MPV: Hard To Justify A Premium On The Eve Of Interest Rate Cuts

alfexe

MassMutual Participation Investors (NYSE:MPV) (formerly Barings Participation Investors) is a closed-end fund that investors can purchase as a method of achieving a high level of income from the assets in their portfolios. As is the case with many income-oriented closed-end funds, this one primarily invests its assets in bonds. This has been generally a fairly attractive asset class to own ever since November of last year, as various market participants have been bidding up the price of both investment-grade and junk bonds out of optimism that the Federal Reserve will shortly begin reducing interest rates. However, that very same phenomenon has greatly reduced the attractiveness of bonds to new investors. As I discussed in a previous article, bond prices and yields are currently priced for every interest rate cut that is likely to occur over the next several years. Thus, there is very limited upside for bonds at this point, and interest rate cuts are unlikely to actually result in bonds increasing in price any further. With that said, though, this fund's current 9.10% yield should provide a reasonably attractive return for investors who purchase their shares in some sort of tax-advantaged account even without any more capital appreciation.

As just stated, MassMutual Participation Investors has a 9.10% yield at the current share price. This is a reasonable yield that compares pretty well to the fund's peers:

Fund Name | Morningstar Classification | Current Yield |

MassMutual Participation Investors | Fixed Income-Taxable-High Yield | 9.10% |

Allspring Income Opportunities Fund (EAD) | Fixed Income-Taxable-High Yield | 8.85% |

BNY Mellon High Yield Strategies Fund (DHF) | Fixed Income-Taxable-High Yield | 8.27% |

BlackRock Corporate High Yield Fund (HYT) | Fixed Income-Taxable-High Yield | 9.32% |

Credit Suisse Asset Management Income Fund (CIK) | Fixed Income-Taxable-High Yield | 8.82% |

PGIM High Yield Bond Fund (ISD) | Fixed Income-Taxable-High Yield | 9.10% |

We can clearly see here that MassMutual Participation Investors is not the highest-yielding junk bond fund around. This might reduce its appeal somewhat when compared to a few of its peers, but overall, this fund still manages to do better than numerous funds in the sector. It also manages to do quite a bit better than the 7.38% average yield-to-maturity of the Bloomberg High Yield Very Liquid Index:

State Street

As such, this fund looks to be a better option than a diversified junk bond index fund for income investors. The fact that its yield is not substantially higher than all of its peers might be disappointing, but this should also mean that the fund's current distribution is quite likely to be sustainable. As income investors, we generally like a fund's distribution to be sustainable because we do not like our incomes to be reduced.

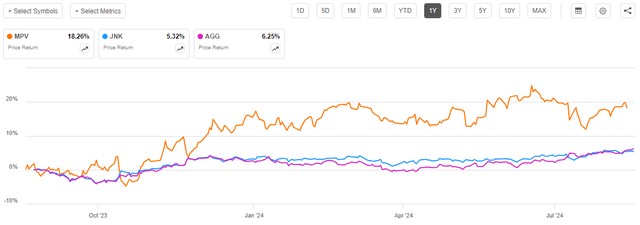

The recent performance of MassMutual Participation Investors has also been quite attractive. Over the past twelve months, the fund's share price has increased by 18.26%:

Seeking Alpha

As we can immediately see, this share price performance was substantially better than either the domestic junk bond index or the domestic investment-grade bond index (AGG). When we consider that this fund also has a substantially higher distribution yield than either of the two indices, it becomes immediately apparent that investors in the fund have been richly rewarded.

The fund's performance over the past five years has also been quite a bit better than the two major domestic bond indices:

Seeking Alpha

Admittedly, in this case, we still see that all three of these assets are down from their 2019 levels. Bonds in general have been a fairly terrible asset to hold over the past five years, which is mostly because of the monetary tightening policies that most central banks around the world have been forced to embark on as a result of the high levels of inflation that resulted from the enormous amount of money printing that went on during the COVID-19 pandemic. However, we can see that MassMutual Participation Investors overall experienced the smallest decline, which is due mostly to its rally over the past year. Prior to the trailing twelve-month period, the fund's share price was generally underperforming the indices.

