ROE: Solid But Thus-Far Ineffective Strategy

Dragon Claws

The Astoria US Equal Weight Quality Kings ETF (NASDAQ:ROE) is an actively and internally managed fund from Astoria Portfolio Advisors that was incepted a little over a year ago, at the end of July 2023. The 0.49% expense ratio falls right on the ETF median, and the fund holds roughly $140 million in equal-weighted assets across all major sectors.

Is the ROE ETF Worth It?

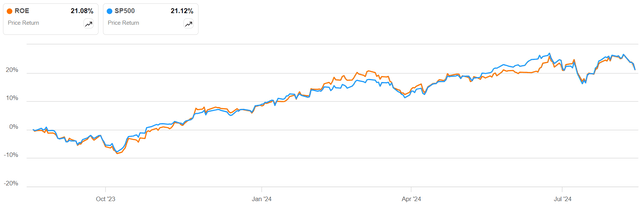

One of the things I'm ambiguous about with this ETF is the relatively high turnover of 23%. The ETF median is about 28%, so this is definitely below average, but the fact remains that the equal-weighted composition makes it hard to find the right picks and still stay within the margins of that equal-weight strategy. One good thing about such a strategy, though, is that it does eliminate a lot of the market cap bias that's inherent in major indices, allowing it to perform optimally in almost any type of market. Of course, the rebalancing is a key component of this performance, and I think Astoria's fund managers have done an excellent job tracking the broader market. Unfortunately, that's where the bullish thesis ends and takes a sharp turn.

To reiterate, the downside here is the lack of additional gains when following such a strategy. I've said this many times before, but it's worth noting again that the sheer 'bulk' of the Magnificent 7 in major indices like the (SP500) makes it difficult for other sectors to showcase their strengths whenever there's a major correction in the broader market. And that's exactly the case with ROE as well, with the result that it actually tracks SP500 very closely.

SA

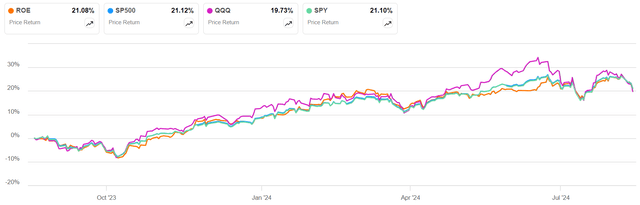

That's not a problem in and of itself, but it doesn't make you wonder why you'd need to pay someone to replicate broad-market returns when you can simply put your money into (SPY) for broader equity exposure, or even (QQQ) for that tech edge, even as the Mag 7 largely continue to beat analyst expectations quarter after quarter on both lines.

SA

To me, it doesn't make sense to piggyback on a strategy that doesn't generate alpha over a broader selection of cap-weighted equities. Sure, the 1.10% forward distribution yield adds a little on top, but not materially so.

Astoria ROE and SA Websites, Combined by Author

The real issue here seems to be the sector distribution, which is hardly different from that of the SPY. The stocks might be weighted equally within each sector, but the sector allocation is almost identical. So, without that sectoral advantage to offset any downturns in the top 4 or 5 segments, I don't expect any sort of outperformance. In a sense, ROE is simply a smaller version of SPY, with a fifth of its holdings but a similar allocation to sectors.

Is There Another ETF I Can Pair This With to Outperform the Market?

In order to identify the perfect 'foil' or pairing for this ETF, we need to identify the source of ROE's flat performance against the broader market. The clue is in the Mag 7 point I raised earlier, but it's worth digging into that aspect a little more.

The key consideration is that the Mag 7 makes up nearly 45% of the Nasdaq 100 (NDX) in terms of total capitalization, according to a report from Investors(.com). For (SPY), that's watered down to 31% because of the broader portfolio, but it's still nearly a third of total holdings.

The implication here is that these 7 companies tend to have an outsized effect on the movement of the overall market. If they drop, as many did over the course of the last two months, the entire market drops with them. It's as unavoidable as it is logical. Of course, that also means they lift the market when they rise.

