BSTZ Continues To Outperform BST And Here's Why

Richard Drury/DigitalVision via Getty Images

Funds are generally unique. More often than not, an investment strives to deliver a unique value proposition to prospective investors, finding points of differentiation to attract interest. Sometimes, this value proposition centers around outperforming an underlying index. In other cases, funds will follow an index competing to deliver the lowest possible cost to shareholders, as is generally the case with asset managers like Vanguard and BlackRock (BLK).

In rare cases, there are funds with more subtle differentiators. These funds can even seem similar from a high level, needing a microscope to identify critical differences. This is the case with two closed end funds targeting the Technology sector, managed by BLK.

The BlackRock Science and Technology Trust (BST) is a closed end fund that launched in 2014. The fund is relatively simple, with no leverage and a portfolio of public and private technology investments. Most of the portfolio is allocated to publicly traded companies, with a small portion of the portfolio invested in private, venture capital investments in the technology sector. To generate additional income, BLK overlays covered calls on a portion of the publicly traded portfolio, generating income to support the fund’s monthly distribution.

Given the success of the sector, BST became an immediate fan favorite. Roughly five years after the launch of BST, BLK decided to launch a similar fund called the BlackRock Science and Technology Term Trust (NYSE:BSTZ). BSTZ is a similar fund, targeting the same sector. However, BSTZ has a more significant portion of its portfolio invested in private investments and other differentiators. This, combined with other contributing factors, caused BSTZ to significantly underperform BST in the post-Covid and rising interest rate era. However, the tides have since turned. Today, we will explore critical reasons why BSTZ has outperformed the older BST over the past year and may continue to do so.

Review Of Recent Coverage

This year, we have covered BST and BSTZ independently, providing comprehensive overviews of their portfolios, performance histories, distribution structures, and expenses. Today, we will be focusing on differences between the funds that have contributed to BSTZ’s outperformance of BST. Accordingly, below is a link to our most recent coverage of each fund independently, along with the corresponding rating at the time of publication.

- BST: Growth From Tech, Yield From Covered Calls, And Potential In The Private Sleeve - Hold

- BSTZ: Why This CEF Is Outperforming The Sector – Strong Buy

Our most recent coverage of BST was published nearly six months ago on March 22, 2024. Our analysis assigned BST a Hold rating. We pointed out that the fund had significant exposure to a handful of large capitalization technology names, such as Nvidia (NVDA). Additionally, a much smaller portion of the fund was allocated to private companies, leaving a smaller amount of potential valuation expansion.

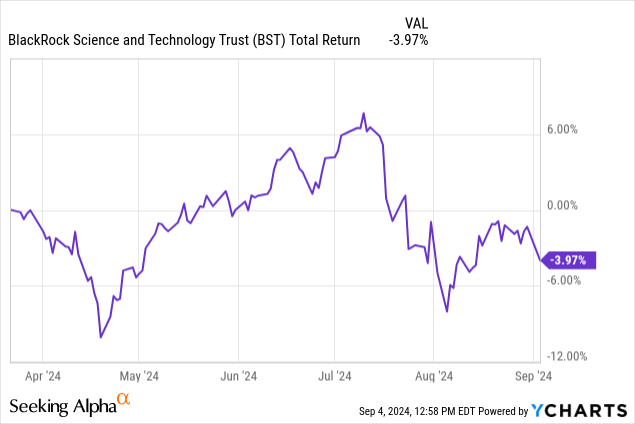

Since publication in March, BST’s total return has been negative.

Our most recent coverage of BSTZ was published on April 13, 2024. The fund was rated a Strong Buy on two specific catalysts. First and foremost, the expectation that the private investments would see increased liquidity as interest rates began to stabilize could provide a rising valuation tide. Additionally, the expectation that interest rates could soon fall would support a potential increase in M&A activity, supporting BSTZ’s larger allocation to private investments. The smaller secondary catalyst was the share repurchase program initiated to close the fund’s discount to net asset value.

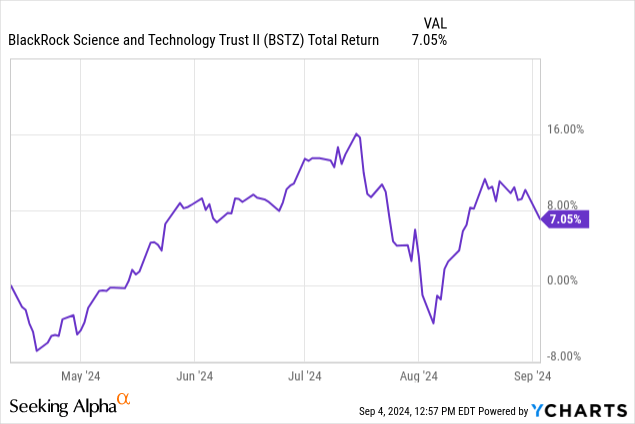

Since publication nearly five months ago, the fund has returned 7% assuming dividends were reinvested.