However, it is important to note that the share price performance does not tell the whole story for a fund such as this. As I stated in a previous article:

A simple look at a closed-end fund's price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

When we include the distributions that were paid out by MassMutual Participation Investors as well as the coupons from the bonds included in the indices over the past five years, we get this alternative performance chart:

Seeking Alpha

This still looks very bad for either of the two bond indices, as even the 17.39% total return of the domestic junk bond index is nothing to be proud of when we consider that this chart covers an entire five-year period. MassMutual Participation Investors managed to do substantially better, though, as it handed its investors a 36.59% total return over the period. That is more than double what the junk bond index delivered and exponentially larger than investment-grade bonds managed. This is something that might appeal to some income investors since, after all, we all like to outperform the market indices. However, it still averages out to only 7.318% per year, which is less than what common equities deliver on average.

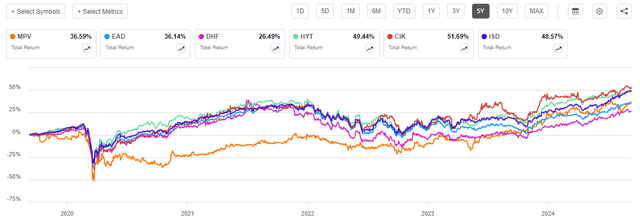

Unfortunately, MassMutual Participation Investors was not the best-performing fund out of its peer group over the trailing five-year period. This chart shows the total returns (distributions included) of each of the six peer funds shown in the first chart above:

Seeking Alpha

MassMutual Participation Investors was below the median of the peer group. It was the best-performing fund in the bottom half of the group, however. We do note that this fund exhibited considerably less volatility than its peers over the period, as it did not appreciate as much as its peers following the initial crash at the outbreak of the pandemic, and it also did not decline as much as its peers during the 2022 monetary tightening period. This low volatility may appeal to some potential investors, but its lower overall total return still works against it for anyone looking for an investment that they can buy and hold for the next several years.

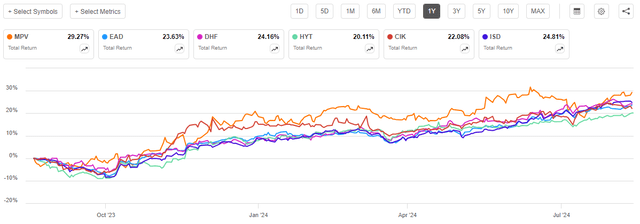

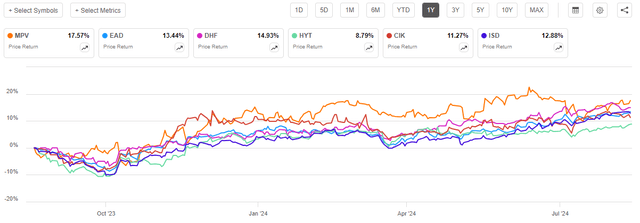

As we all know, though, past performance is no guarantee of future results. It is certainly possible for a fund's performance to improve substantially in one period compared to a previous period, as this fund did over the past year:

Seeking Alpha

As we can see, MassMutual Participation Investors was the top performer of its peer group over the trailing twelve-month period. As such, we should have a look at the fund's positioning today and the overall market fundamentals in order to determine how it might do in the future. The remainder of this article will focus on this task.

About The Fund

According to the fund's website, MassMutual Participation Investors has the primary objective of providing its investors with a very high level of total return. This is a fairly common objective for fixed-income funds, even if it does not make a lot of sense. This one does have a few aspects of its strategy that make the provision of total return a reasonable objective, though. The website describes the fund's strategy thusly:

First offered in 1988, Barings Participation Investors' investment objective is to maximize total return by providing a high level of current income, the potential for income growth and capital appreciation.

