IGPT: A High Fee Fund That Lacks The Right Holdings Mix

J Studios

Investment Thesis

Invesco AI and Next Gen Software ETF (NYSEARCA:IGPT) warrants a sell rating due to its current holdings mix, which will likely lag peer funds with similar objectives. While IGPT has a significant weight on Meta Platforms (META), which is poised to see strong returns from upcoming projects, the fund lacks other leading AI and next-gen software companies with promising returns. Additionally, IGPT has high fees and offers no dividend yield.

Fund Overview and Compared ETFs

IGPT is an ETF that seeks to track the STOXX World AC NexGen Software Development Index. Therefore, the fund seeks to capture holdings that directly benefit from AI and future software development. With its inception in 2005, the fund has 99 holdings and $370M in AUM. By sector, IGPT is heaviest in IT at 69%, followed by communication services at 19%. IGPT predominantly consists of large-cap holdings at 76% weight, but also includes mid-cap (20%), and small-cap (4%). The fund has 85% weight in U.S. companies.

For comparison purposes, other funds examined are Global X Artificial Intelligence & Technology ETF (AIQ), Invesco QQQ Trust ETF (QQQ), and Vanguard Communication Services Index Fund (VOX). AIQ has a similar sector breakdown as IGPT but is a more internationally diversified fund with just 68% weight in U.S. companies. Unlike IGPT, AIQ includes Microsoft (MSFT) and Apple (AAPL). QQQ tracks the Nasdaq-100 and therefore includes predominantly large and mega-cap U.S., IT companies with no small caps. VOX exclusively captures holdings within the communications services sector and has a similar holdings size mix as IGPT with a blend of large, mid, and small caps.

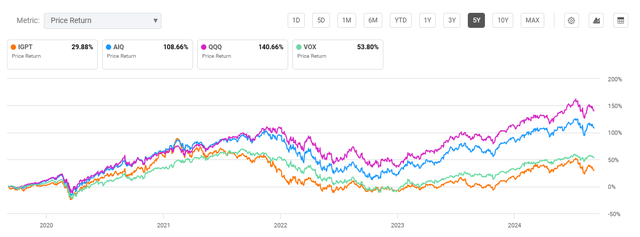

Funds Compared: Performance, Fees, and Dividends

IGPT has the worst average 5-year return of compared funds at 7.37%, significantly lower than AIQ, QQQ, and VOX at 17.42%, 20.56%, and 10.86%, respectively. A contributing factor to the underperformance of IGPT and VOX is their weight on META, which saw a decline of 75% between late 2021 and 2022. As a result, IGPT underperformed peers significantly in 2021 with an -11.7% return. However, VOX, also heavy on META, saw a 2021 performance of 13.83%. Therefore, while both VOX and IGPT have underperformed the S&P 500 Index over the past five years, IGPT's mix of holdings has caused the fund to lag historically. While these are rearward-looking metrics, there are multiple reasons to believe IGPT will continue lagging that I will cover in further detail later.

5-Year Total Price Return: IGPT and Compared ETFs (Seeking Alpha)

A key drawback of IGPT is its expense ratio compared to peer funds. At 0.58%, IGPT is noticeably more expensive than both QQQ and VOX. Another drawback is that IGPT offers no dividend yield. While all compared funds capture holdings that are growth-focused and offer low yields, IGPT's lack of dividends is a noteworthy drawback.

Expense Ratio, AUM, and Dividend Yield Comparison

IGPT | AIQ | QQQ | VOX | |

Expense Ratio | 0.58% | 0.68% | 0.20% | 0.10% |

AUM | $368.92M | $2.06B | $276.24B | $4.16B |

Dividend Yield TTM | N/A | 0.18% | 0.58% | 0.94% |

Dividend Growth 5 YR CAGR | N/A | -12.35% | 12.45% | 9.28% |

Source: Seeking Alpha, 5 Sep 24

IGPT Holdings and Key Outlook Factors

Almost 60% of IGPT's total weight is concentrated on its top 10 holdings. Led by META and Google (GOOGL), the fund shares similarities with Vanguard's VOX fund. Behind these communication services holdings are microchip companies like Advanced Micro Devices (AMD) and Nvidia (NVDA). As stated, IGPT also includes international holdings such as Keyence Corp (OTCPK:KYCCF) (TYO:6861), an electronic application company.