Why Is BSTZ Winning?

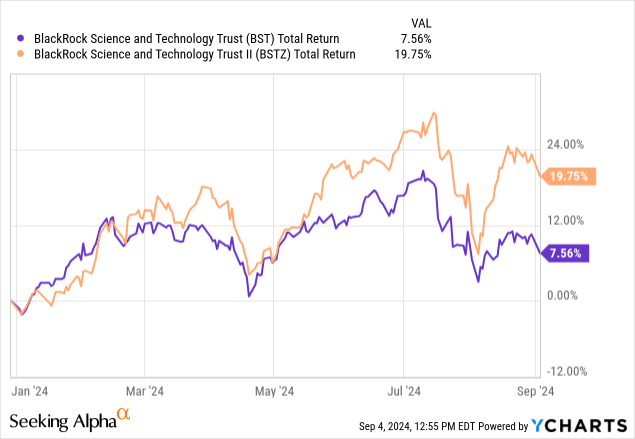

It is unusual for two funds with such similarities to have a significant divergence in short-term performance. With nearly 10% total return separating these funds over the past six months, it is important to understand what accounts for the difference. However, let’s first explore their performance comparison in greater detail.

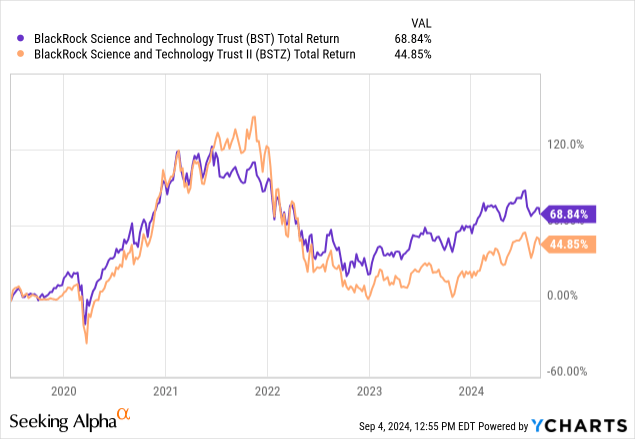

Year to date, BSTZ’s total return has been 19.8%, more than double BST’s return of 7.6%. The outperformance has been a reversal of long-term trends where BSTZ lagged BST and the sector at large. The outperformance has been welcomed by BSTZ shareholders, who have trailed significantly since BSTZ’s inception. Looking back to the date BSTZ launched, the fund has trailed the older BST by around 24%, delivering 45% and 69% to shareholders for BSTZ and BST, respectively.

In fact, at one point, BSTZ’s underperformance was significant enough for activist Saba Capital to get involved and attempt to displace BLK’s management team. Saba has looked to replace BLK’s management team on ten funds under allegations of “crushing shareholder rights.” The activist’s involvement precipitated several critical events for BSTZ which turned the tides.

First, the fund changed its distribution structure from a level distribution to a percentage of NAV. Initially, this was set at 6% of NAV per year, but subsequently increased to the current rate of 12% per year. More recently, the fund had a tender offer for up to 2.5% of outstanding shares at net asset value. This unlocked significant value for shareholders, given BSTZ has traded at a significant discount to net asset value or NAV. However, these changes are largely structural and would not impact the performance of BSTZ shares directly.

Instead, there are two critical pieces which account for BSTZ running ahead of BST in 2024.

Reason #1 - Closing Valuation Gap

Valuation plays a critical role in the pricing and performance of closed end funds. As readers might know, closed end funds, like both BST and BSTZ, trade independently of their net asset value or NAV. For those who are looking to learn more, Nuveen provides a concise explanation of fund valuation.

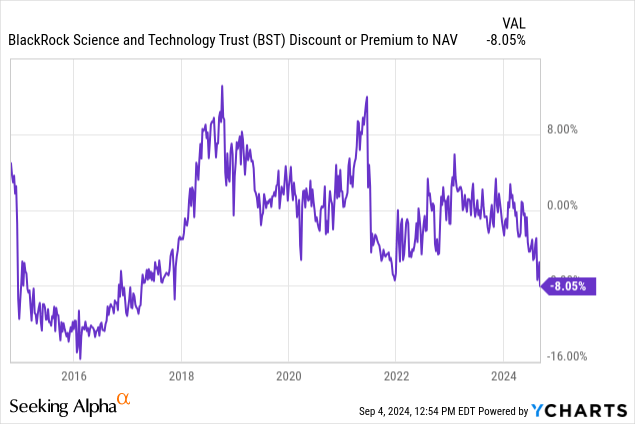

For these funds, valuation has played a significant role in their performance histories. More specifically, BSTZ has traded at a long-term discount to net asset value, which was responsible for a material portion of the fund’s underperformance during the period of rising interest rates. In contrast, BST’s price remained much closer to net asset value as investors selected the fund they believed was better prepared to face rising interest rates. However, as the tides turn, the valuation improvement has been responsible for a large portion of BSTZ’s outperformance.

