With CONY

- 2/1/24 - Revisiting YieldMax's TSLY And My Sell Rating (Downgrade)

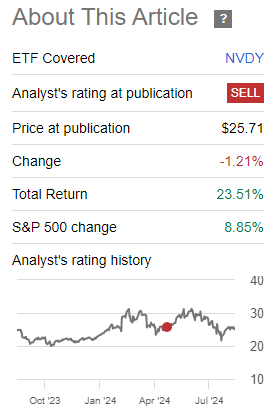

- 5/9/24 - NVDY: Close To Impressing Me, Risks Are Still Too Great

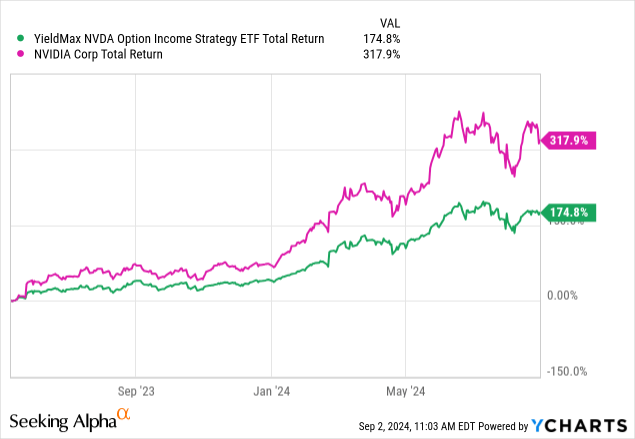

I have a mixed track record here, with my initial call and downgrade on the YieldMax TSLA Option Income Strategy ETF (TSLY) being a massive success and my YieldMax NVDA Option Income Strategy ETF (NVDY) being a failure.

Author's Initial Sell Rating for TSLY (Seeking Alpha) Author's Initial Sell Rating for NVDY (Seeking Alpha)

I am still bearish on these single-stock funds, and I encourage readers to go back and look over those articles, as the risks they discuss have not subsided despite outperformance.

While I have not changed my views on these ETFs as individuals, looking at YMAX as a fund-of-funds has given me a different perspective on the strategy. I believe that in this format, the strategy YieldMax is employing could be profitable for investors.

Fund Overview

Here are some of the defining attributes that investors may be interested in for YMAX:

The fund carries a management fee of 0.29%, but its underlying assets given it an acquired 0.99% additional fee. The gross ER for YMAX is 1.28%.