The principal investments are privately placed, below-investment-grade corporate debt obligations purchased directly from their issuers, which tend to be smaller companies domiciled in U.S. We also invest in publicly traded debt securities (including high yield) and in convertible preferred stocks and, subject to certain limitations, readily marketable equity securities. In addition to these equity securities, we may invest in high-quality, other readily marketable securities.

We manage the Fund on a total return basis and distribute substantially all of its net income to each year via quarterly dividends.

This description is of a rather unusual junk bond fund. We note here a few features that most other junk bond funds do not possess:

- The fund primarily invests in privately placed debt securities as opposed to publicly traded junk bonds.

- The fund specifically states that equities may be included in the fund's portfolio.

- The fund invests in convertible debt securities.

The majority of junk bond closed-end funds available on the market do not do any of these three things. The last two are also the reasons why a total return objective is appropriate for this fund, while it would not be appropriate for most junk bond funds. As I stated in a previous article:

Bonds by their very nature are income securities, as they do not deliver any net capital gains over their lifetimes. This makes sense, as an investor will purchase a bond at face value and receive face value back when the bond matures. The only investment return for a bond held over its entire lifetime is the coupon payments made to the bond's owner. Thus, bonds do not deliver capital appreciation over their lifetimes.

Thus, any fund that invests solely in traditional fixed-rate bonds (or floating-rate securities) should have a current income objective as opposed to total return. However, this one is different because of the inclusion of equities and convertible debt securities. Both of these have the ability to deliver net capital gains over their lifetimes and, as the fund's strategy description states, the fund intends to provide its investors with both current income and capital appreciation as components of total return. The inclusion of common equity and convertible bonds in the portfolio allows it to do that.

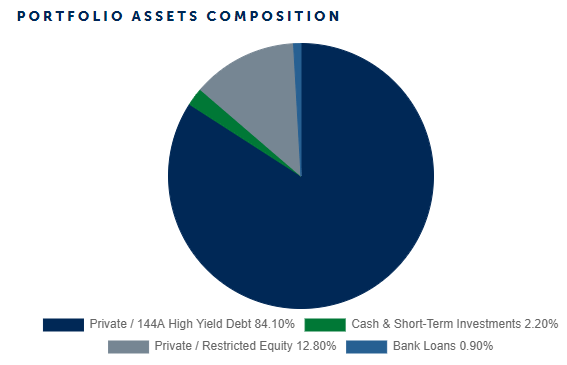

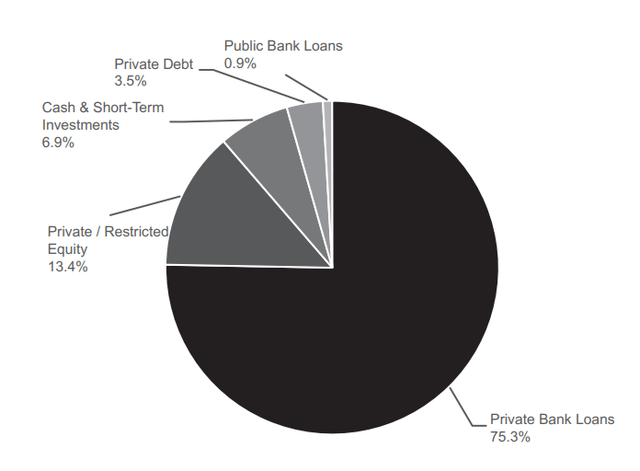

It does not appear that MassMutual Participation Investors is only investing in common stocks as an afterthought, either. The website provides the following asset allocation for the fund as of March 31, 2024:

MassMutual

I will admit that I would have preferred a more recent chart, as March 31, 2024, was more than five months ago. The fund provides that if we look at its financial filings, such as this one that details the fund's holdings as of June 30, 2024:

Asset Type | % of Net Assets |

Corporate Restricted Securities | 97.65% |

Bank Loans | 0.99% |

Commercial Paper | 4.15% |

The "corporate restricted securities" segment consists of common stock in privately held corporations, preferred stock of privately held corporations, as well as both traditional bonds and floating-rate securities issued by these securities. The fund's quarterly filing helpfully provides this graphic to break down what it currently holds by security type:

MPV Semi-Annual Report

This is without a doubt very different from most closed-end funds. The huge allocation to private bank loans, privately held equity, and private debt resembles a business development corporation much more than a closed-end fund. This should perhaps not really be a surprise considering that this is a fund sponsored by Barings, which is pretty well known for its business development company offerings. Barings' website describes it as a closed-end fund though, and a business development company is just a special form of closed-end fund anyway, so the distinction is really just one of semantics.

