VIG: Financials Exposure Is Not What You Might Expect - Sell Rating

lightkey

There's been varying opinions about the Vanguard Dividend Appreciation ETF (NYSEARCA:VIG) (MUTF:VDADX) recent independent analysis articles on this popular fund. Some articles assess the ETF as a standalone, while others compare it to the SPDR S&P ETF Trust (SPY), or dividend-focused alternatives such as the Schwab U.S. Dividend Equity ETF (SCHD); another highly trafficked ticker.

From among these, some analysts prefer SCHD due to its higher dividend, or SPY for its growth potential. Others favor VIG for its higher dividend growth in recent years.

I presented SCHD as a "reasonable hold" a couple of months ago, and VIG has some features that initially led me to favor it in the current climate. However, a more in-depth look at VIG has dispelled my early view of those advantages.

High-Level View of VIG

Vanguard's Dividend Appreciation ETF was formed in 2006, about 5 years before SCHD, and also commands an AUM about 20% higher with just over $80 billion in assets. Both of these funds carry an extremely low 0.06% management fee, versus 0.09% for the SPY, and so no investment decision here will be driven by fees.

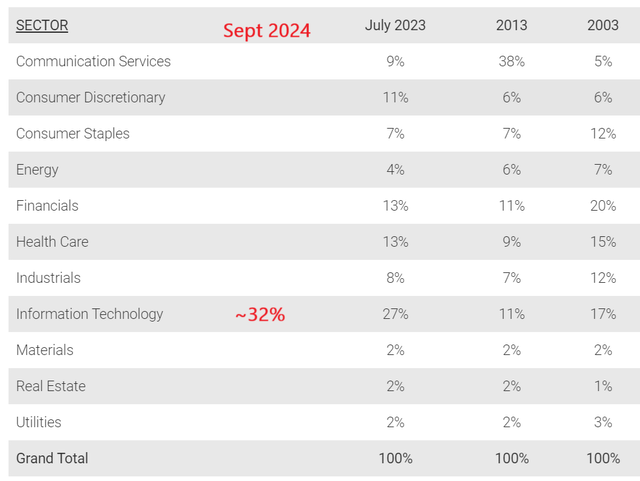

The SPY, consisting of many more growth names with higher valuations, carries a TTM P/E of about 27.5x, which I along with many others deem rather pricey. Those who have followed by work will know that I've been buying election protection on the indices. One of the things that keeps me away from buying the S&P 500 is its heavy dependency on further tech sector gains. Back in the day, investors needed to buy the Nasdaq composite or Nasdaq 100 to build a sizeable diversified exposure to information technology, but nowadays, that sector represents nearly 1/3 of the S&P 500.

einvestingforbeginners.com

(Source)

The nature of the S&P 500 has changed so drastically in recent decades. That's really helped create a successful marketplace for dividend-focused ETFs which more closely align with the S&P 500's historical sector allocation.

Let's review VIG more closely now, and contrast it with SCHD.

VIG basics

The first thing investors are certain to notice about VIG is that it pays a dividend yield (1.76% forward) only about 50% of what SCHD does; (3.45% forward). Yield chasers may run straight into the arms of SCHD for this reason, and this reason alone. But is it the smart choice?