Top 10 Holdings for IGPT and Peer AI and Tech Funds

IGPT - 99 holdings | AIQ - 84 holdings | QQQ - 101 holdings | VOX - 117 holdings |

META- 9.00% | IBM - 3.45% | AAPL - 9.13% | META - 22.39% |

GOOGL - 7.96% | NOW - 3.40% | MSFT - 8.20% | GOOGL - 11.96% |

AMD - 7.59% | BABA - 3.38% | NVDA - 7.05% | GOOG - 9.16% |

NVDA - 7.39% | CSCO - 3.34% | AVGO - 4.97% | VZ - 4.46% |

ADBE - 6.21% | NFLX - 3.29% | AMZN - 4.86% | CMCSA - 4.33% |

ISRG - 5.70% | ADBE - 3.28% | META - 4.82% | NFLX - 4.23% |

QCOM - 5.46% | META - 3.27% | TSLA - 2.86% | DIS - 3.98% |

6861 JP - 3.70% | CAN - 3.24% | COST - 2.75% | T - 3.81% |

MU - 3.09% | 700 HK - 3.18% | GOOGL - 2.48% | TMUS - 2.92% |

INTC - 3.01% | ORCL - 3.06% | GOOG - 2.39% | CHTR - 1.75% |

Source: Multiple, compiled by author on 5 Sep 24

Examining IGPT's specific holdings, there are both strengths and weaknesses compared to peer funds. While META is poised to capture solid returns, other companies like AMD and Intel (INTC) have dimmer outlooks. Each of these outlook factors is discussed below.

META is Strongly Positioned in the AI Wearables Market

IGPT's outlook cannot be examined without considering the expected performance for META, the fund's top holding at 9% weight. While numerous mega-cap tech companies are investing heavily in artificial intelligence and future software, Meta's investments are producing tangible results. A clear example is its Ray-Ban smart glass, which comes with Meta's AI assistant and is equipped with a camera and microphone for voice activation.

Additionally, Meta is a leading contender in the wearable virtual reality device market. While Meta's Quest 3 has comparable features to Apple's Vision Pro, it has a much more affordable price at $499, compared to the Vision Pro at $3,500. Looking forward, META is working on Project Aria which is further accelerating augmented reality into glasses to further advance the user's experience with augmented reality.

Apple Vision Pro (left) compared to Meta's Quest 3 (right) (Scott Stein, CNET)

As a result of its competitive advantage in the wearables market, META has also seen strong fundamentals, including a net profit margin of 34% and YoY revenue growth of 24%. Despite a 45% YTD share price return, META's P/E ratio of 26.2 is on the lower end of big tech companies such as Apple, Microsoft, Amazon (AMZN), and NVDA.

A Giant Gap in The Fund Without Microsoft and Apple

Despite IGPT's inclusion of META, there is a hole in the fund without Microsoft and Apple. Given Microsoft's partnership with OpenAI and incorporation into Microsoft's Azure, IGPT's 0% weight on MSFT is a significant drawback. Microsoft has also recently expanded its partnership with Palantir (PLTR), driving increased revenue from AI applications in the Department of Defense. Microsoft has also commanded strong fundamentals including a 69.8% gross profit margin, 15.67% YoY revenue growth, and 35.9% net income margin.

IGPT's lack of Apple as a holding is also a downside. While Meta may have the competitive advantage in smart glasses, Apple is dominant in the smartwatch market. Additionally, Apple is looking to include Siri 2.0 into Apple's iOS 18, allowing users to have voice assistance. Therefore, despite IGPT's 9% weight in META, QQQ has an advantage over IGPT with its inclusion of Apple and Microsoft.

Dragged Down by AMD and Intel

IGPT is also dragged down by several laggards, including AMD and Intel. With fierce competition among chipmakers, AMD and Intel have seen weaker fundamentals. Despite an attempt to turn around its financials, Intel just failed a manufacturing test with Broadcom (AVGO). Intel's manufacturing process is known as 18A, which the company made central to its turnaround efforts. However, the process has been noted as not yet ready for mass production, negatively impacting Intel's profitability. Even with a turnaround, INTC is not expected to see a break-even point until 2027.