The fact that the overwhelming majority of this fund's assets are private securities creates some challenges. In particular, it is very difficult to accurately value them. There is no market for these securities, so the fund cannot just look at the share price or bond price and calculate the value of its holdings that way. Private equity analysts and managers will frequently rely on things such as discounted cash flow valuations and comparing the company to publicly traded firms engaged in similar business operations, but even that can be fraught with difficulty. For example, companies that are conducting private placements frequently do it because they do not have sufficient revenue (or any revenue), which means that a discounted cash flow valuation is going to rely on a lot of assumptions. I have performed such valuations for private family offices and private equity management companies, and it was very difficult to arrive at a concrete valuation in many cases. The actual valuation that I arrived at via the discounted cash flow varied to a very large extent on the assumptions that were used in the model. Thus, the value that privately held common equity held by this fund has in the net asset value might not bear any relationship to the value that the fund would actually get if it attempted to sell the securities.

Privately held debt, fortunately, is somewhat easier to value. As debt securities simply represent a series of payments made to the lender, a discounted cash flow analysis works just fine. These securities represent the majority of the fund's assets, which is probably a good thing for our purposes, since we always want to make sure that we will be paying an acceptable amount for the fund's assets.

As a result of all of this, though, there is no guarantee that the fund's reported net asset value represents anything close to what the fund would actually get if it were to sell its assets. In addition, the fact that the overwhelming majority of the fund's assets are privately held securities that do not trade on any exchange means that the fund's ability to actually realize capital gains to obtain money to pay out to the shareholders is quite limited. That appears to be baked into the share price, though, since the fund is trading with a yield that is very similar to other junk bond funds despite its promise to only pay out its net income (many other funds pay out both net income and capital gains). This actually might explain why this fund has had more share price appreciation than its peers over the past year:

Seeking Alpha

As the fund cannot easily realize capital gains, this means that it may be retaining more of its portfolio appreciation than its peers. Thus, it has less cash available to distribute. Of course, with that said, the fund does hold a higher proportion of its assets in cash and cash equivalents than some of its peers.

Leverage

As is the case with most closed-end funds, MassMutual Participation Investors employs leverage as a method of increasing the effective yield that it earns from the assets in its portfolio. I explained how this works in a number of previous articles on other closed-end funds. To paraphrase myself:

In short, Barings Participation Investors borrows money and then uses that borrowed money to purchase income-producing securities. As long as the purchased securities earn a higher total return than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to increase the effective yield of the portfolio. Barings Participation Investors is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will ordinarily be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage increases both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an unacceptable amount of risk. I generally do not like a fund's leverage to exceed a third as a percentage of assets for this reason.

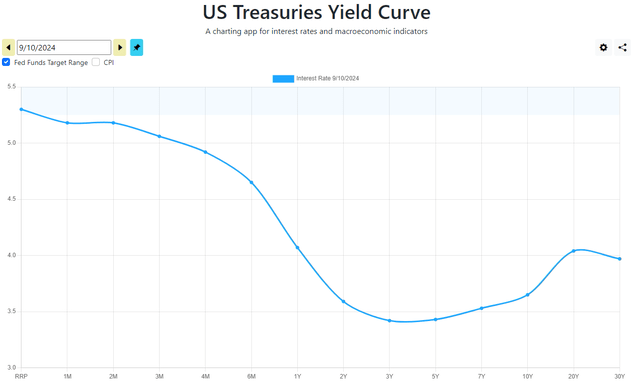

In some other articles, I have pointed out that leverage may not be as effective at boosting the returns of a portfolio today as it was a few years ago. However, this may not be true for this particular fund due to the nature of the assets in which it invests. The real problem with using leverage to purchase bonds occurs when the fund's borrowing rate is higher than the coupon yield provided by the bonds in the portfolio. This might be the case when short-term interest rates are higher than long-term interest rates, as has been the case for most of the past few years and still is today:

USTreasuryYieldCurve

Sometimes these funds will borrow money at short-term rates, such as the broker call rate. That rate is 7% today. That is barely lower than the average yield-to-maturity on the junk bond index right now, and it is higher than the yield that can be obtained from just about any investment-grade bond. Thus, it has been difficult for any bond fund that is borrowing short to actually make sufficient money from the coupons on the bonds in their portfolio to cover the interest rate on short-term debt. Not all funds borrow in this way, but some do and if they have not hedged their interest rate exposure, this situation has been problematic over the past two years.

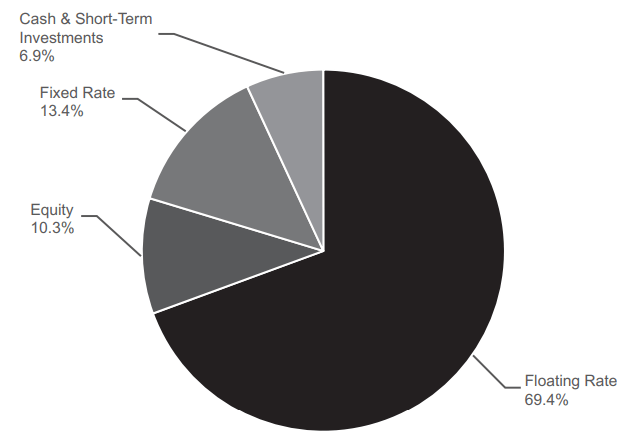

The majority of the securities held by MassMutual Participation Investors are floating-rate debt:

MPV Semi-Annual Report

The coupons made by floating-rate debt securities increase with short-term interest rates. Thus, when short-term interest rates go up, so do the yields of these securities. The spread on floating-rate bonds will normally be greater than the spread that the fund has to pay relative to the secured overnight financing rate. Thus, the fact that most of the fund's holdings are floating-rate bonds should allow this fund to not be as affected by unfavorable interest rate movements as other bond funds. Admittedly, that is not a problem today as short-term rates are expected to drop later this month, but it might be important if interest rates increase again in a few years.

MassMutual Participation Investors does not have an especially high level of leverage in any case. As of the time of writing, the fund has leveraged assets comprising 8.17% of its total portfolio. This is substantially lower than other junk bond funds, as we can see here:

Fund Name | Leverage Ratio |

MassMutual Participation Investors | 8.17% |

Allspring Income Opportunities Fund | 30.80% |

BNY Mellon High Yield Strategies Fund | 28.66% |

BlackRock Corporate High Yield Fund | 25.56% |

Credit Suisse Asset Management Income Fund | 24.90% |

PGIM High Yield Bond Fund | 20.50% |

(all figures from CEF Data)

As we can clearly see, MassMutual Participation Investors has a substantially lower level of leverage than most of its peers. This is probably a good thing, given the relative opacity of the fund's assets and their low liquidity. This fund cannot quickly raise money by selling some of the securities in its portfolio, as most other funds can.

Investors probably do not have to worry about the fund's leverage. It would take an enormous number of defaults for this fund to really run into trouble with its borrowings, and that seems unlikely given the sheer number of assets and diversification of the fund's portfolio.

Distribution Analysis

The primary objective of MassMutual Participation Investors is to provide its investors with a very high level of total return. However, the fund primarily invests its assets in bonds and other income-producing assets, and it outright states that it tries to pay out all of its net income to the shareholders via distributions. To this end, the fund pays a quarterly distribution of $0.37 per share ($1.48 per share annually). This gives the fund a respectable 9.10% yield at the current share price.