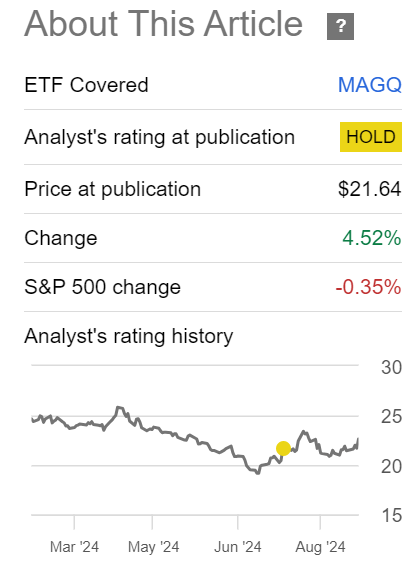

One way to counter their effects during market downturns, therefore, is to explore an ETF that is essentially short the Mag 7. A good example would be the Roundhill Daily Inverse Magnificent Seven ETF (MAGQ), which I covered in an article aptly called, "A Loss-Offset Play For When The Magnificent 7 Magic Fades" published here in July.

In that article, I showcased MAGQ's ability to deliver an inverse performance to the Mag 7. In other words, a collective move down by the Mag 7 of about 5% should push that ETF up by a similar percentage, which is exactly what happened.

Author's article on SA

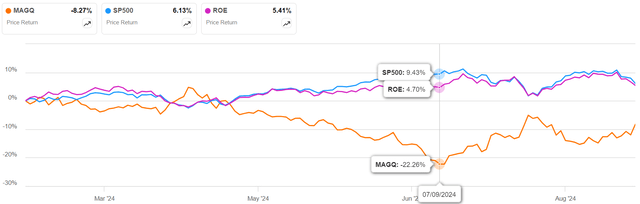

In effect, what this pairing strategy would do is to capture Mag 7's collective downside in the form of capital appreciation for the ETF. Since MAGQ doesn't offer leverage in a multiple higher than 1x, you'd need to weight your holdings of ROE and MAGQ equally, but you can't hold the latter for prolonged periods of time because it will eat up your NAV from the compounding effect of the inverse leverage and the daily rebalancing/reset. I've explained these risks in much greater detail in that article, so I encourage you to read it. It's important to be aware of material risks that you're exposed to when dealing with leveraged ETFs.

SA

You can see this happen when ROE (and, by proxy, the market), performs well - MAGQ will move down just as quickly or, as we see above, much more aggressively. It's equally aggressive when ROE moves down, which is where your alpha is being generated.

Therefore, you'll need to time your entry and exit points for MAGQ, and I've explained the mechanics and modality of how to do that in that July article, so I won't get into it here. Suffice it to say that there are technical indicators you can use as leading signal generators to time your entry and exit points. Doing so will allow you to take advantage of an ETF like ROE, but it will also help offset nearly any Mag-7-heavy basket of equities, including SPY and QQQ.

Should I Invest in ROE or Stick with Broad-market ETFs?

That's the real question here, isn't it? Although a pairing with MAGQ can let you generate alpha over your ROE holding, ROE itself doesn't offer any advantages over owning SPY or QQQ. ROE's yield of 1.1% (forward) doesn't compare favorably with SPY's 1.27%, for instance, nor does its 0.49% expense ratio against SPY's 0.09%.

Any minimal alpha that ROE might generate once market dynamics normalize to pre-pandemic times or the prolonged ZIRP era of the previous decade until 2016 or so is likely to be eaten up by management fees.

SA

As such, there's no way I can reasonably recommend buying this ETF, so I'm going with a Hold. I don't necessarily think that the fund's strategy is faulty in any way, to be clear, but if the fund managers at Astoria haven't been able to overcome the overwhelming effect of the Mag 7 with its sector-agnostic and cap-neutral approach across time-frames stretching back to a year ago, then I don't see that happening in the foreseeable future, either.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10