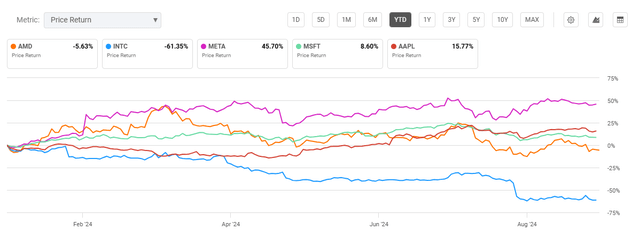

Year-to-Date Price Return for Large Tech and AI Companies (Seeking Alpha)

While AMD is on a stronger footing than Intel, its valuation is unattractive, with a price-to-earnings ratio over 100. Additionally, growth for the company has slowed, with a 6.4% YoY revenue growth and net income margin of just 5.8%. In contrast to IGPT, peer funds like QQQ have a much lower weight on INTC and AMD at just 0.59% and 1.54%, respectively.

Current Valuation

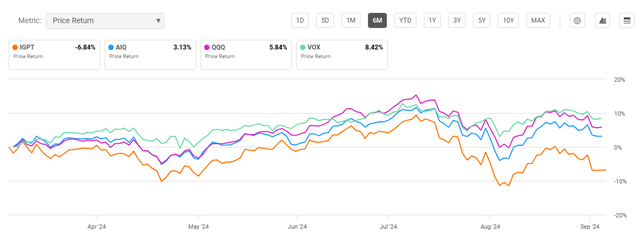

While META, GOOGL, and NVDA have seen strong returns for the fund, AMD, INTC, and Micron Technology (MU) have driven negative performance for IGPT over the past few months. As a result, IGPT has seen the worst six-month performance of peer funds. Given the weak prospects for AMD and INTC looking forward, peer funds QQQ and VOX have a stronger mix of holdings for performance.

Six Month Price Return: IGPT and Compared Tech and AI Funds (Seeking Alpha)

Despite having the worst performance of compared funds over the past six months, IGPT's current valuation does not warrant a compelling reason to buy. While QQQ has a higher P/E and P/B ratio than IGPT, its current holdings mix postures the fund for strong returns looking forward. Additionally, Vanguard's VOX fund also has a strong mix with a heavy weight on META and is attractively valued compared to IGPT.

Valuation Metrics for IGPT and Peer Competitors

IGPT | AIQ | QQQ | VOX | |

P/E ratio | 25.87 | 22.09 | 27.84 | 17.71 |

P/B ratio | 4.19 | 4.24 | 6.57 | 2.77 |

Source: Compiled by author from Morningstar.com, 5 Sep 24

Risks to Investors

In addition to the risk factors regarding IGPT's mix of holdings, the fund is also the most volatile compared to AIQ, QQQ, and VOX. Using standard deviation as a measure of volatility, IGPT's value of 23.4 is the highest of peer funds. In contrast, VOX is the least volatile at just 13.71.

Consumer sentiment is another risk factor for the AI industry. Surveys have shown that most consumers still have concerns about businesses using artificial intelligence, concerns about misinformation, and concerns about their information being collected. Despite these risk factors, artificial intelligence is expected to see staggering growth, with an expected annual growth rate of over 37% through 2030. Such growth is caused by a wide variety of sources, such as autonomous vehicles, government and military applications, and overall business productivity.

Concluding Summary

While IGPT offers diversification for investors seeking increased exposure to AI and next-generation software, the fund lacks a strong mix of holdings. Although Meta Platforms is expected to see strong growth due to its competitive advantage in AI wearables, IGPT's exclusion of MSFT and AAPL is a major drawback. The fund will also likely be dragged down by AMD's high valuation and Intel's manufacturing issues. Furthermore, IGPT has a high expense ratio at 0.58% while QQQ and VOX are more affordable. IGPT's valuation, as measured by its overall P/E ratio, also does not present a compelling reason to buy. As a result of these factors, QQQ and VOX both have a stronger performance outlook along with lower fees compared to IGPT.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10