YMAG: Major Shift In Strategy

TERADAT SANTIVIVUT

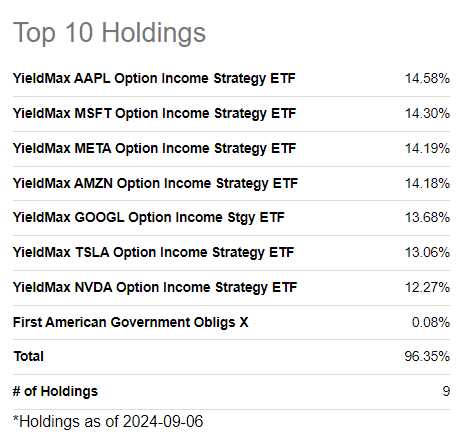

YieldMax Magnificent 7 Fund of Option Income ETFs (NYSEARCA:YMAG) is a fund of funds that includes an equal distribution of 7 YieldMax funds such as APLY (APLY), NVDY (NVDY), and MSFO (MSFO) that represent the 7 big technology stocks also known as the magnificent seven. Basically, when you own YMAG you are effectively writing covered calls on these 7 stocks individually.

YMAG Holdings (Seeking Alpha)

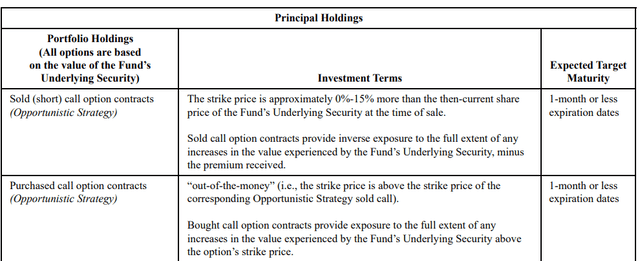

Late last week, YieldMax announced a major shift in its strategy which a lot of people haven't noticed yet, but it will affect both individual YieldMax funds as well as YMAG significantly. The announcement basically says that the fund company will use a more flexible approach in how it writes contracts. More specifically, it will deploy a variety of strategies instead of doing plain covered call strategies such as covered call spreads. The fund calls these opportunistic strategies.

Covered Call Spread Strategy (YieldMax)

Let me give an example. Let's say you want to sell covered calls on Nvidia (NVDA) and you buy 100 shares of the stock at a price of $105. Then you write a call option with a strike price of $110 and collect $3 in premiums. Following this, one of three things will happen. Either the stock rises above $110, you make a maximum profit of $8 due to a $5 upside plus $3 from option premiums, but you don't participate in any further upside, so if Nvidia were to suddenly jump to $150 overnight, you'd miss out on huge gains. Two, the stock could drop, and you'd lose money but your losses would be somewhat buffered by the $3 you collected. Three, the stock would stay flat or in a range, and you'd keep your $3 premium and be able to write more options later on for more premium.

What if you wrote covered call spreads instead of covered calls? In the same scenario, you are buying 100 shares of NVDA for $105, write NVDA $110 calls, and buy NVDA $115 calls. This way you collect a smaller premium (perhaps $1.5 instead of $3) but now you get to participate in any upside above and beyond $115 so if NVDA were to suddenly gap up to $150, you'd participate in most of this upside.

Since covered call funds tend to participate in almost all the downside but almost none of the upside, it's always considered a lopsided trade. This is why most covered call funds suffer from NAV decay over time. Let's say you are writing monthly covered calls on a stock that loses 10% one month, gains 10% next month, loses another 10% next month, and gains another 10% in the following month. When it drops 10%, you participate in most of this fall, but when it gains back 10%, you only participate in a small portion of this upward move, so over time your account value keeps decaying. This is where NAV decay comes from.

For example, look at how TSLY (TSLY) performed in relation to TSLA (TSLA) since its inception. Notice how it participates in all downside moves almost fully but rarely participates in upside moves to the same extent.

Selling covered call spreads can limit this NAV decay because you will participate in most of the upside movement as you already participate in most of the downside movement. But this also comes with collecting less premium since you are sacrificing a portion of your premium to buy out-of-money call options. This could mean that YieldMax funds won't be able to enjoy those huge 50-70% yields anymore, but it's not necessarily bad if this means more NAV stability.