First, let’s examine BST in greater detail. Since inception, BST has traded relatively close to net asset value. Pricing was initially elevated to a premium. However, price closed in on net asset value leading up to and following the pandemic.

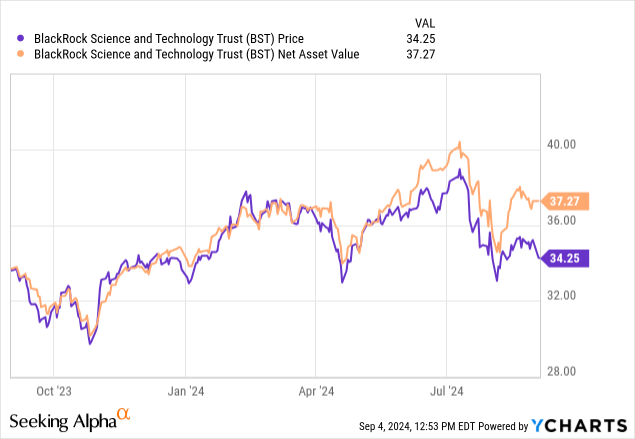

From 2023, BST has traded around net asset value. Over the past two years, shares of BST have traded within five percent of net asset value with few exceptions, as illustrated below. However, more recently, BST’s valuation has begun to shift. Since the start of 2024, shares of BST have begun to trade at a consistent discount to net asset value. Over the past three months, shares have remained near a discount of 4%.

The shift to a discount has negatively impacted total return for the fund. Although BST’s net asset value has remained relatively flat over the past six months, share price has declined by more than five percent. This change has a negative impact on shareholders whose shares of BST are underperforming the holdings of the fund.

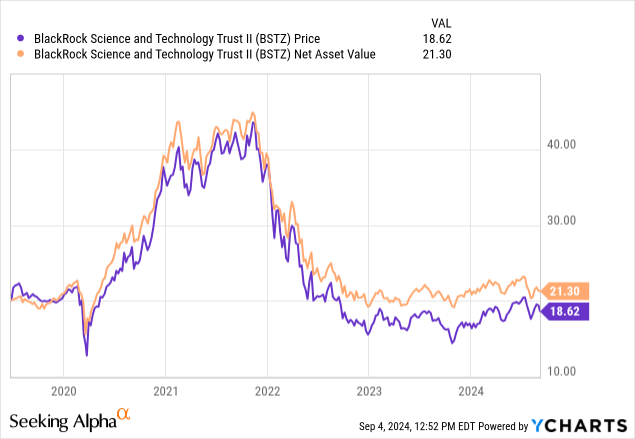

However, BSTZ shares have told a different story. As we mentioned, BSTZ has traded at a long-term discount. Launching just before the pandemic, BSTZ has been on a roller coaster ride, encountering rising interest rates soon after the pandemic subsided. As a result, BSTZ’s performance history looks more volatile than BST’s.

In fact, BSTZ shares have almost always traded at a discount to NAV. However, this phenomenon was less perceptible during the incredible bull run after the pandemic. Despite trading at a consistent discount, BSTZ’s performance was extraordinary, but short-lived. In 2022, the fund’s performance shifted significantly. The appreciation of price and net asset value collapsed, and the fund began to bleed. However, during this period, BSTZ’s discount became larger and much more perceptible. In 2023, BSTZ reached the deepest discount in the fund’s history, around 25% relative to net asset value. This point marked rock bottom in terms of relative performance of BSTZ and BST.

Since the start of the year, these two funds have exhibited the exact opposite pricing impacts. BST’s valuation has begun to price at a consistent discount to net asset value, currently hovering at a discount of around 5%. On the other hand, BSTZ’s valuation has begun to appreciate significantly, moving from a discount of 20% to the current discount of 8% over the course of the calendar year. Bear in mind, BSTZ’s valuation improvement of around 12% is around half of the fund’s 23% year to date return.

As the valuation gap continues to close between these two funds, there is room for additional improvement. BSTZ still trades at a deeper discount to net asset value than BST. As the valuation gap continues to improve, we should understand whether there is enough enthusiasm to support more upside.

Reason #2 - Private Investments Are Looking Brighter

As we have reiterated, BSTZ has a larger portion of its portfolio allocated to private companies. According to the fund’s website, BSTZ invests around a quarter of its total portfolio in investments that have not yet reached the public market. Currently, six of BSTZ’s top ten holdings are private. These positions account for a total of 23.9% of BSTZ’s total holdings. Currently, BST has no private investments in the fund’s top ten holdings. When interest rates were increasing, these illiquid securities created a significant drag on BSTZ’s portfolio, but the tables have since turned as the private equity markets begin to look more optimistic.