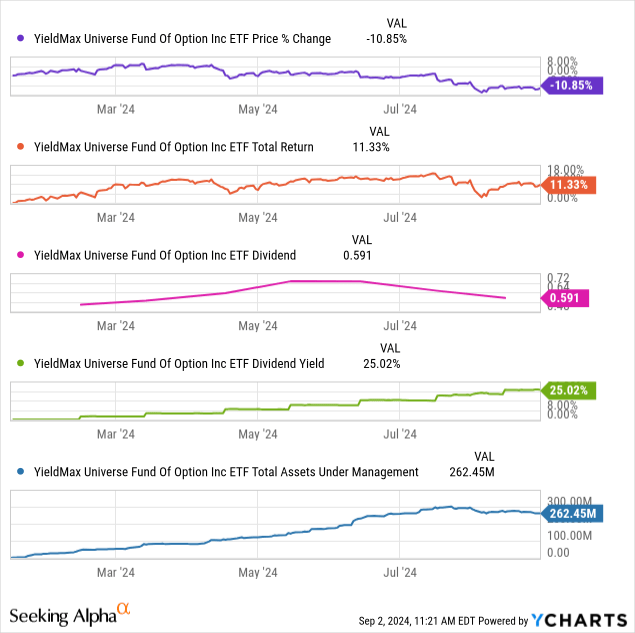

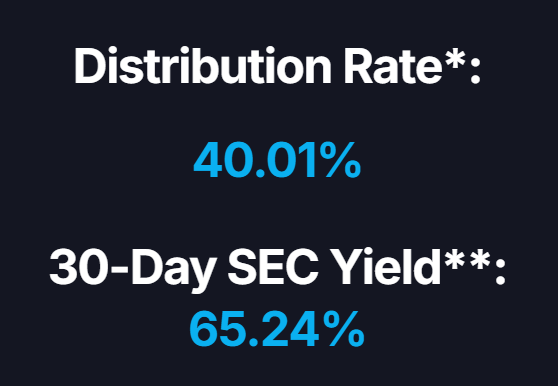

As per YieldMax, YMAX carries an incredible looking yield. I am including it below because YCharts calculates it far lower, as shown by the cactus colored line above.

YMAX Yield on 9/2/24 (YieldMax ETFs)

The major risk to most of the single-stock ETFs that I have covered in the past is simple: it relies on a single stock's performance. This is a major issue for most investors in these funds, who are happy to trade upside for income. YieldMax funds do not carry the same earning potential in price as the stocks they cover, since their upside is capped in order to produce income.

Underperforming the Underlying

In the past, the argument I've made in that investors are better off buying the stock itself and ignoring all of the options overlay entirely. I have been right on all accounts.

One thing that is common among all of these charts is that investors saw more volatile, but higher returns owning the stock over the YM ETF. Don't get me wrong, volatility is something I like in optionable instruments; I have been a very outspoken bull on short volatility strategies.

When there is a single point of failure in a short volatility strategy, tail risk is very high, and I find the strategy unattractive. However, because of how YMAX is built, no single stock can tank the fund and harm it in a freefall.

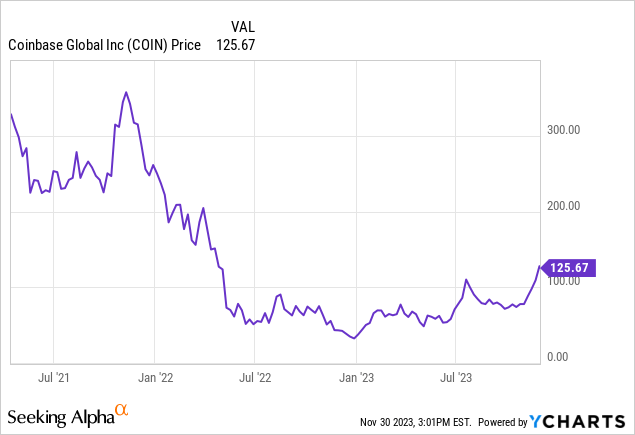

I demonstrated this risk in my CONY article, as COIN investors saw a drawdown of almost 90% from the IPO. This may have devastated CONY had it existed back then, and may have caused the fund to shutter.

COIN from IPO to 10/30/23 (YCharts)

Absent this concentration tail risk, I see a lot of potential to be short volatility on a select few stocks that YieldMax managers have identified as good targets for this strategy.

Risks

Capped Upside, but More Downside?

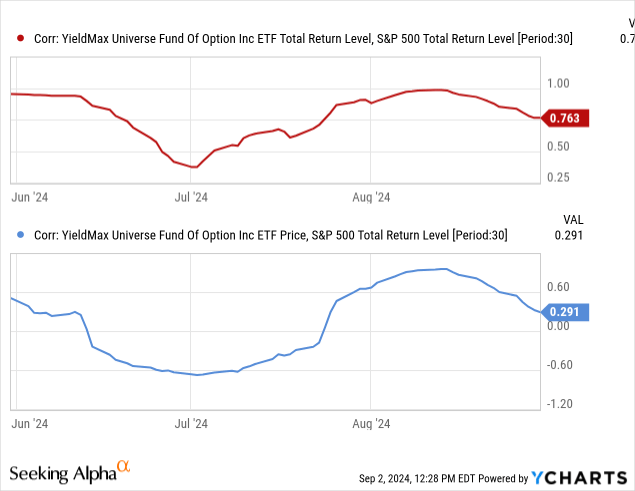

Spreading out the single-stock concentration risk has given YMAX a fairly high correlation to the return of US markets (the proxy for which I am using SPX), but only in the scope of its total return. Price return wise, we still see some weakness with YMAX.