Performance

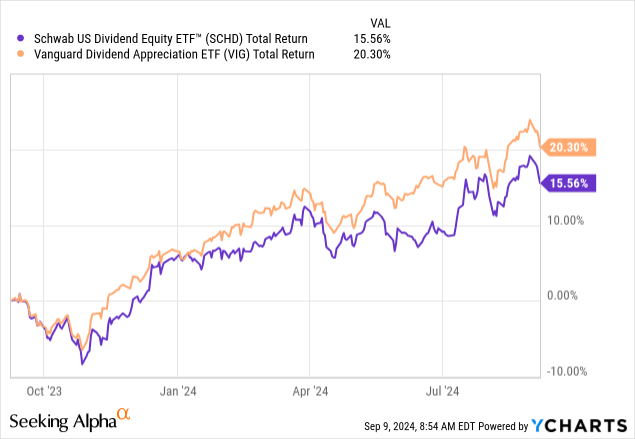

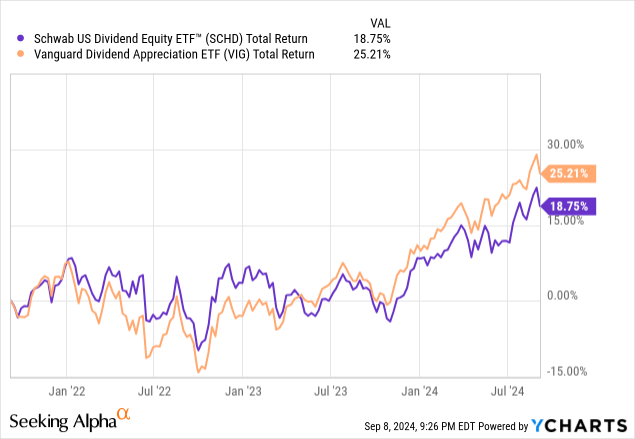

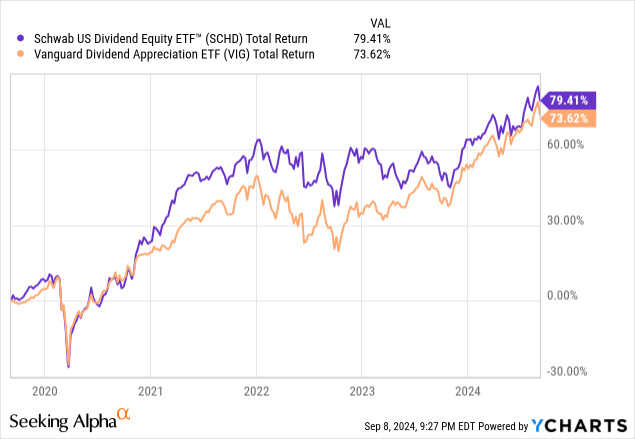

SCHD's price appreciation is disadvantaged from the lower dividend, so it's best to look at things on a total return basis. VIG is still the absolute performance winner here in recent years, although on a 5-year basis SCHD delivered better returns.

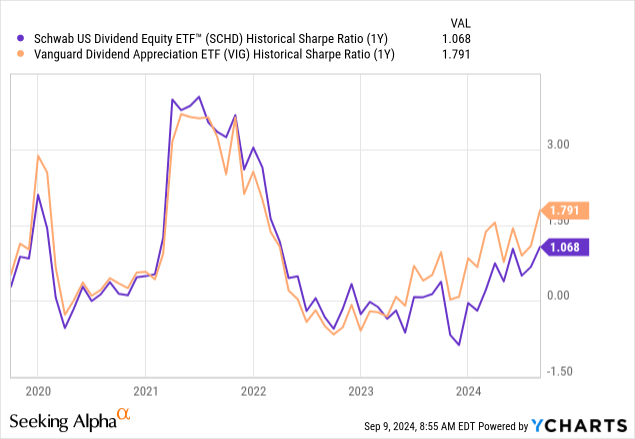

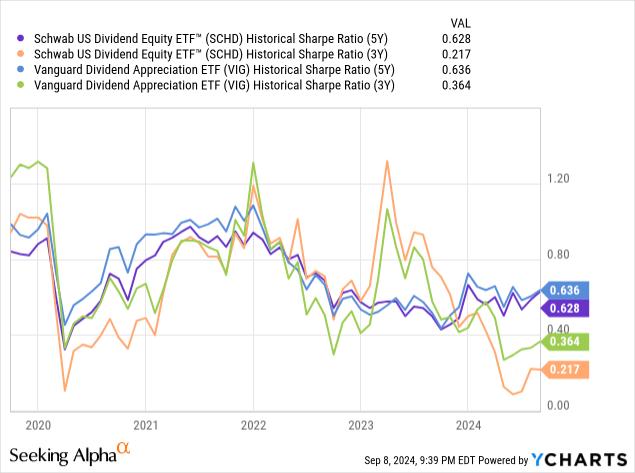

Out of curiosity, I wanted to take a look at the Sharpe ratio for these 2 ETFs. VIG has definitely posted the better Sharpe for 1-year, 3-year and 5-year periods ending today, but over history it's been a more mixed bag. There's no clear evidence either ETF is better than the other at consistently generating better risk-adjusted returns (on a standard deviation basis).

Performance Attribution

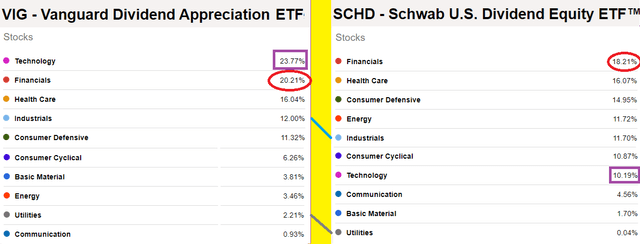

In looking at the sector allocation, investors would be quick to attribute VIG's excellent performance to its higher technology weighting. Obviously, the tech sector has been on fire, save for a few blips here and there.

author, using data from Seeking Alpha

But there's something else going on here below the surface, and it has to do with the Financials sector. Like many other investors, these days I'm not making many investment decisions without assessing interest rate exposure. I wasn't going to overlook that study here, even though the Financials sector weightings between VIG and SCHD look like a 'wash'.

