VGK: Europe Earnings Growth Taking Hold

Klaus Vedfelt

There’s little doubt that macro troubles brew. Rising unemployment, softer GDP growth rates, and worries about consumer spending are not just US narratives put forward by the bears, but they are also issues overseas. In Europe, recent sentiment data has been weak while overall economic expectations are tempered.

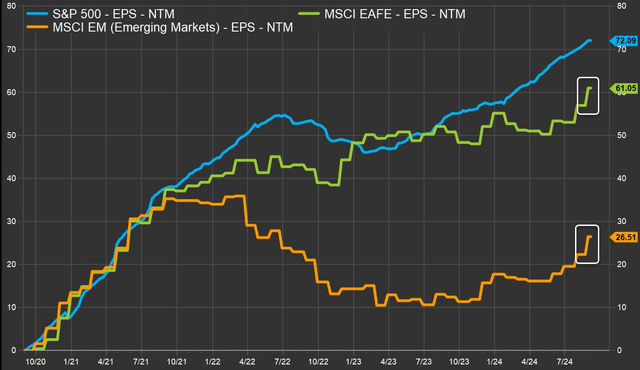

What’s on the rise, however, are corporate profit estimates. In fact, as of late August, according to FactSet, EPS forecasts outside of the US have been on the rise for just about all of this year. For EAFE, which encompasses most foreign developed markets outside of the US, the forward 12-month EPS outlook has never been as high. That means a lower price-to-earnings ratio for ex-US equities, including those in Europe.

I reiterate a buy rating on the Vanguard FTSE Europe ETF (NYSEARCA:VGK). The major international index ETF sports a modest valuation, rising earnings estimates, and a decent chart after a 12% total return so far in 2024.

Global EPS Forecasts Are on the Rise, Including EAFE and Europe

Matthew Miskin, FactSet

According to the issuer, VGK seeks to track the performance of the FTSE Developed Europe All Cap Index, which measures the investment return of stocks issued by companies located in the major markets of Europe. It holds shares of companies located in Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

VGK has grown in size since my previous analysis in Q4 of 2023. Total assets under management is now $26.3 billion, up about 15% from late last year. The index fund features an ultra-low 0.09% annual expense ratio and its forward dividend yield is more than twice that of the S&P 500 at 3.1% as of September 6, 2024. With high share-price momentum, evidenced by a B+ ETF Grade in that category by Seeking Alpha’s quantitative system, the fund should capture the appeal of near-term traders and long-term value investors.

The fund also scores generally well on risk metrics given its measured annualized historical volatility trends and a diversified portfolio. Finally, liquidity is very strong with VGK given high volume, averaging almost two million shares daily and a median 30-day bid/ask spread of just a single basis point, per Vanguard.

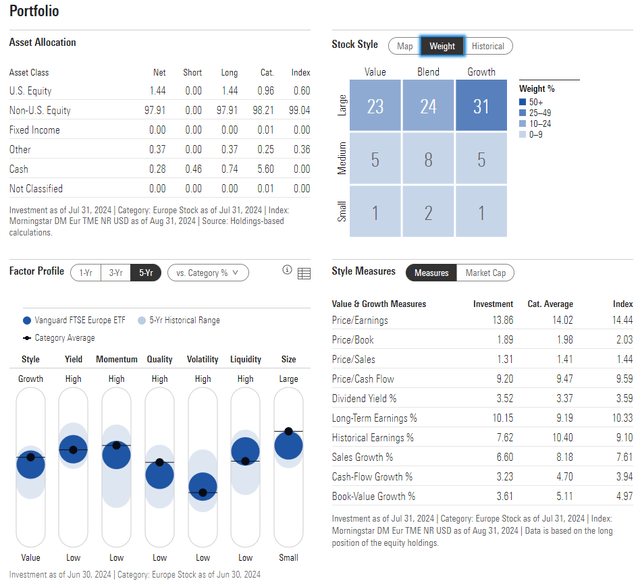

Looking deeper into the allocation, the 4-star, Gold-rated ETF by Morningstar plots along the top row of the style box, indicating its bent to large caps, though there is a material SMID-cap exposure. The asset mix has not shifted much since late 2023, though there is more growth access today compared to then. The fund’s P/E multiple has expanded by about 2.7 figures since last December, but with a still-solid 10.2% long-term EPS growth rate, the resulting PEG ratio is compelling.

