Electro Optic Systems Holdings Limited's (ASX:EOS) 27% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Electro Optic Systems Holdings Limited (ASX:EOS) shares have had a horrible month, losing 27% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 16% in the last year.

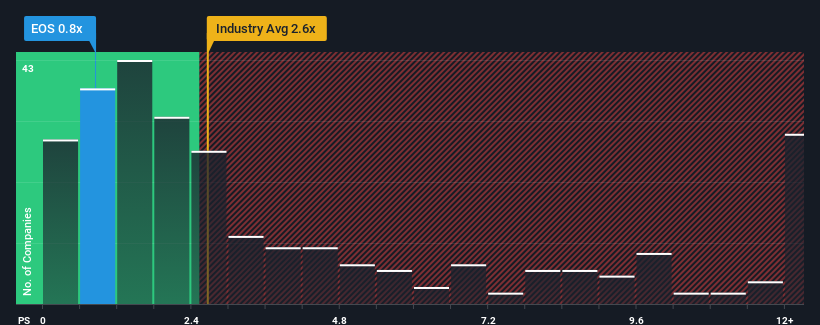

Although its price has dipped substantially, it's still not a stretch to say that Electro Optic Systems Holdings' price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Aerospace & Defense industry in Australia, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Electro Optic Systems Holdings

What Does Electro Optic Systems Holdings' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Electro Optic Systems Holdings has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Electro Optic Systems Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Electro Optic Systems Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 82%. Pleasingly, revenue has also lifted 42% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 2.0% per year over the next three years. That's shaping up to be materially lower than the 7.9% per year growth forecast for the broader industry.

With this information, we find it interesting that Electro Optic Systems Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Electro Optic Systems Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Electro Optic Systems Holdings' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Electro Optic Systems Holdings that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Electro Optic Systems Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10