BIZD: A Public Way To Access Private Credit

ryasick

We live in a unique time where you can make money from more than just typical blue chip dividend stocks. One area of the market that doesn't get much attention but has some solid income possibilities is the Business Development Companies (BDCs) space. These firms invest in small and medium-sized businesses. They offer debt, equity, or mixed financing to companies that might have trouble getting money through regular channels. BDCs focus on businesses with yearly sales between $10 million and $1 billion filling an important gap in the financial world. Besides money, BDCs often give management help and industry know-how to the companies they invest in. This leads to some unique ways they make income.

One fund that gives investors access to BDCs is the VanEck BDC Income ETF (NYSEARCA:BIZD). This fund tries to match the performance of the MVIS® US Business Development Companies Index. This index keeps track of how traded BDCs perform overall. The fund's main goal is to generate strong income. It does this by investing in BDCs that lend to or invest in private companies that have below investment grade ratings. This effectively lets investors get into private credit markets in a roundabout way through the public equities of these companies.

Holdings Analysis

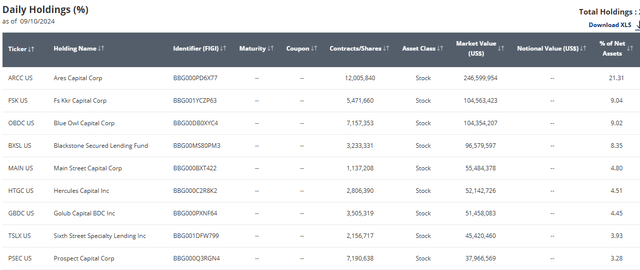

BIZD's portfolio consists of major players in the BDC field. The largest position makes up 21% of the fund, and as you can see it's a fairly top heavy fund overall.

vaneck.com

What do these companies do? Ares Capital Corporation (ARCC) gives flexible funding options to mid-sized firms across many industries. It focuses on debt and equity investments. FS KKR Capital Corp (FSK) offers tailored credit options to private mid-sized companies. It specializes in secured and unsecured debt investments. Blue Owl Capital Corporation (OBDC) lends and provides capital solutions to upper mid-sized companies. It focuses on senior secured loans. Blackstone Secured Lending Fund (BXSL) invests in first lien senior secured debt of private U.S. firms. It targets mid-sized businesses. And Main Street Capital Corporation (MAIN) gives long-term debt and equity capital to lower mid-sized companies and debt capital to mid-sized companies. It often takes a more hands-on approach with its portfolio companies.

Sector and Global Allocation

BIZD's sector makeup tilts toward financials, as it zeroes in on BDCs. This focus gives investors targeted access to the financial services industry the private credit market. While the fund backs U.S. companies, the businesses that BDCs finance might themselves have international exposure. This emphasis on financials means that BIZD reacts to interest rate shifts and economic swings, which can affect BDC performance and, in turn, the ETF itself. Still - that may not matter given that the 30-Day SEC Yield is 10.76%.

Peer Comparison

BIZD is not the only BDC focused fund out there. Another one that's got high yield is the Putnam BDC Income ETF (PBDC). This also focuses on BDC part of the marketplace. When we look at the price ratio of BIZD to PBDC, we find that BIZD has underperformed but seems to be finding a relative base. This appears to be more of a weighting issue as Ares in PBDC has half the exposure while still being the largest position in the fund.

stockcharts.com

Pros and Cons

On the positive side, the fund zeroes in on BDCs, which helps it rake in substantial income through dividends. This can be quite appealing when yields are low across the board. On top of that, BDCs give you a way to dip your toes into private credit markets. This means you're not just stuck with the usual stocks and bonds. Having this mix in your portfolio can boost your returns when the economy's humming along and private companies are doing well.

The downside? The fund's focus on the financial sector makes it vulnerable to economic slumps and changes in interest rates, which can affect how BDCs perform. Also, the high yields BDCs offer often come with more risk, as they put money into companies that are below investment grade or lack ratings. Investors should keep in mind the fund's expense ratio, which wraps in the fees of the underlying portfolios as well. Not unusual, but the total expense ratio factoring in the acquired fund fees is 13.33%.

Conclusion

Overall, the VanEck BDC Income ETF is an interesting fund for those looking for high yield and want access to private credit markets. Because it centers on BDCs, investors can gain from small and mid-sized business growth, while the high dividend yield gives a steady flow of income. I'd worry about private credit should we be entering a recession, so I may not want to consider an allocation right now, but I think it's worth considering down the line.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10