But in fact, it isn't a wash at all.

Financials Sector Exposures

Banks

Although investors likely remember banks clamoring for higher interest rate environments during the days of ZIRP (zero interest rate policy), the period itself where rates are rising isn't actually beneficial for banks with a traditional balance sheet. In a rising interest rate environment, bank liabilities (customer deposits) will reset at those higher rates much sooner than bank assets (loans & mortgages) which are longer term in nature.

(Bank of America (BAC), for example, is one of the banks that has struggled with this in the latest rising-rate environment. Investors can read more about Bank of America's interest rate positioning here.)

That dynamic puts short-term pressure on banks' net interest margin when rates are rising, until the point where the rates stabilize at a higher level. At that point of stabilization, traditional banks can set and capitalize on greater interest rate spreads than they could when rates were lower (~ZIRP). That's positive.

What's further good news for banks, in the short-run, is when interest rates decline from those higher levels, allowing traditional banks to cut customer deposit rates lower before longer-term loans and mortgages come due. We're soon to enter this period, with the FOMC set to lower the Fed Funds Rate this month for the first time since the early months of the COVID-19 pandemic.

Insurance Companies

Insurance companies, whose stocks are classified as making part of the Financials sector, have very different exposures to interest rates. That's because, in their traditional business divisions, insurance companies hold longer-term liabilities (insurance payouts).

When interest rates are rising, insurance companies can increase the discount rate on those longer-term liabilities, resulting in lower PV (present value) of those liabilities. On the flip side, when interest rates are declining, the lower discount rates translate into increasing fair value of those liabilities.

Insurance operations are substantially much more complicated than what I've explained above, but for the sake of this article I wish to leave it at the basics.

VIG's Financial Sub-Sector Exposures

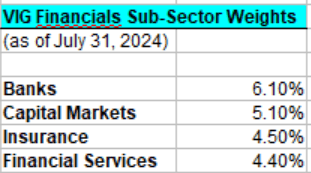

While VIG holds a Financials sector allocation of more than 20%, digging into the actual holdings revealed an exposure setup I wasn't anticipating.

author, using VIG holding information

I was astonished to see how little traditional banking exposure VIG carries, at least as of July 31, 2024 (which is the most recent full holdings file I could find). Furthermore, some of the benefits from declining interest rates seem likely to be offset from pressures on the insurance holdings.

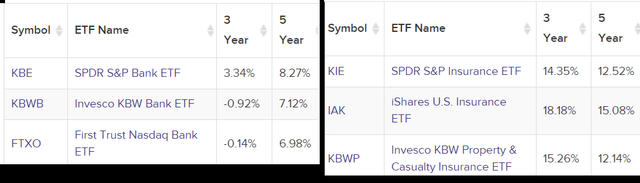

It's not surprising to see that the insurance sector has outperformed banks during interest rates' road higher, and the opposite will likely be true on the way back down.

etfdb.com

Meanwhile, by my manual count, more than 12% of SCHD's Financials sector weighting is allocated to banks, which should bode well for that ETF, at least compared to VIG in my opinion.

Conclusion

When I started researching the Vanguard Dividend Appreciation ETF, I was quite interested in the prospect of adding it to my portfolio. This is a fund that has performed well, after all, and appeared to hold substantial appeal in an environment of declining interest rates. I wasn't going to be thrilled about the 20%+ allocation to technology shares in a dividend fund, but the higher exposure to Financials, as well as Industrials and Utilities (other notable sectors that usually benefit from lower rates) as compared to peer SCHD looked enticing.

After drilling down a bit further, I've concluded that I have limited interest in buying VIG units in the current environment. VIG's very small exposure to banks, and larger-than expected exposure to insurance, serves as a detractor for me.

Risks

The main risk to my view, in my opinion, is a scenario where the economy crashes and financial institutions start taking on large amounts of credit losses. In such a scenario, the benefit of a declining interest rate environment for banks could be overwhelmed by those credit losses. I'm expecting a soft landing for the economy, but other investors might not.

Completely separately, if tech shares decide they're going to rally further, VIG could certainly outperform more traditionally weighted ETFs like SCHD and the iShares Core Dividend Growth ETF (DGRO).

As a final risk, banks are increasingly making use of derivatives to manipulate their traditional interest rate exposures, and thus some banks may realize artificially reduced benefits from a declining rate environment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10