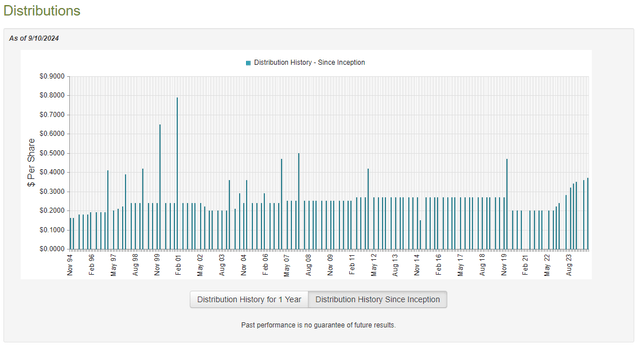

However, as we can see here, the fund has not been particularly consistent with respect to its distribution over the years:

CEF Connect

This lack of consistency might be something of a turn-off for those investors for whom the receipt of a steady income is a very high priority. This is a description that applies to many retirees and other income-focused investors. However, it does fit well with the fund's stated distribution policy, which is described in its most recent quarterly report:

The Trust records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. The Trust's net investment income dividend is declared four times per year. The Trust's net realized capital gain distribution, if any, is declared in December.

As this statement tells us, the fund basically just pays out its net investment income every quarter. As the net investment income could vary with interest rates or other factors, we can expect that this policy will result in a certain amount of distribution fluctuations.

Let us have a look at the fund's finances just to make sure that it is simply distributing its net income as it claims.

The most recent financial report for the fund is the semi-annual report that corresponds to the six-month period that ended on June 30, 2024. A link to this document was provided earlier in this article.

For the six-month period that ended on June 30, 2024, MassMutual Participation Investors received $9,799,051 of interest and $51,864 of dividends from the assets in its portfolio. When we combine this with a small amount of income from other sources, we see that the fund had a total investment income of $9,980,480 during the six-month period. The fund paid its expenses out of this amount, which left it with $7,869,483 available to the shareholders. The fund only distributed $3,824,072 during the period, so it was fully covered by net investment income.

We see the same thing for the full-year 2023 period. For that full-year period, MassMutual Participation Investors reported net investment income of $15,877,015, but it only paid out $13,676,193 in distributions. Thus, the end conclusion here is that the fund is indeed just paying out its net investment income.

The distribution is certainly not destructive to the fund's net investment value. However, it will vary significantly based on interest rates and other factors. In particular, the majority of the fund's holdings are floating-rate securities, so their yield directly depends on short-term interest rates. The Federal Reserve is expected to reduce short-term interest rates over the remainder of this year, so it seems likely that this fund's interest income will start to decline in short order. That could put some pressure on the fund's net investment income and potentially lead to a distribution decrease later this year or early next year.

Valuation

Shares of MassMutual Participation Investors are currently trading at a 3.80% premium to net asset value. This is in line with the 3.80% premium that the shares have had over the past month.

While the current price is in line with the fund's recent average, it seems unwise to purchase this fund at a premium right now. In particular, the prevalence of floating-rate securities in its portfolio seems very likely to result in declining distributions in the near future. If the fund were currently trading with a much higher yield than similar funds, that would be acceptable, but it is currently not. Thus, as of right now, it seems likely that either the fund's yield will decline, or its share price will once the distribution cuts occur. It is hard to justify paying a premium for any fund in that situation.

Conclusion

In conclusion, MassMutual Participation Investors is one of the more unique closed-end funds currently available in the market because of its substantial allocation to private credit and private equity securities. This makes it more difficult to value this fund than most because the assets themselves are illiquid and cannot be sold quickly. However, if the fund's estimates are reasonable, then this fund is currently trading at a premium on net asset value.

It is very hard to justify a premium for any fund that has more than half of its assets invested in floating-rate securities. This is especially true for this one because the low liquidity means that it cannot change its portfolio very easily. Once the Federal Reserve starts reducing interest rates, floating-rate coupons are going to start falling. This will almost certainly result in falling interest income for the fund along with a possible distribution reduction. It is hard to justify a premium for any fund that is facing a distribution cut.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10