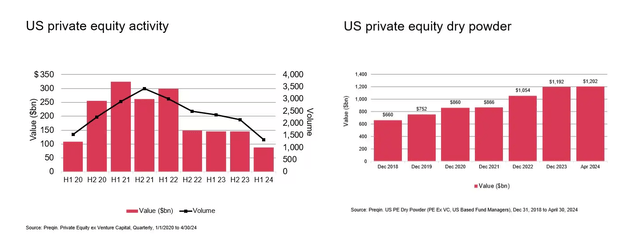

With a larger portion of the portfolio invested in venture-stage investments, BSTZ’s outlook was grim during the rising interest rate era. As borrowing costs increased, private investment activity declined. This was because capital became more expensive, which caused pricing to deteriorate from both sides of the table. This caused transaction volume to decline through 2023 and into 2024.

PWC

However, the decline in activity caused an accumulation of dry powder. Over the past three years, more than $300 billion in dry powder has amassed among large, institutional investors. While the outlook has remained pessimistic as the likelihood of returning to a zero interest rate environment seems low. However, some believe the likelihood of firms starting to deploy capital is improving.

Chances for private equity to chip away at the mountain of dry powder are improving, said Glenn Mincey, head of private equity for KPMG. Private equity-backed deal activity, running slower since inflation and interest rates spiked in 2022, ticked up in the first half of the year, raising hopes for continued improvement in the second half, Mincey said.

"When that deal market comes back, it will come back much more quickly and more robust than anticipated," Mincey predicted.

If the private markets pick up, it would benefit BSTZ more than BST. In the meantime, the shift has heralded some enthusiasm for BSTZ, contributing to the fund’s improving valuation.

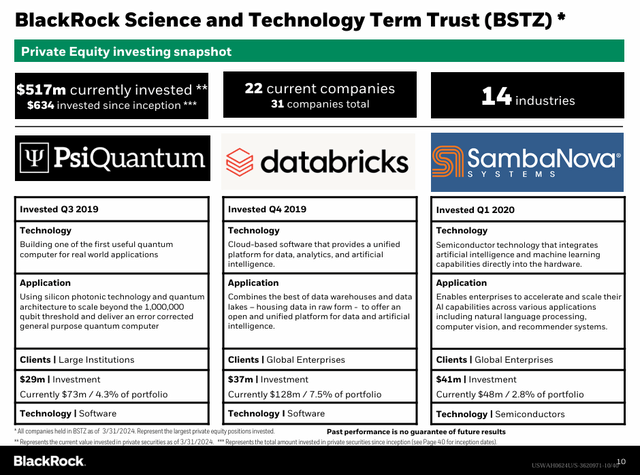

The investment in private and pre-public securities raises questions amongst BSTZ shareholders. BLK provides ongoing commentary for private investments that have received an investment. Most recently updated in Q1, it includes information of their investments including PsiQuantum which currently accounts for 4.3% of the portfolio.

BLK

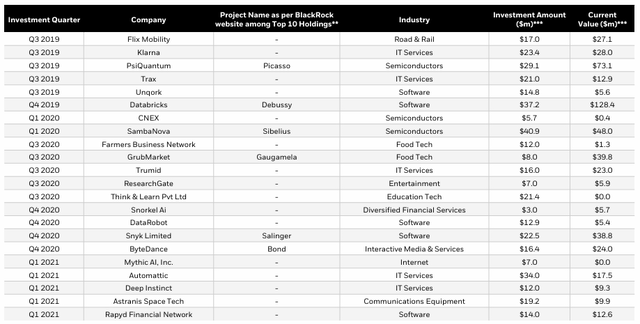

The presentation also includes data on all the fund’s private investments, including BSTZ’s basis and the estimated fair value of the investment. While many investments are currently valued at a loss, there have been some superstars. For example, one of the fund’s largest private investments is DataBricks, also known as Project Debussy. BSTZ’s basis of $37.2 million has reached a current value of over $125 million during the first quarter. Currently, BSTZ is invested in 22 private companies in 14 industries.

BLK

Conclusion

The past year has been an interesting saga for BST and BSTZ. Despite being similar in terms of sector allocation and overall strategy, a radically different story has unfolded for these two funds. As it stands today, BSTZ still has a brighter outlook than BST due to the optimistic outlook for the fund’s privately held investments. This means BSTZ still has one catalyst remaining to unfold, which could mean continuing outperformance of BST. For the time being, BST is still priced closer to net asset value and the fund holds a smaller portfolio of private investments than BSTZ. This earns BSTZ a Buy rating and BST a Hold rating.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10