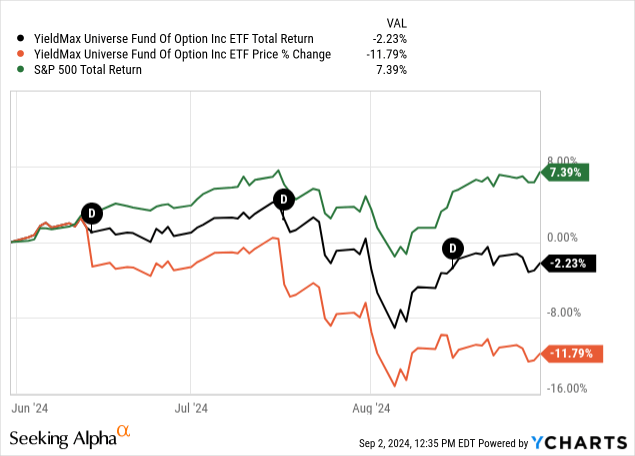

The weakness of YMAX underperforming a large cap equity index is unavoidable. The income strategy relies on a capped upside, meaning that the fund should always underperform in rising markets. It should, in theory, outperform in falling markets. However, looking at the last month's drawdown, that wasn't true. YMAX not only seems to have softer peaks, but deeper troughs. This is a red flag that investors should consider.

The first thing to notice is how the dividends soften YMAX's returns. The onyx line above factors dividends, and their distributes dates are displayed with the "D" icons.

The reason for this underperformance of US large caps is unknowable, as there are too many moving parts within YMAX funds. Here are some ideas I have:

- Individual single-stock YM funds trade intraday, meaning that their strategy is never consistent day to day, leading to underperformance.

- This could be due to bad timing on trades, since most of the trades in the funds are timed by managers and executed intraday.

- Individual single-stock YM funds are made of synthetic options positions instead of long stock, which are subject to significant Vega risk, which could cause losses even if the position is directionally correct.

Suitability

Who is this ETF for?

My answer to this question is surprisingly simple: I am giving it a buy rating because I feel like this strategy could have a place in most income-oriented portfolios.

For aggressive income investors, I recommend no allocation to any YieldMax individual fund, and instead only recommend up to a 5% allocation to YMAX. I would also recommend pairing this fund with a short volatility strategy targeting the VIX, like Simplify's Short Volatility Premium ETF (SVOL), which I've written about extensively. I have recommended a 15% allocation to SVOL in an income portfolio in the past; paired up, I would recommend a 1:2 allocation of YMAX to SVOL and an aggressive portfolio could reasonably hold up to 5% of assets in YMAX and 10% of assets in SVOL.

Conservative income investors should not invest in any YieldMax fund, period. They are fall too volatile for conservative investors, who are better off getting their equity premium exposure from less leveraged and less aggressive funds like JPMorgan's JEPI.

Conclusion

I have finally relented and seen the light; I will finally admit that YieldMax has offered something I could recommend to income-oriented investors.

The YieldMax Universe Fund of Option Income ETFs offers investors access to a uniquely managed short volatility strategy that does not suffer from the same extreme risks that have made me a hater of ETFs such as TSLY, CONY, and NVDY. YMAX is diversified across 22 funds, all held at equal weight, so that no one underlying stock's performance can significantly affect the fund's overall price or income by itself. This is a major boon for investors already interested in the strategies that the underlying funds use.

Investors should exercise caution still, as these funds have had a history of underperformance on both the up and downside of equity indices. Despite the promise of YieldMax funds delivering mammoth yields of 50%+, it may not pan out. For that reason, conservative investors are recommended to avoid this fund (and the company entirely for that matter), but aggressive investors are recommended up to a 5% stake for their income portfolios.

Thanks for reading.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10