XDTE: Extracting S&P 500 Returns As Weekly Distributions

xavierarnau/E+ via Getty Images

Roundhill's S&P 500® 0DTE Covered Call Strategy ETF (BATS:XDTE) is one of the most exciting income fund launches in 2024. It's the only fund on the market currently selling 0 days-to-expiry (0DTE) options and paying a weekly distribution. And so far, the fund has shown good performance backed by a solid options strategy. Since its inception, it has actually outperformed the S&P 500 in total returns with a projected distribution rate of 25.93%, according to Roundhill Investments. Although its distributions have come with a cost of slight NAV erosion, the benefits outweigh the cost for many buy-and-hold investors, and thus, I rate XDTE a Buy.

The Misconception About 0DTE Options

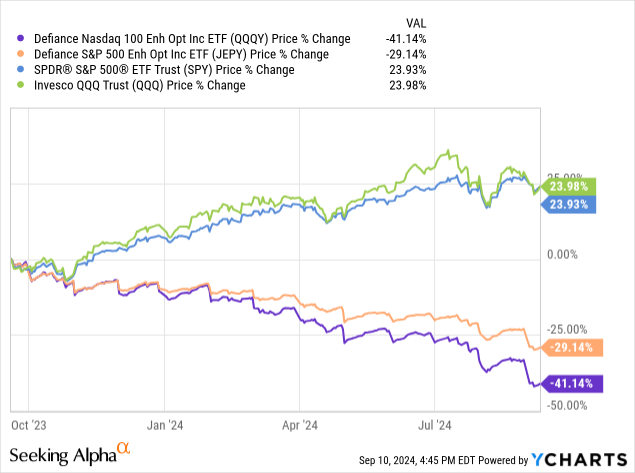

One misconception about 0DTE options is that they're riskier than monthly options. This is partly due to the performances of other funds, namely Defiance's QQQY and JEPY, which have suffered significant NAV decay, losing upwards of 30% in about a year.

However, QQQY and JEPY's NAV decay problem stems from their option strategy rather than the 0DTE options themselves. By selling aggressive at-the-money and in-the-money put options to reach an ambitious distribution rate of 0.25% minimum daily income, the funds are doomed to decay over time. This is not the case for XDTE and its 0DTE covered call options.

XDTE uses a much more conservative strategy than other covered call funds. The fund runs a synthetic covered call strategy that sells 0DTE call options on the S&P 500 via Flexible Exchange options® (“FLEX Options”) while mimicking a long position in the index by buying long call options on the S&P 500 far in-the-money. This strategy is more stable because it's less affected by time. Consider how much you can expect an index like the S&P 500 to move in one day versus one month. If you look at the historical data of the S&P 500's daily price changes in the last 50 years, you'll see that, on average, the price increases by 0.75% when only considering days with positive growth. In fact, in the past 11,276 tradable days, the S&P 500 only grew more than 1% 13.60% of the time. Compare this with the S&P 500's monthly price changes, where the S&P 500 rose more than 1% 52% of the time in the last 50 years and grew, on average, 3.48% when only considering months with positive growth. These numbers are significant when discussing XDTE because it sells calls out-of-the-money. Per an interview done on the Passive Income Investing YouTube channel with Roundhill Investment's CEO, Dave Mazza, Mazza confirmed that XDTE will adjust the moneyness of its options depending on market conditions, but they will always be out-of-the-money. This allows XDTE to operate with an extremely high win percentage with the idea of consistently generating small profits rather than inconsistently generating big ones. For reference, just selling fixed 1% out-of-the-money 0DTE calls on the S&P 500 would be a winning trade 86.4% of the time compared to 48% from 1% out-of-the-money monthly calls in the last 50 years.

That being said, the higher win percentage does not necessarily mean that 0DTE is always superior to monthly options. Both have their advantages and disadvantages. One advantage of monthly options is that they are worth much more. If your prediction is correct, you can generate significantly higher premiums than 0DTE, which can offset any paper losses on the asset when the options don't get exercised. On the other hand, out-of-the-money 0DTE call options rarely get exercised, but the small option premiums barely offset any losses to the underlying asset. As a result, XDTE's strategy closely follows the S&P 500 returns but pays them out as distributions rather than retaining the capital appreciation.

Matching the S&P 500's performance is why XDTE is appealing as an income investment for long-term buy-and-hold investors. Income is paid weekly, which makes it much easier for investors to manage cash flow, and it is currently rocking a forward double-digit yield.

