Xerox Holdings (NASDAQ:XRX) Is Due To Pay A Dividend Of $0.25

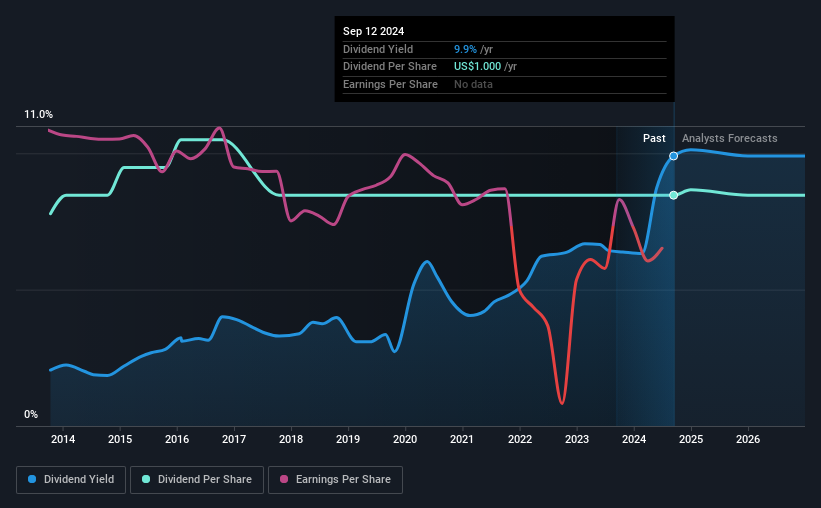

Xerox Holdings Corporation (NASDAQ:XRX) will pay a dividend of $0.25 on the 31st of October. This means the annual payment is 9.9% of the current stock price, which is above the average for the industry.

See our latest analysis for Xerox Holdings

Xerox Holdings Might Find It Hard To Continue The Dividend

A big dividend yield for a few years doesn't mean much if it can't be sustained. Even though Xerox Holdings isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

EPS has fallen by an average of 45.3% in the past, so this could continue over the next year. While this means that the company will be unprofitable, we generally believe cash flows are more important, and the current cash payout ratio is quite healthy, which gives us comfort.

Xerox Holdings Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2014, the annual payment back then was $0.92, compared to the most recent full-year payment of $1.00. Its dividends have grown at less than 1% per annum over this time frame. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Xerox Holdings' EPS has fallen by approximately 45% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

Our Thoughts On Xerox Holdings' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We don't think Xerox Holdings is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 3 warning signs for Xerox Holdings you should be aware of, and 2 of them are a bit concerning. Is Xerox Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10