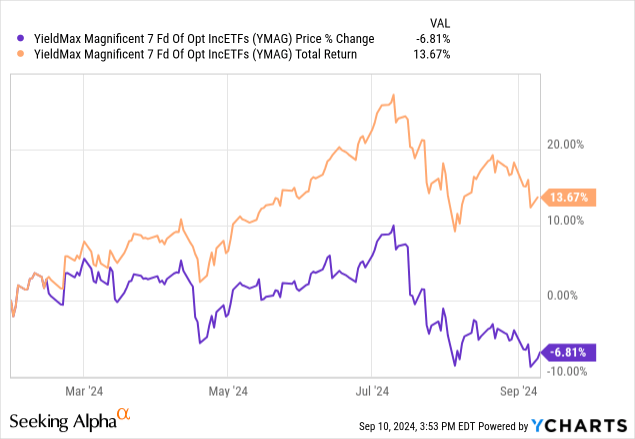

YMAG has been around for less than a year, and so far, it's been performing decently in terms of total returns. The fund suffered a NAV decay of almost -7% since inception, but even with this NAV decay, it still posted a total return of almost 14%. As a matter of fact, the fund was up almost 25% as late as last July.

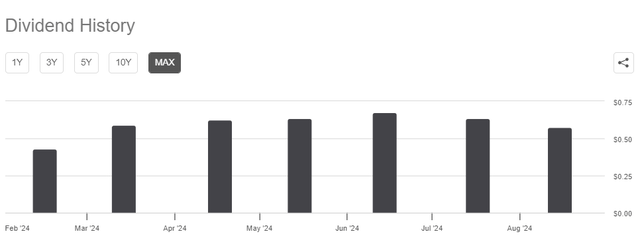

The fund has a variable dividend strategy. Its monthly distributions have varied so far depending on how much covered calls bring in. So far, the fund has made 7 distributions ranging from 43 cents to 67 cents per share, with the average being 60 cents. This gives us an annualized yield of 38% but expect it to drop a bit in light of the fund's new strategy. This number will also vary depending on the implied volatility of big tech in the previous month. When implied volatility rises (along with VIX), so do option premiums, which means funds that sell options can generate higher income. When volatility is down, distributions could also drop, but NAV decay is likely to be smaller as well since the market is more likely to be up than down when volatility is on the decline.

YMAG Distributions (Seeking Alpha)

Speaking of dividends, the fund has also made another change in how it pays dividends. Moving forward, the fund will be distributing its dividends in weekly payments instead of monthly, so it will be following the path of newly rising funds like QDTE (QDTE). This will only affect YMAG and YMAX and not individual stock-based YieldMax funds such as NVDY as those will continue to make monthly payments.

I still think YMAG could have a small place in your portfolio. There are inherent risks with covered call funds such as NAV decay, but they are also suitable for certain environments such as flattish or range-bound markets. Historically, we've had time periods in history where stocks went nowhere for years. There are even some "lost decades" in the past where stocks were virtually flat or range-bound for more than a decade. If we had a scenario where stocks were flat for a decade, having a covered call fund in your portfolio could boost your returns.

Then again, that's a very specific scenario. Covered call funds underperform during bull runs, and they only slightly outperform during bear markets. This is why you don't want to put the majority of your portfolio in them unless you are really convinced that we are up for a lost-decade type of scenario. Having a well-diversified portfolio is crucial for investors, and having diversity in your portfolio means more than just buying stocks from different sectors such as technology, utilities, and real estate. It also means having different funds that work best under different scenarios. Your portfolio should have at least one or two elements that work in scenarios where other parts of your portfolio might not work out so that it's all balanced out at the end. Covered call funds seem to fit this for many people, so it's fine to allocate about 5-10% of your portfolio to them, but I wouldn't go overboard either since these tend to underperform during bull markets and markets are in a bull market majority of the time.

Of course, the new changes made by YieldMax will make it less likely that this fund underperforms during a bull run because it will be able to capture more upside and participate in more of the bull market, but only time will tell how good of a job they will do since there are so many moving variables in play such as implied volatility, strike prices set and wideness of their call spreads. We will wait and see if the new strategy results in better returns, and I am somewhat hopeful.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10