Slight NAV Erosion And Other Risks

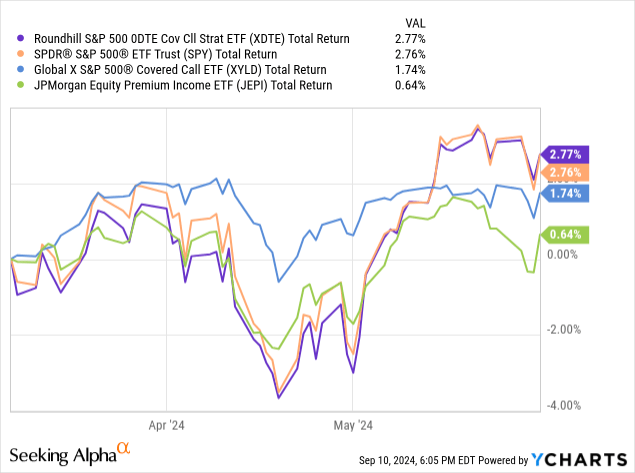

Of course, there are reasons why XDTE isn't more popular. Despite its outperformance so far, XDTE will likely underperform the S&P 500 over the long run due to inefficiencies, including management fees, options risk, and taxes if you buy this outside a tax-sheltered account. XDTE's 0.95% expense ratio is high when considering other funds like JEPI at 0.35% or S&P 500 index funds like VOO at 0.03%. It does not make sense to pay 0.95% if all you want is the S&P 500's performance. Keep in mind that 0DTE options barely protects you from any downside, if at all. Pay attention to how XDTE handles market dips compared to other funds like JEPI and XYLD:

In a bear market, XDTE will experience the same volatility levels as the S&P 500. This makes XDTE a less appealing choice if reducing volatility in your portfolio is one of your primary goals.

Options risk is also something you must consider, as the fund still runs the risk of having its contracts assigned. No system can predict market moves perfectly and XDTE still needs to write its calls close enough to the money to earn a meaningful distribution. When the market moves up enough, XDTE's upside is still capped like all other covered call funds. There hasn't been enough time to see how XDTE responds to different market conditions.

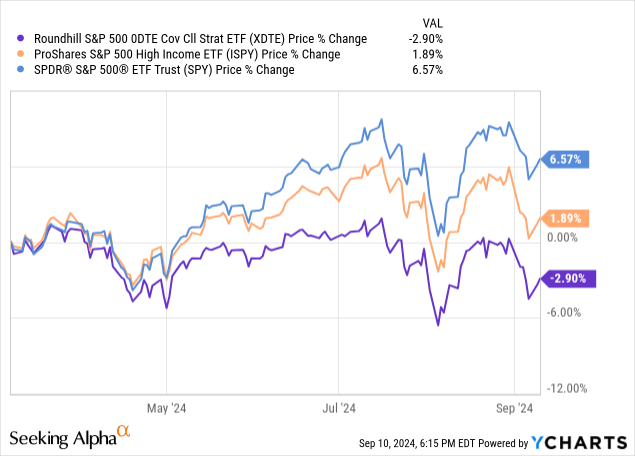

Additionally, XDTE has suffered some NAV erosion. When not considering distributions, XDTE is down 2.9% since its inception.

Fortunately, this problem can be neutralized by investing a portion of your distributions back into XDTE. Let's examine what happens if you reinvest half of your distributions.

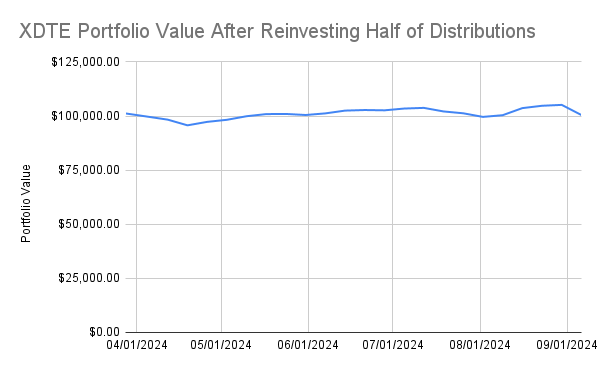

Chart From Author Chart From Author

If you bought $100K worth of XDTE at its inception date and reinvested half of your distributions on every distribution date (rounded down to the nearest whole share), the overall portfolio value would have remained steady with a current balance of $100,450.50 at the time of writing, and your total "take-home" distributions would be added up to $5734.96. If we project these distributions over the next 28 weeks, you would have an annual yield of approximately 12.4%.

These distributions are pretty tax-efficient for a covered call fund if you're not investing in a tax-sheltered account, too. By using index options that benefit from a 60/40 long-term and short-term capital gains tax treatment, XDTE can reduce the amount it pays compared to selling options on an index ETF such as SPY. Roundhill has also reported these distributions as ROC in their 19a1 notices, which means you're essentially deferring your taxes until your adjusted cost basis hits zero or when you sell the ETF. I would definitely consult a tax expert, though, to understand what's best for you.

Worth Looking Into As Buy-And-Hold Income Investors

Overall, however, XDTE has done well so far, and its strategy is fundamentally sound. It will likely match the S&P 500's performance over time, which is good news for buy-and-hold income investors who aren't particularly worried about volatility. The limited history can be a concern, but its weekly payouts and performance so far are worth putting in a small portion of your money if you're an income investor.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10