VGK: Portfolio & Factor Profiles

Morningstar

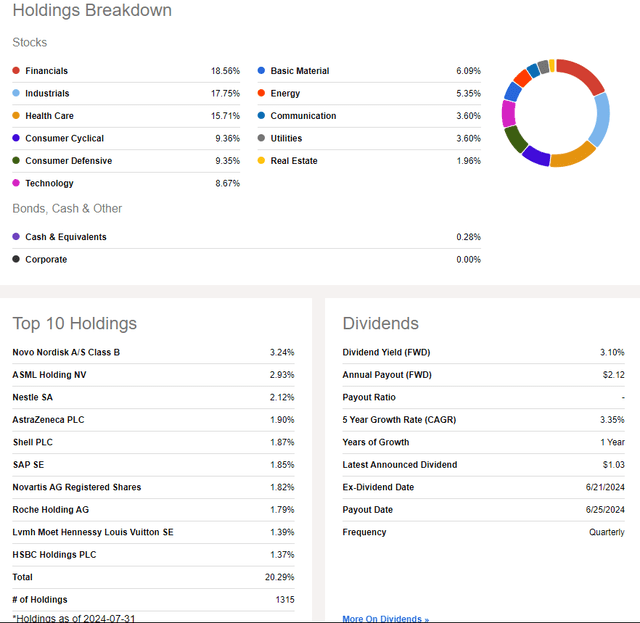

I also continue to favor VGK’s sector breakout. Three areas – Financials, Industrials, and Health Care – command about 50% of the ETF, but that’s much less concentrated versus the SPX’s high 30% weight to the Information Technology space.

Moreover, the largest single position is just 3.2%, another sign of much less top-heaviness. Unfortunately, VGK has not benefitted much from relative strength in Real Estate and Utilities in the past two months.

VGK: A Diversified, High-Yield Regional Index ETF

Seeking Alpha

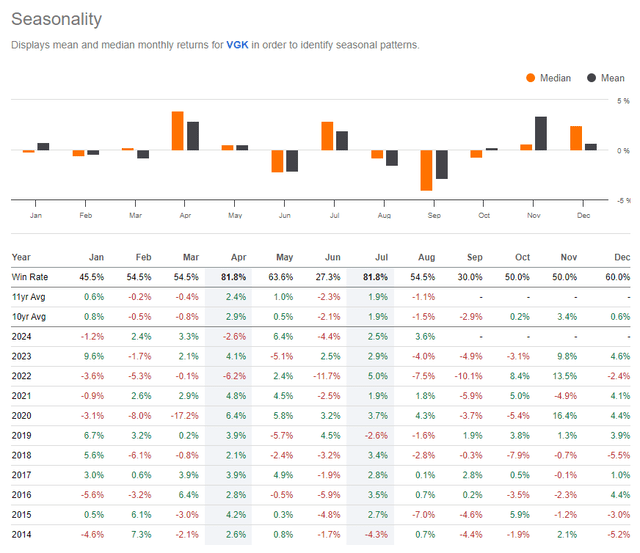

We are also nearing better seasonal trends with VGK. September is far and away the worst month on the calendar, and the fund is already off to a poor start to the final month of the third quarter, down 3.6% in September’s first four trading days.

Returns have fared better in October and are outright bullish from November through January, on average, over the past 10 years.

VGK: Weak In September, But Better Trends in Q4

Seeking Alpha

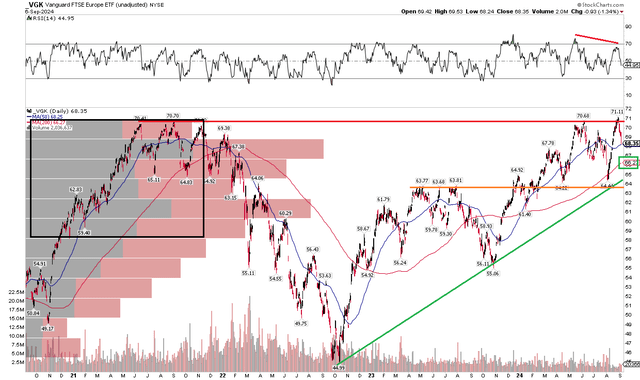

The Technical Take

With sanguine EAFE EPS trends, a low VGK valuation, and mixed seasonals, the ETF’s technical chart is mixed, but still generally attractive. Notice in the graph below that shares have retreated from an obvious level – the previous all-time highs notched in 2021. The low $70s is indeed resistance, but I see support not too far down at the range-highs from the middle of 2023 around $64. That’s also where shares fell to this past April and a month ago.

With a long-term rising uptrend in place, I assert that it’s just a matter of time before VGK rallies through those old highs. If that takes place, then an upside measured move price objective to $97 would be in play based on the $26 range over the past four years. Moreover, take a look at the long-term 200-day moving average – it's rising in its slope, suggesting that the bulls command the primary trend. Finally, despite a near-term bearish RSI momentum divergence (noted at the top of the chart), there’s a high amount of volume by price down to the upper $50s which should offer some cushion if we see a broader pullback.

Overall, resistance is near $71 while $64 is support.

VGK: Shares Pause At the All-Time High, Rising Long-Term Trend

Stockcharts.com

The Bottom Line

I have a buy rating on VGK. I see the European large-cap index fund as attractive on valuation despite some short-run downside price action lately.

Risks include weaker macro data in Europe, a stronger US dollar, any hiccups in geopolitics, and rising energy prices in the region. Manufacturing and Services PMI readings across the Euro Area have been concerning at times this year, and any fall-off in sentiment would have negative implications for investors in European stocks.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10